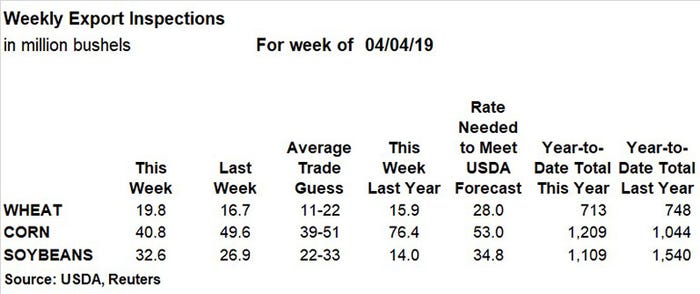

Another round of grain export inspection data is in the books, with the latest numbers from USDA not offering any real surprises, according to Farm Futures senior grain market analyst Bryce Knorr.

“Export inspections were about as expected this week, but trade guesses set a low bar,” he says. “Shipments need to pick up to meet USDA’s forecast for the marketing years for corn, soybeans and wheat.”

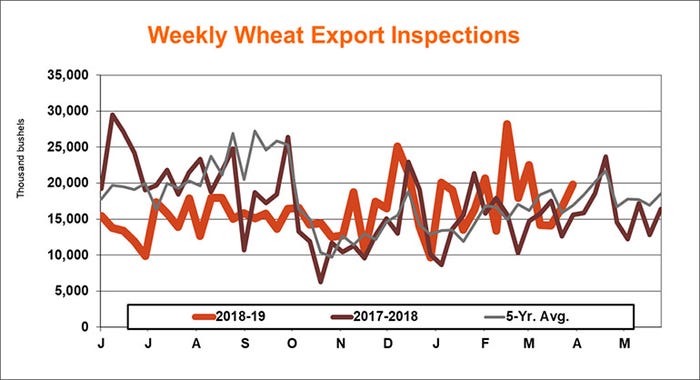

Time is running out for wheat, which has less than two months to go in the 2018/19 marketing year, Knorr adds.

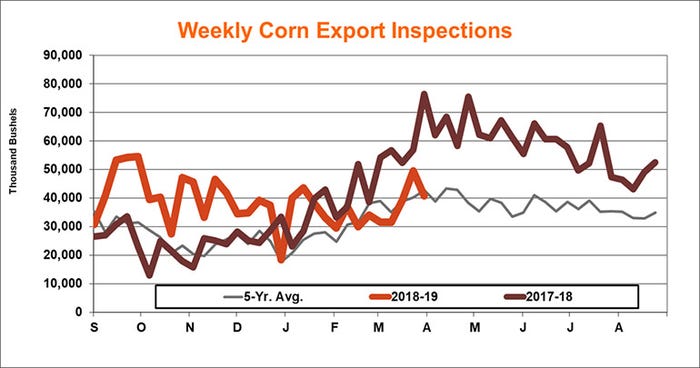

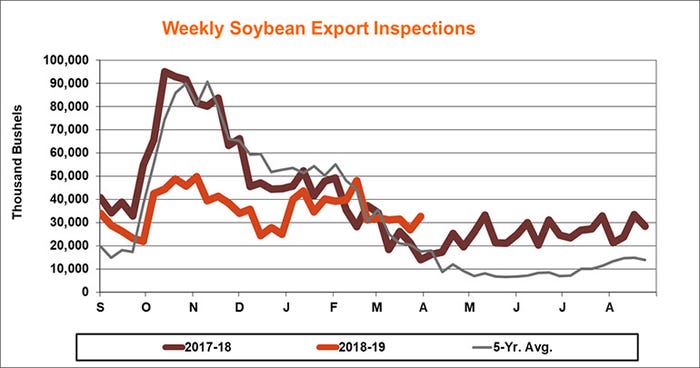

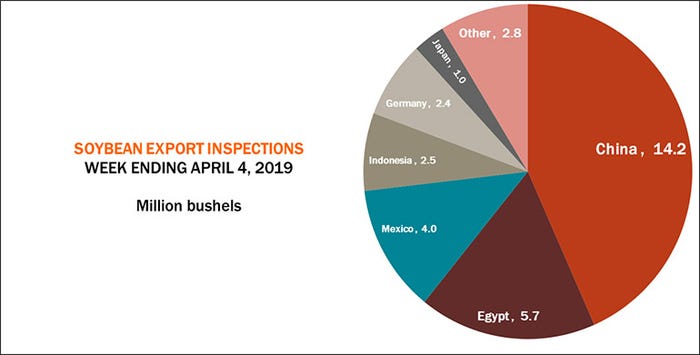

“Corn and soybeans have more time to get the job done, but flooding on the river system has nothing moving above St. Louis, where locks will be closed this week,” he says. “Corn sales must pick up, too. Soybeans have a record book of unshipped sales, including 279 million bushels purchased but unshipped so far by China, which accounted for 14.2 million more bushels last week.”

Corn export shipments reached 40.8 million bushels for the week ending April 4, which came in moderately below the prior week’s tally of 49.6 million bushels and on the low end of trade estimates that ranged between 39 million and 51 million bushels. The weekly rate needed to match USDA forecasts moved up to 53.0 million bushels, although cumulative totals for the 2018/19 marketing year are still trending 16% higher year-over-year, with 1.209 billion bushels.

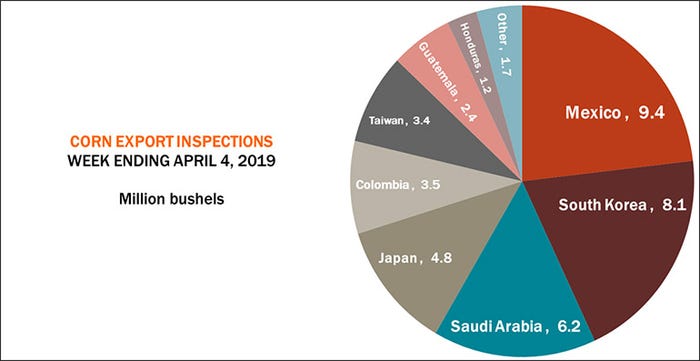

Mexico was the top destination for U.S. corn export inspections last week, with 9.4 million bushels. Other leading destinations included South Korea (8.1 million), Saudi Arabia (6.2 million), Japan (4.8 million), Colombia (3.5 million) and Taiwan (3.4 million).

Soybean export inspections improved over the prior week’s total of 26.9 million bushels after reaching 32.6 million bushels last week. That total also landed on the high end of trade estimates that ranged between 22 million and 33 million bushels. The weekly rate needed to meet USDA forecasts inched higher to 34.8 million bushels. Cumulative totals for 2018/19 reached 1.109 billion bushels, still 39% behind the prior marketing year’s pace of 1.540 billion bushels.

As Knorr pointed out, China was the No. 1 destination for U.S. soybean export inspections last week, with 14.2 million bushels. Other top destinations included Egypt (5.7 million), Mexico (4.0 million), Indonesia (2.5 million) and Germany (2.4 million).

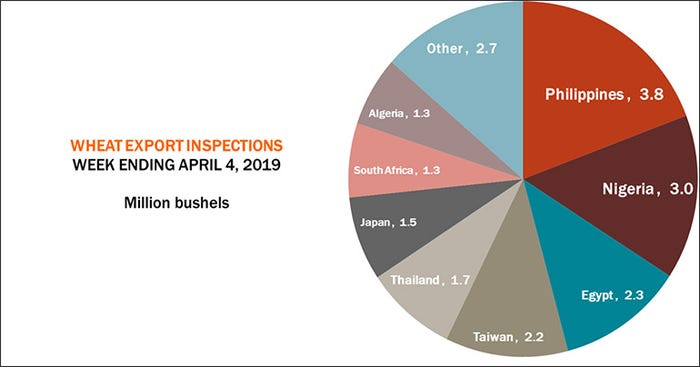

Wheat export inspections moved up to 19.8 million bushels – an improvement over the prior week’s tally of 16.7 million bushels and on the high end of trade guesses that ranged between 11 million and 22 million bushels. The weekly rate needed to meet USDA forecasts still moved higher, however, reaching 28.0 million bushels. Cumulative totals for 2018/19 are now at 713 million bushels, lagging 5% lower year-over-year.

The Philippines accounted for the most U.S. wheat export inspections last week, with 3.8 million bushels. Other top destinations included Nigeria (3.0 million), Egypt (2.3 million), Taiwan (2.2 million), Japan (1.5 million), South Africa (1.3 million) and Algeria (1.3 million).

About the Author(s)

You May Also Like