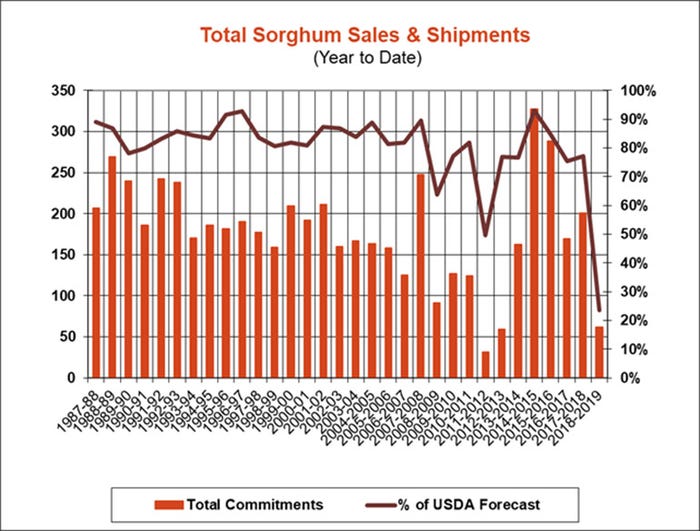

Grain prices ebb and flow on the tides of supply and demand. The former factor is proving problematic after USDA released its latest export report this morning – especially for corn, according to Farm Futures senior grain market analyst Bryce Knorr.

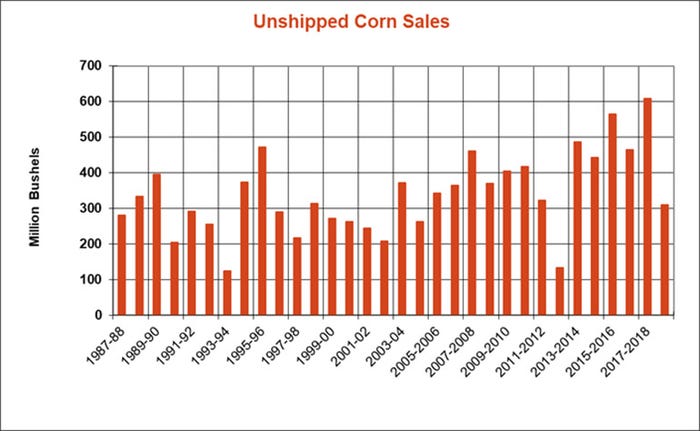

“Reaction to today’s corn export numbers suggests this market is focused completely on supply issues, for better or worse,” he says. “Old crop corn sales last week featured enough cancellations to make the total for the week negative. New crop bookings weren’t that bad but were small enough to take the total for the week to less than a million bushels. This suggests foreign customers aren’t worried about getting corn they need from the U.S. thanks to a big Brazilian crop coming on to the international market this summer.”

Even so, corn futures showed little reaction to the latest export news, which suggests the trade is obsessed with the size of the 2019 crop as farmers make final decisions on whether to keep planting, Knorr adds.

“Even if the crop is substantially smaller than USDA forecast May 10, end users appear confident large inventories left over from the 2018 crop will be enough to satisfy their needs even if the U.S. harvest is delayed by late planting, which seems likely,” he says.

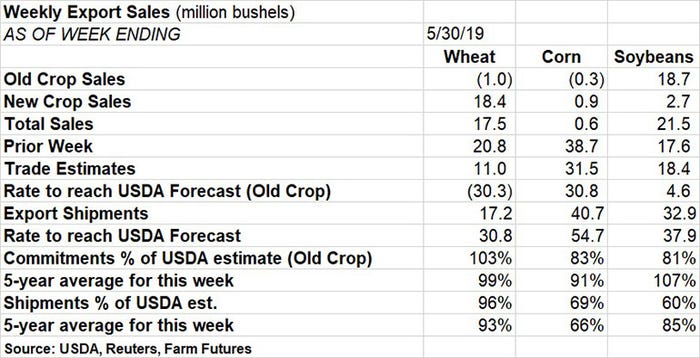

Corn exports tallied just 600,000 bushels of export sales for the week ending May 30, down sharply from the prior week’s total of 38.7 million bushels and trade estimates of 31.5 million bushels. The weekly rate needed to match USDA forecasts for old crop sales moved higher, to 30.8 million bushels.

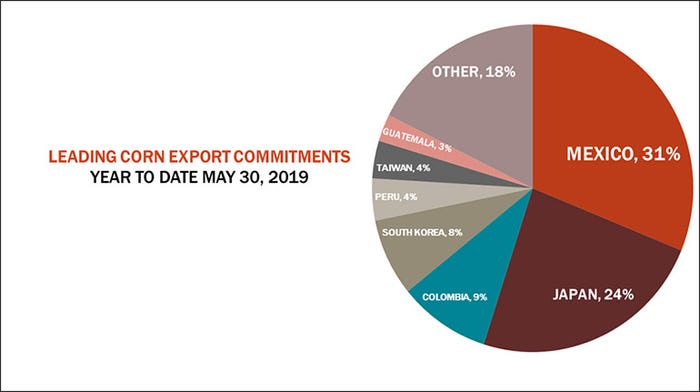

Corn export shipments of 40.7 million bushels are also below USDA weekly forecasts of 54.7 million bushels. For the 2018/19 marketing year, Mexico leads all destinations for U.S. corn export commitments, accounting for 31% of the total. Other top destinations include Japan (24%), Colombia (9%), South Korea (8%), Peru (4%) and Taiwan (4%).

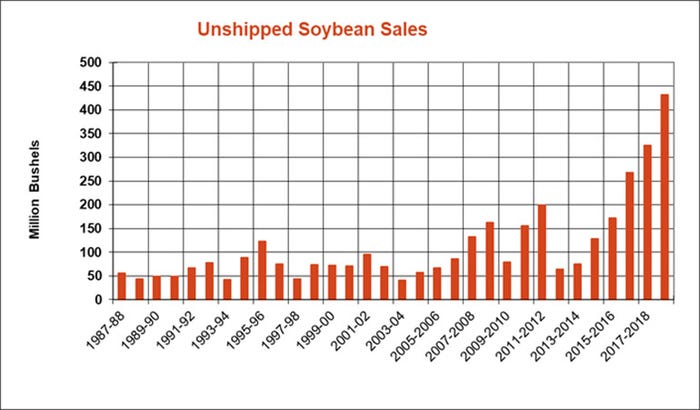

Soybean export sales fared a bit better last week, with 18.7 million bushels in old crop sales plus another 2.7 million bushels of new crop sales for a total of 21.5 million bushels. That tally was slightly ahead of the prior week’s total of 17.6 million bushels and ahead of analyst expectations of 18.4 million bushels. The weekly rate needed to match USDA forecasts for old crop sales moved lower, to 4.6 million bushels.

Soybean export shipments were for 32.9 million bushels. Trade war pressure with China has receded from the headlines somewhat, Knorr says.

“Buyers continue to ship out their large book of previous purchases, with those supplies apparently headed for state-owned reserves,” he says. “Chinese buyers booked another cargo, though that was just switched from a deal announced as going to unknown destinations.”

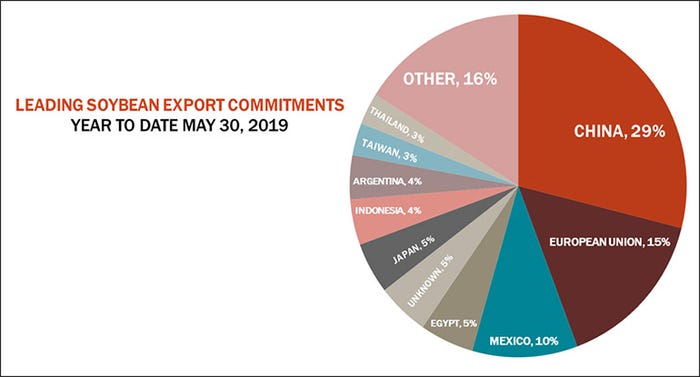

China continues to lead all destinations for U.S. soybean export commitments this marketing year, accounting for 29% of the total. Other top destinations include the European Union (15%), Mexico (10%), Egypt (5%), unknown destinations (5%) and Japan (5%).

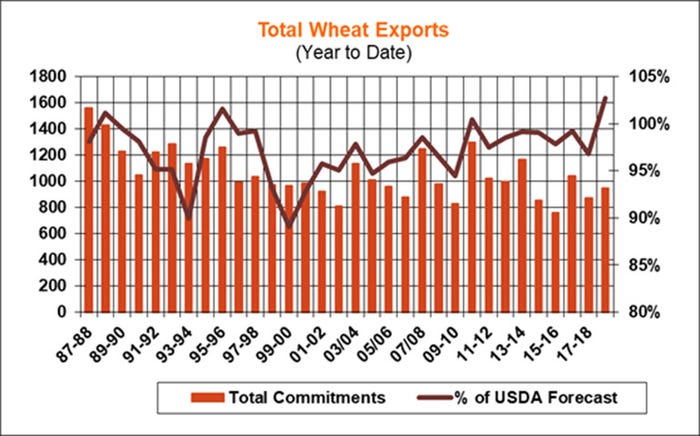

For wheat export sales, 1.0 million bushels in old crop cancellations were more than balanced by 18.4 million bushels in new crop sales, for a total of 17.5 million bushels, pushing well past trade estimates of 11.0 million bushels.

“Wheat sales and shipments through May 30, one day before the end of the 2018 marketing year for wheat are actually above USDA’s forecast,” Knorr says. “Some of the sales should be rolled to new crop, but the overall total looks on track to meet USDA’s forecast for the crop.”

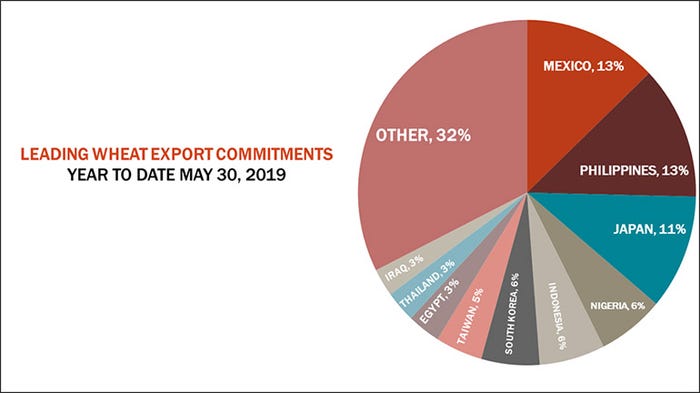

Wheat export shipments reached 17.2 million bushels last week. As the 2018/19 marketing year wraps up, Mexico and the Philippines lead all destinations for U.S. wheat export commitments, with 13% of the total each. Other top destinations include Japan (11%), Nigeria (6%), Indonesia (6%) and South Korea (6%).

About the Author(s)

You May Also Like