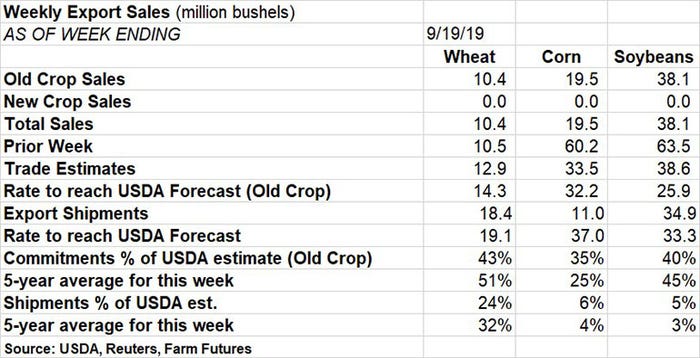

The latest round of USDA export data, covering the week ending September 19, didn’t contain much for bulls to chew on.

“The only good news in today’s export reports from USDA came for soybeans,” according to Farm Futures senior grain market analyst Bryce Knorr. “Business, as expected, was good for the third straight week. Chinese buyers continue to book supplies after getting a green light from the government, which waived tariffs for private firms.”

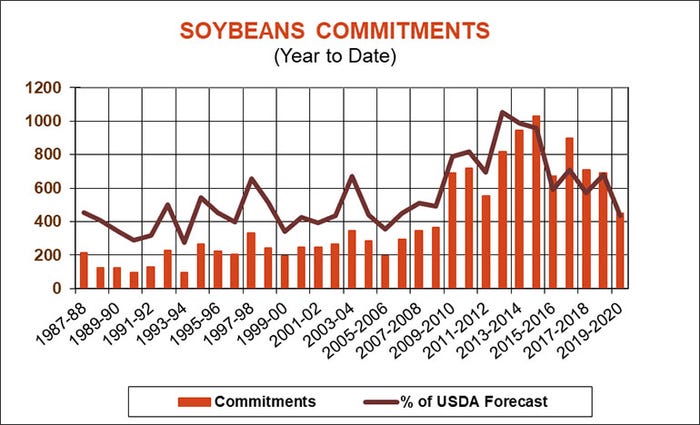

Soybeans notched another 38.1 million bushels in sales last week, which still fell well below the prior week’s tally of 63.5 million bushels and just under trade estimates of 38.6 million bushels. Still, the weekly rate needed to match USDA forecasts moved lower, to 25.9 million bushels.

“Chinese buyers continue to book supplies after getting a green light from the government, which waived tariffs for private firms,” Knorr says. “Net new sales last week totaled 14.8 million bushels, and USDA later announced another 10.1 million bushels under its daily reporting system for large purchases. That brings total known Chinese purchases to 107 million bushels, and recent unannounced deals could double that total.”

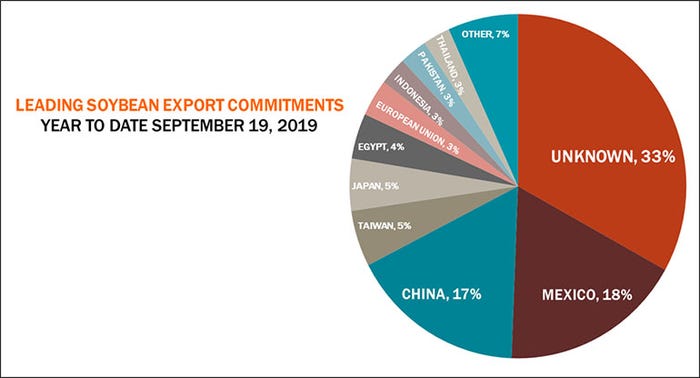

Soybean export shipments were for 34.9 million bushels. Unknown destinations are leading the way for 2019/20 U.S. export commitments, so far, accounting for 33% of the total. Other top destinations include Mexico (18%), China (17%), Taiwan (5%) and Japan (5%).

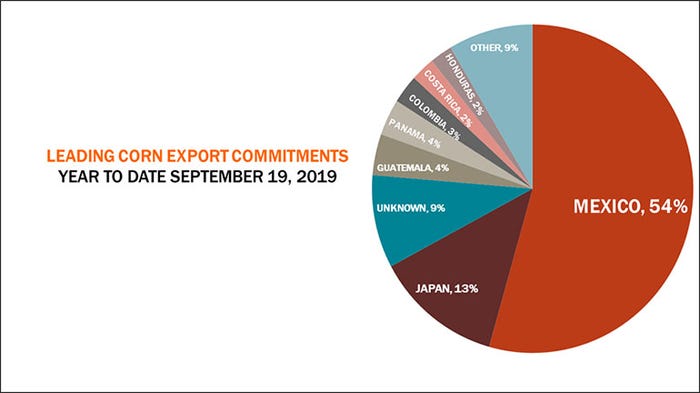

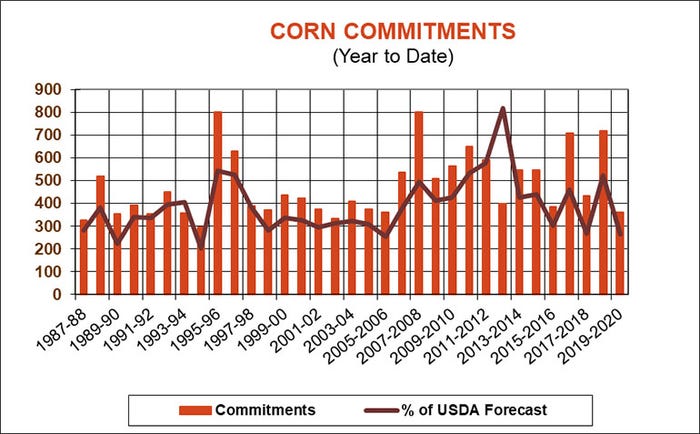

Corn export sales slumped, in contrast, reaching only 19.5 million bushels last week. That was less than a third of the prior week’s tally of 60.2 million bushels and well below trade estimates of 33.5 million bushels. The weekly rate needed to meet USDA forecasts moved up to 32.2 million bushels.

“The latest numbers for corn were disappointing, with total commitments at the lowest year-to-date level in nearly two decades,” Knorr notes. “It’s hard to blame the slow pace of harvest for this slow start, because plenty of 2018 crop corn is still sitting around. Lower prices out of Brazil continue to attract our regular customers, including Taiwan, which picked up a cargo out of South America earlier this week.”

Corn export shipments were also a lackluster 11.0 million bushels last week. For the 2019/20 marketing year, Mexico has picked up more than half of U.S. corn export commitments, with 54% of the total. Other top destinations include Japan (13%), unknown destinations (9%), Guatemala (4%) and Panama (4%).

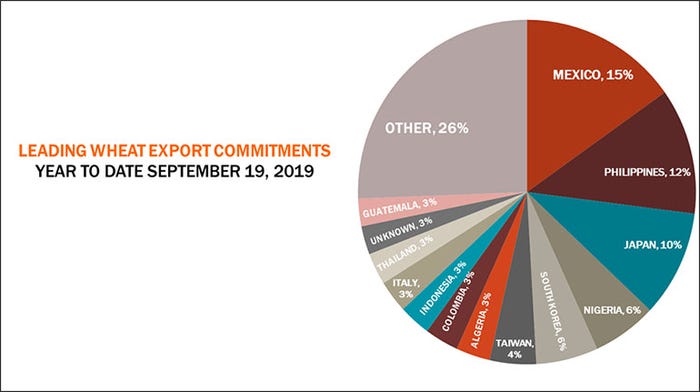

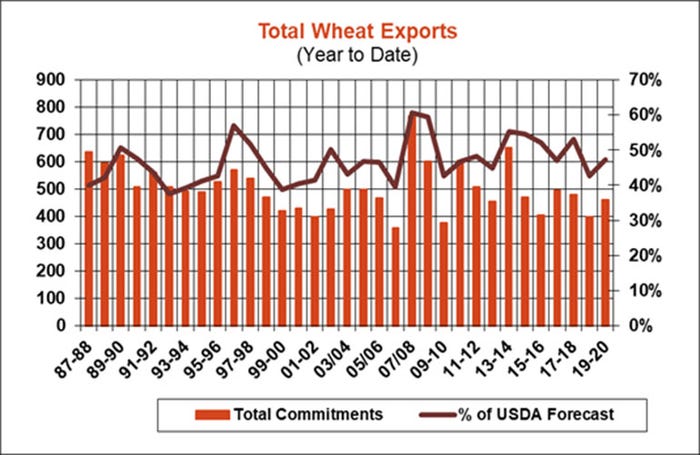

Wheat export sales last week were a mediocre 10.4 million bushels but mostly kept pace with the prior week’s tally of 10.5 million bushels and trade estimates of 12.9 million bushels. The weekly rate needed to match USDA forecasts inched up to 14.3 million bushels.

“Wheat continues to suffer from a highly fragmented market where buyers take only small amounts,” Knorr says. “Japan was the only customer taking more than one cargo this week, and their net new bookings amounted to just 3.8 million bushels. White wheat had a good week nonetheless as supplies of milling quality wheat out of Australia are limited by the third consecutive year of drought.”

Wheat export shipments fared somewhat better, with 18.4 million bushels. With the 2019/20 marketing year nearly one-third complete, Mexico leads all destinations for U.S. wheat export commitments, accounting for 15% of the total. Other top destinations include the Philippines (12%), Japan (10%), Nigeria (6%) and South Korea (6%).

About the Author(s)

You May Also Like