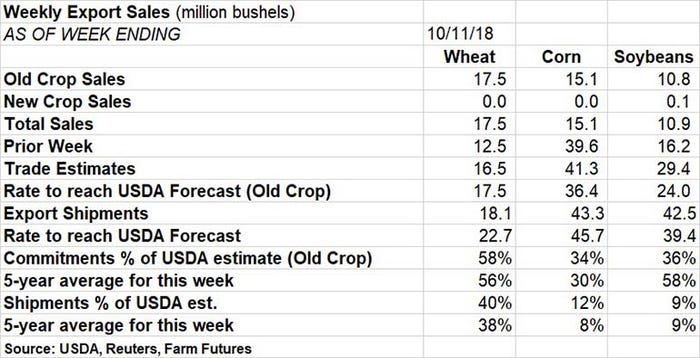

U.S. grain exports did not impress last week after the latest USDA weekly report showed corn and soybean totals down noticeably from the prior week, with wheat posting moderate gains.

“While wheat bookings picked up a bit last week, new business in corn and soybeans was disappointing as buyers waited to see results from USDA October production, supply and demand report,” says Farm Futures senior grain market analyst Bryce Knorr.

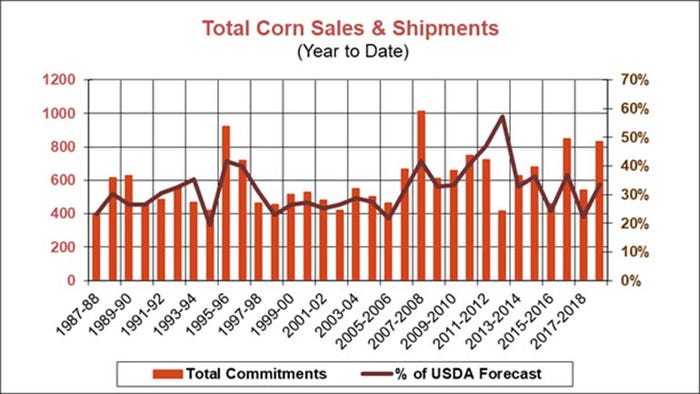

Corn exports reached just 15.1 million bushels in total sales for the week ending October 11, less than half of the prior week’s tally of 39.6 million and trade estimates of 41.3 million bushels. The lackluster total pushed the weekly rate needed to match USDA forecasts higher, to 36.4 million bushels.

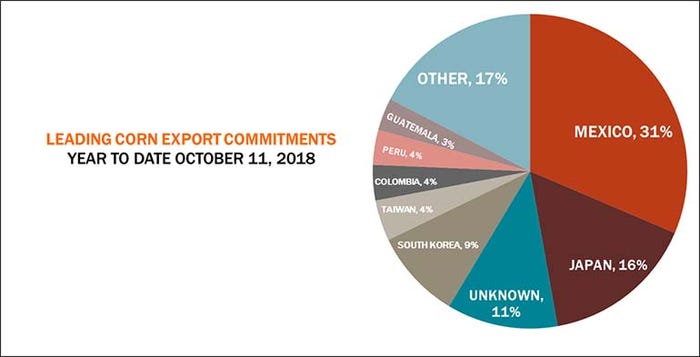

Corn export shipments last week fared better, with 43.3 million bushels, but still landed below the weekly rate to keep pace with USDA forecasts, now at 45.7 million bushels. For the 2018/19 marketing year, Mexico is still the No. 1 destination for U.S. corn export commitments, accounting for 31% of the total. Other top destinations include Japan (16%), unknown destinations (11%) and South Korea (9%).

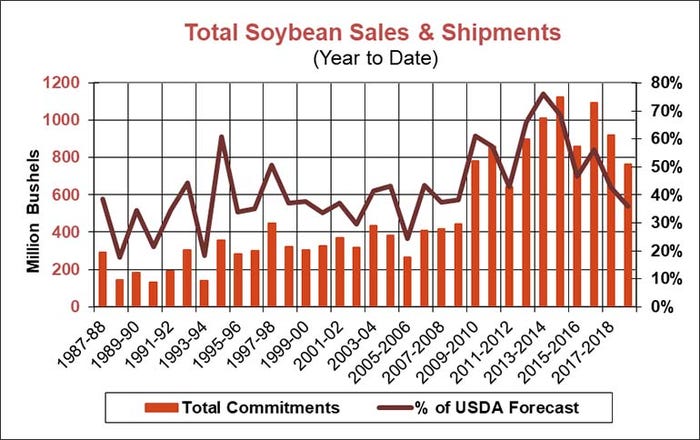

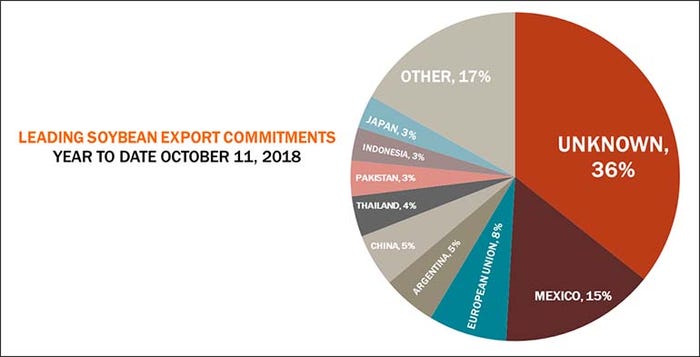

Soybean exports were also mediocre last week, with 10.8 million bushels in old crop sales plus another 100,000 bushels in new crop sales for a total of 10.9 million bushels. That total fell moderately below the prior week’s count of 16.2 million bushels and fell significantly beneath trade estimates of 29.4 million bushels. The weekly rate needed to match USDA forecasts is now 24.0 million bushels.

Soybean export shipments reached 42.5 million bushels last week, barely surpassing the weekly rate needed to meet USDA forecasts, now at 39.4 million bushels. The leading destination for U.S. soybean export commitments for the 2018/19 marketing year is unknown destinations, accounting for 36% of the total. Other top destinations include Mexico (15%) and the European Union (8%). China has only accounted for 5% of total U.S. soybean export commitments so far.

“China is still the missing link for soybeans,” Knorr says. “Though buyers shipped out a couple loads last week – the first in a month – new business is restricted to small container loads. Chinese buyers still have 32.5 million bushels of sales on the books, but total commitments are down 92% from year-ago levels.”

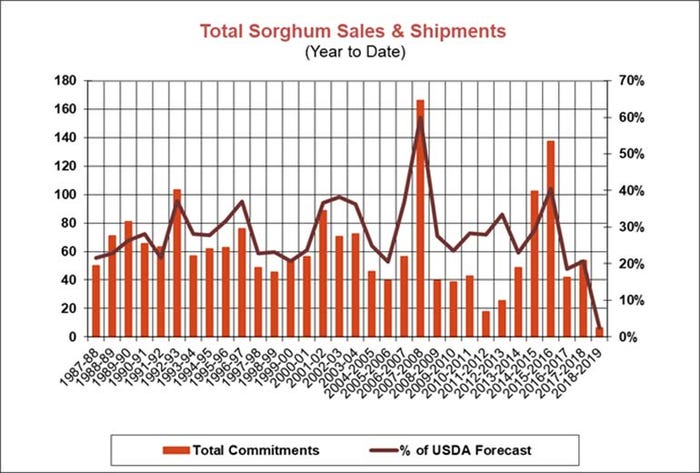

China’s inactivity is also creating a major slump in sorghum sales, Knorr adds.

“There were no new sales recorded at all last week, and total commitments in the first six weeks of the marketing year are just 6 million bushels, by far the least in at least 30 years,” he says.

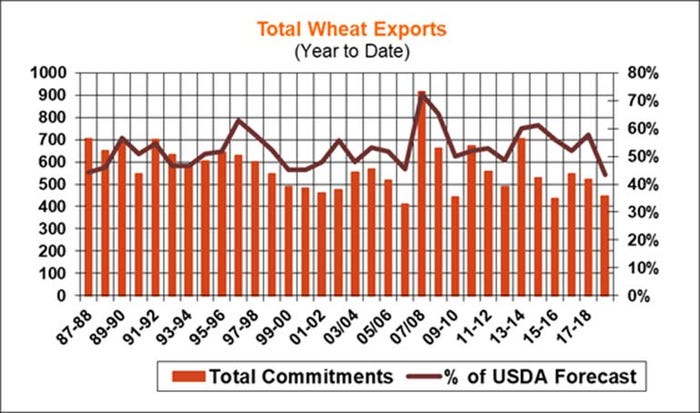

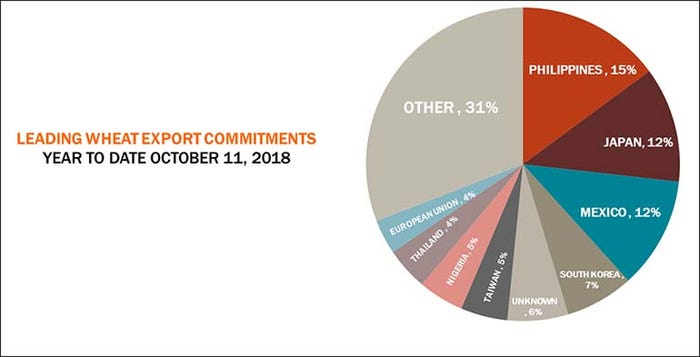

Wheat exports reached 17.5 million bushels last week, moderately besting the prior week’s total of 12.5 million and coming in just ahead of trade estimates of 16.5 million bushels. The weekly rate needed to reach USDA forecasts is also 17.5 million bushels.

“Wheat is going to a lot of individual customers, including Europe, where the crop was hurt by growing season weather,” Knorr says. “Sales throughout the Americas are also strong. But most of the business is for hard red spring wheat and white wheat, classes helped by drought in northern Europe and Australia.”

Wheat export shipments of 18.1 million bushels last week lags behind the weekly rate needed to match USDA forecasts, now at 22.7 million bushels. The Philippines retained the top spot for total U.S. wheat export commitments for 2018/19, accounting for 15% of the total. Other top destinations include Japan (12%), Mexico (12%), South Korea (7%) and unknown destinations (6%).

About the Author(s)

You May Also Like