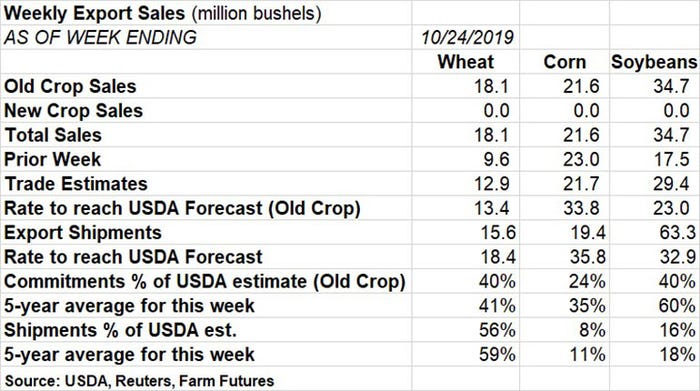

Grain exports found a little momentum for the week ending October 24, according to USDA’s latest export sales report, out Thursday morning. But the data was not very impressive, with commodities pointed lower in early trading.

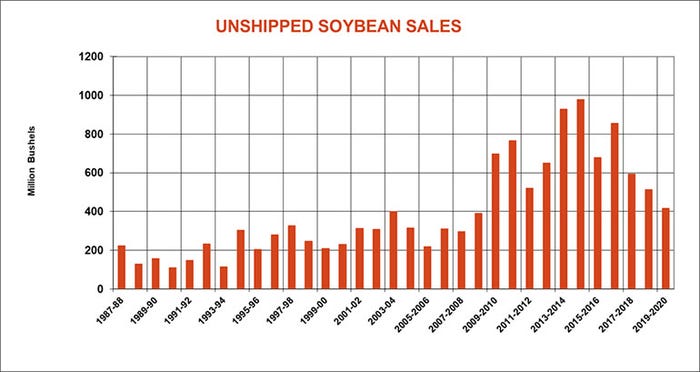

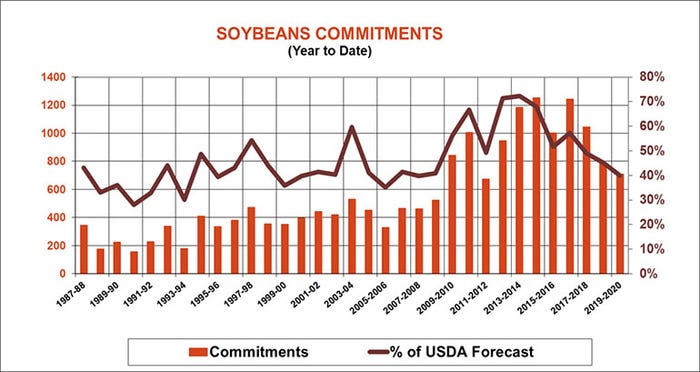

Soybean exports saw the most upside last week after posting another 34.7 million bushels in total sales. That nearly doubled the prior week’s tally of 17.5 million bushels and landed ahead of the average trade guess of 29.4 million bushels. The weekly rate needed to match USDA forecasts slipped to 23.0 million bushels. Soybean export shipments were even better, at 63.3 million bushels.

Chinese soybean buyers returned to the market last week, booking 17.6 million bushels – more than half of the total volume, according to Farm Futures senior grain market analyst Bryce Knorr.

“Stocks at ports in China dwindled to very low levels due to lack of supply out of Brazil right now as crushers enjoyed strong margins there on demand boosted by hog producers feeding animals to very heavy weights in order to take advantage of high pork prices,” he says. “The Chinese government waived tariffs on some 370 million bushels of imports, but buyers had been slow to take advantage of that action.”

Total Chinese commitments for 2019 soybeans are 227.5 million bushels, but most of that total was bought before the recent tariff waiver, and 167.3 million of the total has still not been shipped out, Knorr adds.

“So, it’s unclear just how many 2019 soybeans China will buy,” he says. “Reports overnight suggested China might be willing to eliminate tariffs but wants flexibility in any trade deal, rather than being tied to any firm schedule or total goal.”

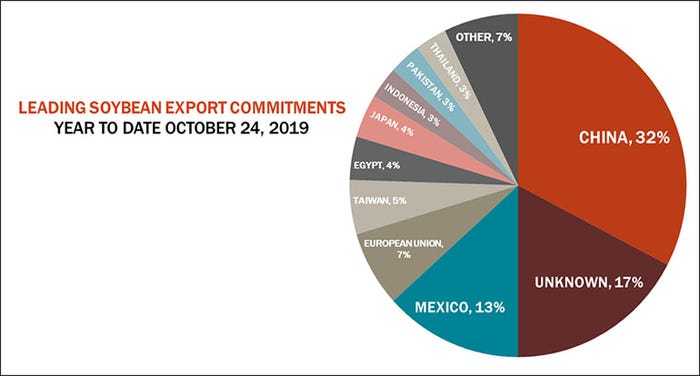

Meantime, China leads all destinations for 2019/20 soybean export commitments, accounting for 32% of the total. Other top destinations include unknown destinations (17%), Mexico (13%), the European Union (7%) and Taiwan (5%).

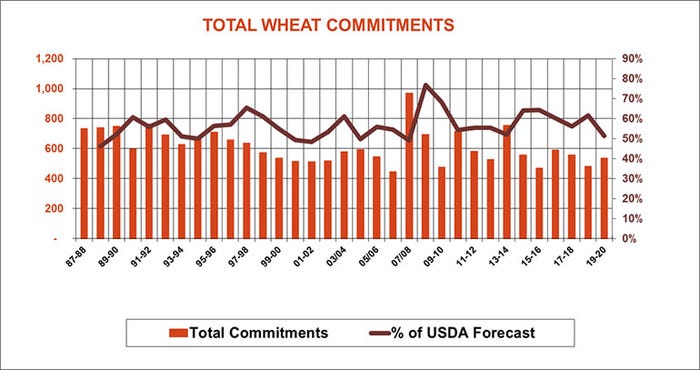

Wheat exports also trended higher last week, moving from 9.6 million bushels up to 18.1 million bushels. That tally also bested trade estimates of 12.9 million bushels and lowered the rate needed to match USDA forecasts to 13.4 million bushels. Export shipments were for 15.6 million bushels.

“Wheat sales nearly doubled last week, getting back on track,” Knorr says. “Business isn’t gangbusters, but it’s fairly close to the estimates put out by USDA.”

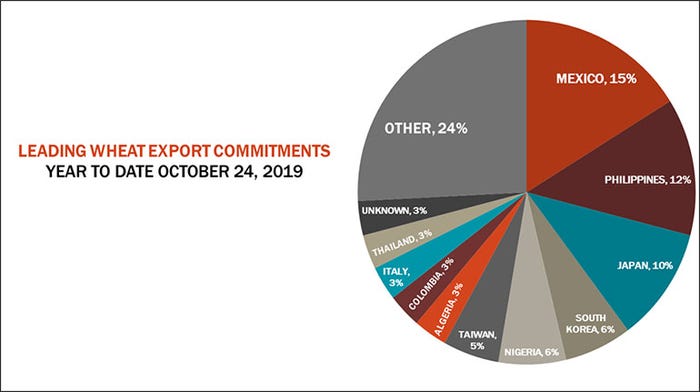

Mexico remains the No. 1 destination for U.S. wheat export commitments, with 15% of the total. Other top destinations include the Philippines (12%), Japan (10%), South Korea (6%) and Nigeria (6%).

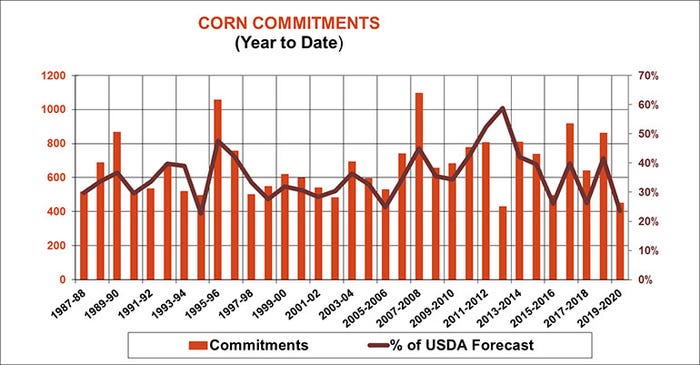

Corn exports were relatively disappointing last week, at 21.6 million bushels. Totals were fractionally below trade estimates of 21.7 million bushels and slightly behind the prior week’s tally of 23.0 million bushels. The weekly rate needed to match USDA forecasts moved up to 33.8 million bushels. Corn export shipments were also lackluster, at 19.4 million bushels.

“Corn exports remain disappointing as even some of our most loyal Asian customers take advantage of cheaper priced deals available from Brazil,” Knorr says. “Sales likely won’t pick up until Brazil is out of a huge crop harvested this summer.”

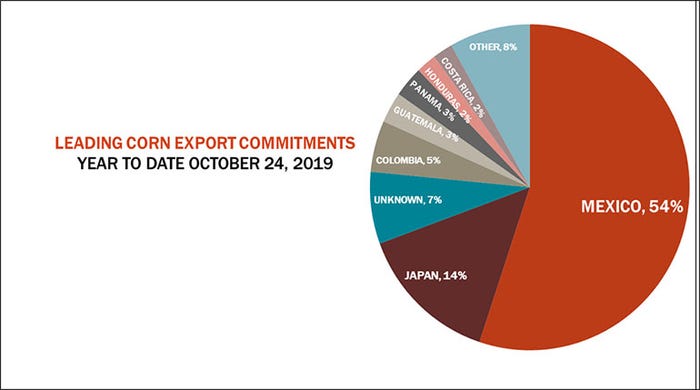

Mexico remains by far the No. 1 destination for U.S. corn export commitments, accounting for 54% of the total. Other leading destinations include Japan (14%), unknown destinations (7%) and Colombia (5%).

About the Author(s)

You May Also Like