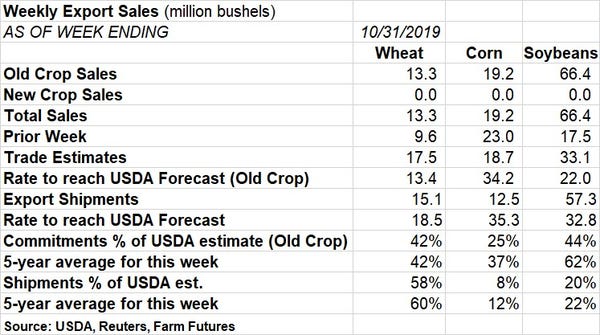

For the week ending October 31, grain export sales were fairly tepid for corn and wheat, but sales to China lifted soybean totals significantly from the prior week.

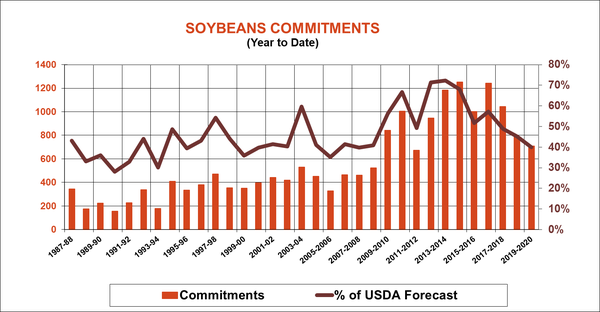

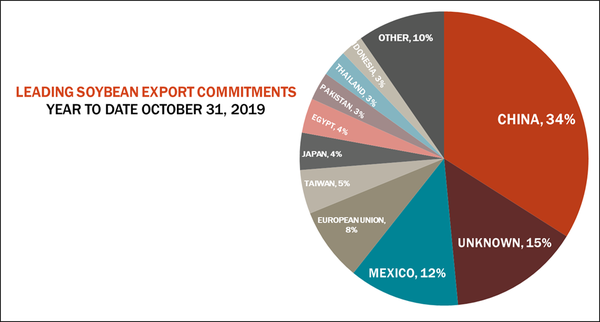

“Chinese purchases of soybeans nearly doubled last week, accounting for 53% of total new bookings,” according to Farm Futures senior grain market analyst Bryce Knorr. “But so far China accounts for only 34% of U.S. sales and shipments.”

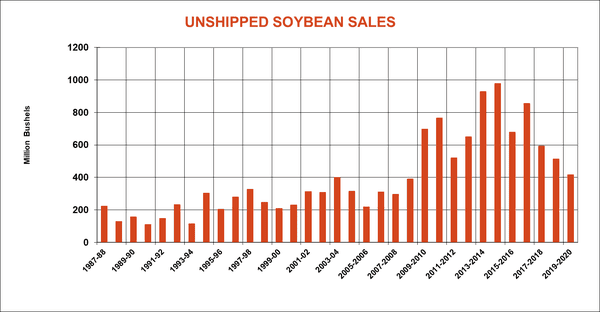

Before the trade war Chinese buyers typically took around 60% of all U.S. soybean exports, Knorr notes. So far this marketing year, nearly two-thirds of China’s purchases have yet to be shipped.

“While that should keep shippers busy, supporting basis feeding the export pipeline, it may also limit how quickly China adds to its shopping list,” he says. “The danger for 2019 crop exports is another large crop looming in Brazil that could lure many buyers with cheaper offers.”

Total soybean exports reached 66.4 million bushels last week, booming above the prior week’s tally of 17.5 million bushels and trade estimates of 33.1 million bushels. The weekly rate needed to match USDA forecasts fell to 22.0 million bushels.

Soybean export shipments were also robust, at 57.3 million bushels. For the 2019/20 marketing year, China leads all destinations, accounting for 34% of the total. Other top destinations include unknown destinations (15%), Mexico (12%) and the European Union (8%).

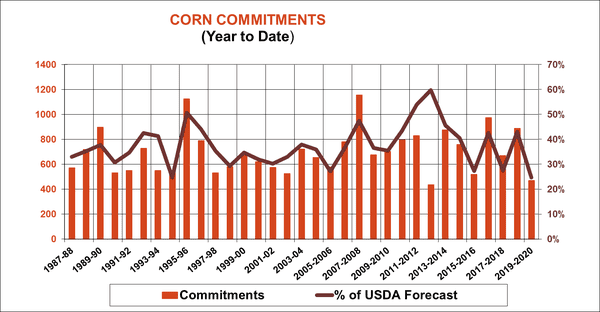

Corn export sales only reached 19.2 million bushels last week, slipping below the prior weeks’ totally of 23.0 million bushels while barely besting trade estimates of 18.7 million bushels. The weekly rate needed to match USDA forecasts increased to 34.2 million bushels. Export shipments were even more dismal, at just 12.5 million bushels.

“Corn continues to fall seriously behind, with Asian customers other than Japan taking cheaper corn out of South America and the Black Sea,” Knorr says. “Business remains focused on nearby buyers in Latin America and the Caribbean, which isn’t enough. Look for USDA to cut its forecast of exports in tomorrow’s monthly production, supply and demand report as a result.”

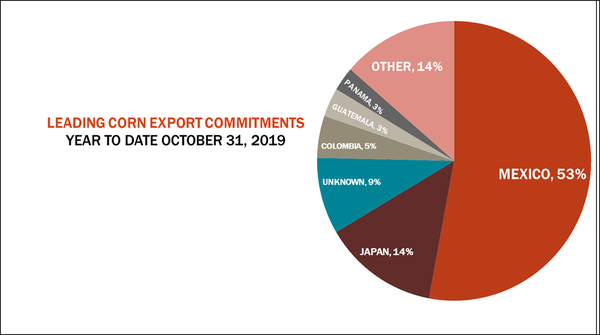

Mexico continues to dominate all destinations for corn export commitments this marketing year, accounting for 53% of the total. Other top destinations include Japan (14%), unknown destinations (9%) and Colombia (5%).

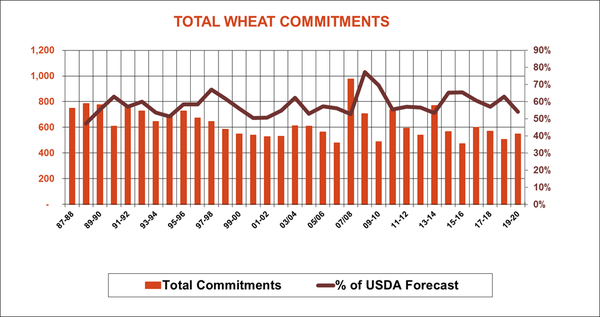

Wheat export sales improved a bit last week but still remain tepid, at 13.3 million bushels, falling below trade estimates of 17.5 million bushels, with the rate needed to match USDA forecasts holding steady at 13.4 million bushels. Export shipments of 15.4 million bushels didn’t fare much better.

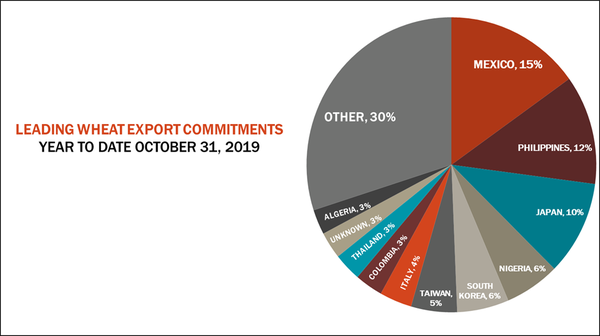

As with corn, Mexico leads all destinations for U.S. wheat export commitments in the 2019/20 marketing year, accounting for 15% of the total. Other top destinations include the Philippines (12%), Japan (10%), Nigeria (6%) and South Korea (6%).

About the Author(s)

You May Also Like