March 18, 2016

By Jeff Dema, MachineryLink Solutions

Today’s ag economy is prompting producers and others in the industry to scrutinize every dollar they spend and look for new revenue streams. The USDA predicts that farm income will decline 55 percent over 2013 levels. This would represent the lowest farm income level since 2002.

Profit-minded farmers need new solutions to help optimize their farming operations. Ag bankers are looking more closely at debt-to-asset ratios and solutions that help lower loan risks. And next-generation farmers are looking for ways to reduce barriers to entry into farming.

There are many options for creating increased profitability that can then be reinvested in other areas of farm operations – and beyond. Disruptive technologies and solutions that are revolutionizing other industries are among them. It’s what sparked the precision ag revolution, and now we’re seeing the impact of new technologies and business models – and fresh thinking – in our industry.

Rethinking farm equipment

The Sharing Economy is a new way of thinking that is taking hold in other sectors of our economy, and for good reason. Think Uber for transportation and Airbnb for lodging. Why buy – or pay for more expensive options – when you can access these products and services more efficiently without the burdens of ownership?

That’s the question many retailers and growers are asking when it comes to rethinking one of their biggest capital expenditures – farm equipment. And with good reason.

That’s the question many retailers and growers are asking when it comes to rethinking one of their biggest capital expenditures – farm equipment. And with good reason.

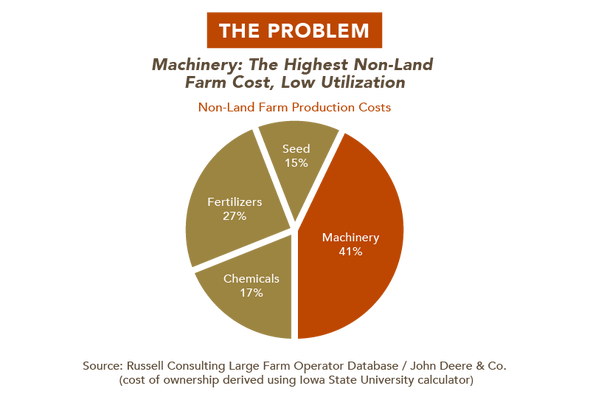

Farmers own approximately $244 billion in machinery and equipment. The USDA estimates equipment and machinery represent 41 percent of non-land production costs. Further, the average asset turnover ratio (ATR) in farming is $0.34, meaning that for every $1 a farmer has tied up in assets, he generates just $0.34 of revenue, placing it among the most capital-intensive and capital-inefficient industries in our economy.

An ag economist from Purdue University recently stated that one of the fastest ways for farmers to grow their business today is by managing their assets more effectively. For many, owning expensive assets such as a $400,000 combine that sits idle for 11 months out of the year is a business model that is running out of gas.

That was the case last year for Jason Wykoff, who farms near New Carlisle, Ind. With the industry cutback in seed acres, Jason responded by converting some of his seed corn and soybean acres to conventional grain production. That change meant he needed the capacity to harvest more of his acreage, but tighter margins made the purchase of a combine tough to swallow. He turned to MachineryLink Sharing, an online equipment sharing platform, to help make it happen. Jason tells us he is able to make the purchase work on his balance sheet from the income he generates by renting – or sharing – the combine to other growers when he is not using it.

With about 25 percent of farm assets (excluding land) being financed with debt, according to USDA, bankers appreciate the reduced risk and improved debt-to-asset ratios sharing brings. And for next-gen farmers, sharing platforms can greatly reduce a significant barrier to entry in large farm equipment.

Challenging times require bold steps to drive revenue and positively impact the bottom line. Farmers from California to Iowa to Virginia are checking out new ideas, such as this sharing platform, to help them thrive, not just survive, during these tough times.

About the Author(s)

You May Also Like