Fair market value is pretty-straight forward for an accounting basis. Most of the time, we only set up balance sheets for fair market value because it is only interested in two things – your net worth at a specific date.

That’s it.

It’s most important for the following situations because we are interested in value at specific dates:

Succession planning

Estate planning

Loan collateral

We focus on the balance sheet because it is exactly what we need; it provides our assets, liabilities, and equity and a specific date. We start with our accrual balance because it has all our assets and liabilities that may not be on our cash basis balance sheet: accounts receivable, inventory, accounts payable, accrued interest, etc. It’s important to include these accounts because they provide the total picture and our equity should have increased/decreased by running them through the necessary income and expense adjustments.

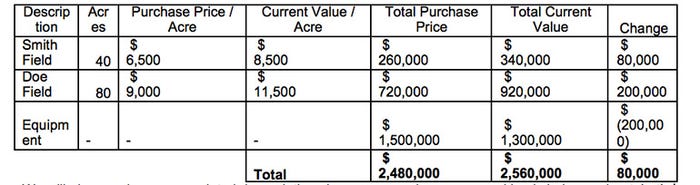

The major changes to fair market value will generally occur in your intermediate and long-term assets. Below is an example of Farmer Dave’s major assets:

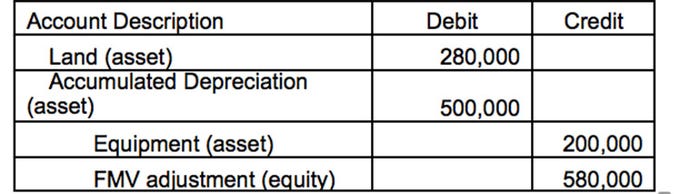

We will also need our accumulated depreciation since we are using our accrual basis balance sheet. Let’s assume it is $500,000. To get to our fair market value balance sheet, we will need to:

Remove our accumulated depreciation because it is implicit in our fair market value, and

Increase our equity to adjust for our unrealized gain.

With all other assets staying the same, we would need to make the following entry to adjust our accrual basis balance sheet to our fair market value balance sheet:

This is a quick adjustment that you can make with your accrual balance sheet to get you actionable information for succession planning, estate planning, and value of collateral for loans. The more technical approach would be to maintain fair market books that run the unrealized gains and losses through the equity accounts on an annual basis. We call these “unrealized” because there are no “real” (in this case – cash) transactions associated with them. These calculations can get tricky and you should work with a professional accountant if you want to go this route.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like