Commodity Credit Corporation loans (or CCC loans) are interesting. For those of you that are not familiar with CCC loans, the best thing I can do is send you to the FSA website.

In essence, you pledge a number of bushels of grain as collateral for a loan. The loan is roughly 50% of the current price for the grain. What this does is allows you to create cashflow without actually selling your grain. When prices get a little better, you sell the grain, pay off the loan (with interest), and you get to keep the rest of the cash.

CCC loans are interesting because the IRS allows farmers to either 1) treat the CCC loan as any other loan (loan method) or 2) include the amount of the loan as income in the year received (income method). Commonly, we see this used in December when prices are not as good to get some cash in the farmers pocket when they want to increase their taxable income for… reasons.

Tricky transactions

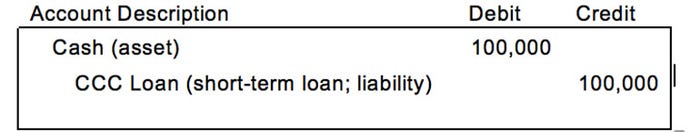

Though these transactions are very common, the transactions for them are actually kind of tricky and not really intuitive like cash basis transactions should be. Let’s start with booking the loan using the loan method:

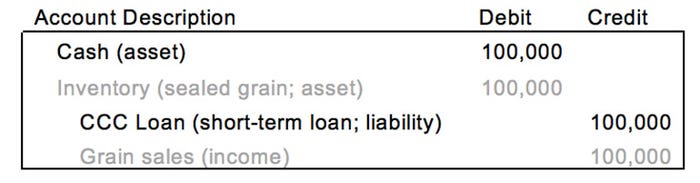

When you book a CCC loan under the income method, you are creating accrual income. So the next step is to create the income adding the grey transaction below:

Here is the reasoning behind using an inventory account. By elected to tax yourself for the loan, you are assigning a value to the inventory and giving it a tax basis. The value of those bushels of sealed grain are equal to the loan that you took on them; that is equal to the taxable income that you created in the current tax year.

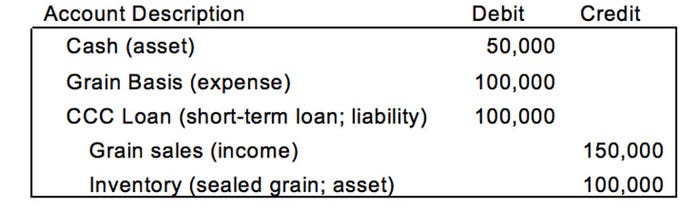

When you sell the grain, you generally don’t see the cash but it is a sale that you make in the year the grain is sold. So – using the CCC loan we created in the last year (transaction more specifically for our case) – when grain prices go up 50% and you sell the grain, you should be booking the total sale – the cash you receive plus the funds directly paid to for the loan. You expense the basis you created in the previous year to offset the funds paid directly to the CCC:

The good news is that whenever you want to elect a CCC loan as income, you just do it. However, if you want to go back to the loan method after you’ve used the income method, you need to file a Form 3115 with your tax return. It’s not difficult but it will take some extra time (and cost) for your annual tax return. Work with your tax preparer and keep them in the loop on your sealed grain. They may be able to save you some tax dollars next year without having to take low prices this year.

� The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like