August 28, 2019

By Roy Black and John Jones

Financial benchmarking results for 2018 for Corn Belt and Great Lakes states farms have been widely reported in the press, particularly for dairy and cash grain farms. In many reports, summaries cover the five-year, 2014-18 period, describing and discussing trends.

For cash grain farms, the period reflects the adjustment toward yet another “new normal” after the higher grain and oilseed prices during the 2006-13 period.

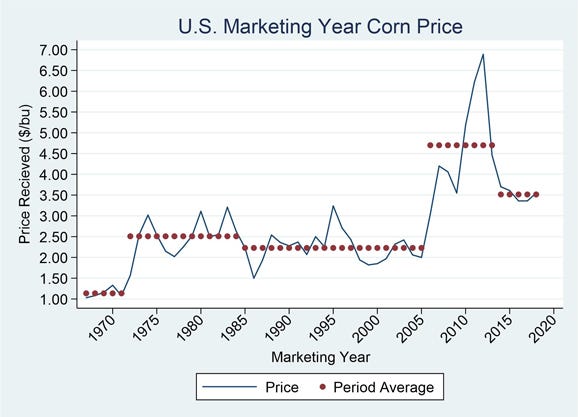

For reference, the figure below describes corn prices over the past 50 years, covering the price regime of the 1960s, the 2.5x run-up beginning in 1972, the crash of the 1980s, the doubling beginning in 2006, and the fall to the current level.

Historically, it has taken six to 12 years for the market to discover the “new normal” after shocks similar to the 2006-13 period, with a similar period for farm financial accommodation.

Laid over the top of these adjustments has been trade uncertainty and USDA programs set up to partially reduce effects on corn and soybean prices with Market Facilitation Program payments.

For Michigan dairy farms, the 2014-18 period reflects adjustments in national and international dairy product markets, feedstuffs markets, and Michigan production exceeding Michigan processing capacity. This has been the longest subpar financial performance sequence in modern history.

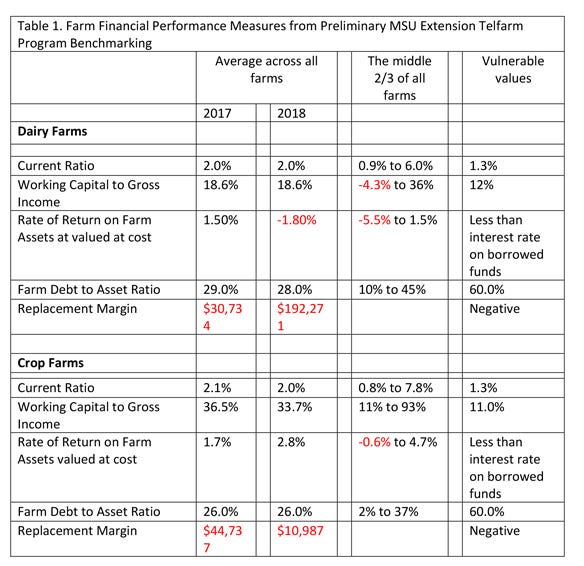

Table 1 below shows preliminary financial benchmarking results for cash grain and dairy farm farms participating in Michigan State University’s Telfarm Project for 2017 and 2018. Averages across all farms are shown, as well as the range for the middle two-thirds of farms for 2018. The last column describes values used to describe vulnerability or a weak position.

The measures reported are liquidity — current ratio and working capital as a percent of gross revenue; profitability — rate of return on farm assets; capacity to meet principal and interest payments — replacement margin; and solvency — debt as a percent of assets.

The complete report can be downloaded from the Telfarm center at canr.msu.edu/telfarm. There are 16-plus financial measures used in the more extensive analyses.

Perhaps the most striking measures are the negative replacement margins and rate of return on assets. The replacement margin is a measure of repayment capacity and is determined based on information derived from the cash-flow statement.

The term refers to the borrower’s ability to repay term debt on time; it measures the income that remains following the payment(s) for principal and interest on term loans and any purchased capital assets paid for in cash. The measure is an important indication of the financial stress many dairy and cash grain farms face.

The rate of return on farm assets, valued at cost as contrasted to market, captures the earning capacity of farm assets. An opportunity cost of unpriced owner labor is subtracted from income before making the return on assets calculation. When the rate of return is less than the interest rate paid, the return on farm business equity will be less than the ROA, as was the case for most cash grain and dairy farm businesses in 2018.

The variation in values across farms within the middle two-thirds of farms is equally striking. The farms were ranked on ROA to permit the grouping to obtain the middle two-thirds. The bottom and top 16% were excluded from the calculation. All measures show substantial variation with some farms appearing in the vulnerable area.

Financial metric comparisons are done for individual farm businesses over years; individual farm business compares to peers; and current situation compared with intermediate- and longer-run prospects.

The FarmDoc group at the University of Illinois has made five-year-out projections for corn-soybean farms beginning with 2019. Because of lower anticipated yields in 2019, they project profitability in 2019 to fall relative to 2018. They have net worth remaining pretty flat over the period.

The Center for Farm Financial Management at the University of Minnesota has a database covering several states, which is widely used in benchmarking. It is located at finbin.umn.edu.

Roy Black is a professor in the Department of Agricultural, Food, and Resource Economics at Michigan State University. He can be reached at [email protected]. John Jones is a co-coordinator for Telfarm at Michigan State University. He can be reached at [email protected].

You May Also Like