Profit margins for the ethanol industry have been in negative territory for 2012, resulting in the closure of more than 20 refineries. The cause of the problem is the high cost of corn, due to the drought-shortened crop and the inability to find adequate supplies of corn to continue refining. The U.S. ethanol mandate is keeping production going, despite the economics, and without that, ethanol content in gasoline would be cut to 3-5%. Profits of the ethanol industry have been used to pay for corn that costs about $1 more/bu. than in 2011.

March 11, 2013

With high gasoline prices at the pump one would think the ethanol industry would be making money. But about 10% of the ethanol refineries are closed and some plants are shifting to wheat as a feedstock due to unavailable supplies of corn. Times have been rough for the ethanol industry, but one has to follow the money to find out where it is going.

“An unprecedented rough financial time for corn ethanol production,” is the description used by Iowa State University economist Don Hofstrand to indicate how the industry fared in 2012. He says his calculations show the typical ethanol plant sustained a financial loss in every month last year. He says, “The major culprit was high corn prices.”

Expensive corn

The last half of 2012 saw corn prices at $1 higher than the prior year, but while the price of ethanol was high, Hofstrand says it was not high enough to offset the cost of corn. And while distillers’ dried grain was also at a record high, there was still not enough margin to offset the lower revenue from ethanol. He calculates total revenue for ethanol and DDG sales at 30¢ under 2011 revenue. 2012 was the first year that the Iowa State economic model for ethanol plants recorded a loss for the entire year, which was 9¢/gal. The business model reflected a negative 8% return on equity, compared to the 26% return from 2005-2012 and compared to the 94% return on equity recorded in 2006.

Like what you're reading? Subscribe to CSD Extra and get the latest news right to your inbox!

Hofstrand says ethanol plants will report return over fixed costs and a return over variable costs. The latter, which includes the cost of corn, natural gas and other costs that vary with production, was actually a positive number. And a return over the variable costs is usually the determining factor over whether to keep a plant in operation. Another determining factor for continuing in operation is the “grind margin,” which was positive for 2012 and averaged 30¢/gal. The grind margin equals revenue from ethanol and DDG sales, minus the cost of corn and energy to operate the plant.

Follow the money

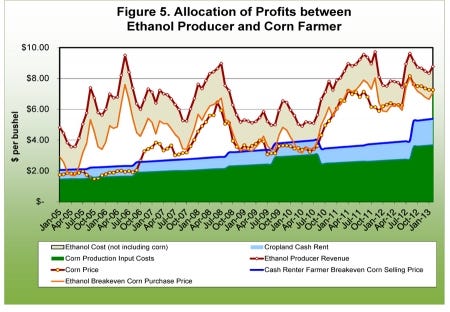

So if a plant has to shut down, and if profitability of other plants is challenged, where does all of the money go that was received for ethanol and DDG sales? Hofstrand says there is an interesting allocation of those funds across the spectrum from cash rent and crop inputs to corn prices and the plant’s return on its investment. And he adds, “The corn price allocated virtually all of the profits from the 2010 and 2011 corn crops to the corn farmer. During 2012 the corn price has allocated more than the supply chain profits to the corn farmer. This has resulted in the ethanol producer losses.”

Hofstrand says corn production levels for 2013 are yet to be determined as well as the level of corn prices. And while gas prices are high, the declining consumption of gasoline may lead to lower ethanol prices and use. He says the ethanol mandate is keeping use at a high level, and without it, the percentage of volume in gas would fall to the 3-5% range to supply enough oxygen content, without being a direct substitute for gasoline.

Where does the buck really stop?

To answer the question of where the money goes, Hofstrand says the profits from ethanol production have gone to corn farmers to purchase higher-priced quantities of corn. However, farmers will report their profit margins have been clipped by income transfers of their own to land owners wanting higher cash rents and input suppliers for seed, fertilizer and equipment.

Read the article at farmgateblog.com.

You might also like:

Farming is a Way of Life, Not a System

You May Also Like