by Miles Weiss, Jennifer A. Dlouhy and Mario Parker

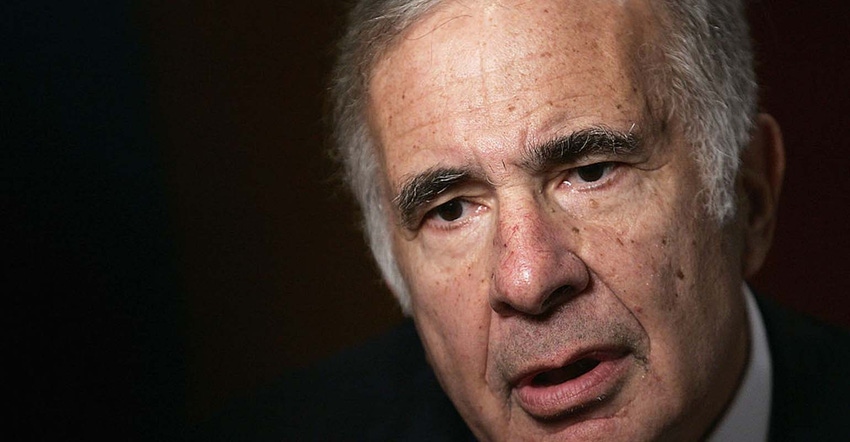

Federal investigators have issued subpoenas for information on Carl Icahn’s efforts to change biofuel policy while he served as an adviser to President Donald Trump, according to regulatory filings.

The U.S. Attorney’s Office for the Southern District of New York is “seeking production of information” pertaining to Icahn’s activities regarding the Renewable Fuel Standard, according to a Form 10-Q that Icahn Enterprises LP filed on Friday with the U.S. Securities and Exchange Commission.

The investigators also want information on Icahn’s role as an adviser to the president, the document says.

“We are cooperating with the request and are providing information in response to the subpoena,” Icahn Enterprises said in the filing. “The U.S. Attorney’s office has not made any claims or allegations against us or Mr. Icahn.”

Representatives of the White House and Icahn did not respond to messages seeking comment. Wyn Hornbuckle, a spokesman for the Department of Justice, declined to comment.

When Trump named Icahn as an unpaid “special adviser” on Dec. 21, he tasked the billionaire with helping to shape his regulatory agenda. By August, Icahn had left the role, after drawing criticism from senators and watchdog groups for pushing a change to the renewable fuel program that would benefit CVR Energy Inc., the independent oil refiner in which he owns a majority share.

Specifically, Icahn wanted the Environmental Protection Agency to alter the way it administers the Renewable Fuel Standard, a program that requires refiners to use biofuel. Under the current structure, refiners that have relatively little or no blending infrastructure must buy compliance credits known as "renewable identification numbers" to make up for their shortages. Icahn has argued that market was "rigged" in favor of big oil companies.

Amid climbing RIN prices and compliance costs last year, Icahn began pushing the EPA to relieve refiners of their obligation to fulfill the mandate, potentially shifting it to fuel blenders instead. Once Icahn was named an adviser, prices for the renewable fuel credits began a two-month decline, eventually losing almost half their value by the end of March.

During that first quarter of 2017, CVR boasted about saving $60 million buying RINs. It was a departure for the company, which reported losing money buying RINs for every quarter since the beginning of 2012, according to regulatory filings.

In March, Icahn told Bloomberg he was betting against the credits by delaying purchases in the expectation their value would fall. Icahn has said he never had access to nonpublic information nor profited from his position. And he has described his advocacy as normal given his refinery stake.

"I own a refinery," Icahn said in a phone interview in March. "Who knows it better than me? Why shouldn’t I advocate?”

After Bloomberg broke the news that Icahn had struck a deal for changes with a leading biofuel industry trade group in February, RIN prices plummeted. That agreement never resulted in a policy shift, and EPA Administrator Scott Pruitt specifically ruled out the change in a letter to a handful of farm-state senators last month.

The U.S. Attorney also sent subpoenas to CVR Energy for information on its activities, as well as those of CVR Refining and Icahn, according to a separate filing by the refiner.

CVR Energy shares slipped 13 cents, or 0.4%, to $31.29. Earlier Wednesday, they sank as much as 2.9% to $30.50, the steepest intraday decline since Oct. 23.

RINs tracking 2017 ethanol consumption targets fell as much as 4.3% Wednesday to 90 cents in intraday trading. That’s the lowest in at least two weeks, according to broker data compiled by Bloomberg.

Icahn’s role as an adviser to Trump has drawn scrutiny on Capitol Hill, as Democratic lawmakers argued his appointment ran afoul of ethics standards and presented a conflict of interest because Icahn hadn’t made any obvious effort to separate his business holdings from his broad mandate to address regulations. Senator Tammy Duckworth of Illinois asked the FBI to open a criminal investigation of Icahn in August.

"It’s clear that the company crossed a number of lines in influencing policy while Icahn had this role as special adviser," said Tyson Slocum, director of the energy program at the watchdog group Public Citizen. "It’s important for prosecutors to be looking into the actions and activities of Icahn and his company around biofuel policy."

To contact the reporters on this story: Miles Weiss in Washington at [email protected]; Jennifer A. Dlouhy in Washington at [email protected]; Mario Parker in Chicago at [email protected]

To contact the editors responsible for this story: Jon Morgan at [email protected]; Margaret Collins at [email protected]

Mark Drajem

© 2017 Bloomberg L.P

About the Author(s)

You May Also Like