What are the key themes impacting the farm economy today?

“Bottom line, we have too much supply,” according to Sam Miller, managing director of agricultural banking for BMO Harris. “The good news is demand is pretty good, but it’s not eating into the supply fast enough.”

Miller spoke to more than 100 ag lenders and other agribusiness professionals on Jan. 9 at a meeting in Kiel, Wis., sponsored by University of Wisconsin-Extension. The event was designed to teach agribusiness professionals how to work with struggling farmers.

Dairy volatility

While crop farmers are feeling some pain, dairy farmers are hurting more, Miller said.

“We have a lot of volatility in the dairy business,” he said. “There’s stress and there’s strain out there. Wisconsin lost just under 900 dairy farms last year. But cow numbers didn’t change much — cows just changed addresses.”

Miller said this is the start of the fifth year of low milk prices for dairy farmers. “We’ve had some voluntary exits, but now we’re getting more bankruptcies and foreclosures.”

He said there is an ownership and management transition happening across agriculture right now. “Grain elevators, banks, agronomy centers and farms are all consolidating.”

While several factors have impacted the dairy industry during the past four years, Miller said the biggest disruption to the milk supply came from the European Union. “The European Union was just coming off milk quotas four years ago and transitioning to a free market system. In January 2017, they really increased milk production. That had a direct impact on world dairy supplies.”

The U.S. dairy industry relies heavily on exports. The U.S. exported 16% of its dairy products in 2018 — more in the first half of the year before the trade tariffs were imposed by President Donald Trump, Miller said.

“It wasn’t the case 20 or 30 years ago, as we were primarily a domestic dairy market,” he added.

Another major factor affecting all of agriculture is a strong dollar, he said.

“Five years ago, the dollar was weaker, and our trading partners could get more when they bought dairy products, corn, soybeans and other commodities from us,” Miller explained. “Now with a strong dollar, they get less.”

Miller said farm prices were good from 2008 to 2014. “Now we’re on the opposite side of the cycle — prices are low,” he said. “Farmers have to be able to manage risk to survive. They have to plan, and they have to be ready to take action.”

Miller said while the collective debt-to-equity ratio of all U.S. farms is 15.6%, which is very strong, there are some troubling signs.

Declining net farm income

“Five out the last six years, we’ve had lower net farm income than the previous year,” Miller noted. “The last four years have been below the year 2000, when this index started.”

Miller said when net income began declining, assets flatlined. “We are funding losses with debt,” he said.

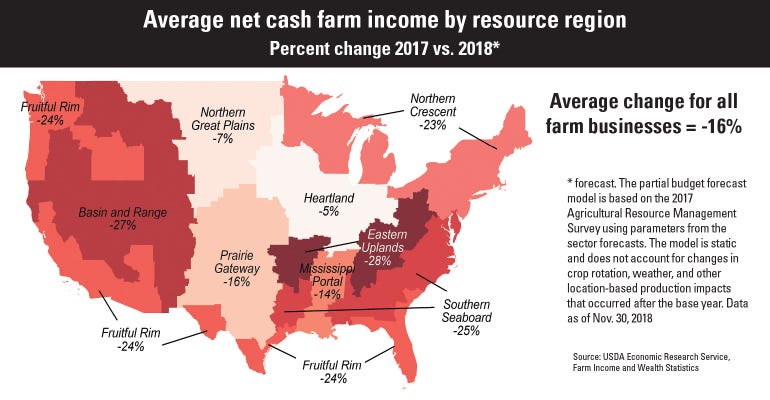

Miller showed the audience the graphic below, which shows that the Northern Crescent states — which include Wisconsin, Minnesota, Michigan, New York and the New England states — was one of the worst-performing regions of the country in 2018. In this region, according to USDA, net cash farm income declined 23% from 2017 to 2018. The illustration shows that the Heartland states — which include Iowa, Illinois and Indiana — was the best-performing region. The Heartland states’ net cash farm income declined only 5% from 2017 to 2018.

“Even though corn and soybean prices were not that high, this region experienced high corn and soybean yields, which offset the lower prices,” Miller explained.

Take action

What can dairy farmers do to hang on until milk prices improve?

“This is not the time to sit back and hope things are OK,” Miller said.

He suggested farmers sell underused assets, such as the woods on their farm. “If you have a tillage tool you’re no longer using, sell that, too,” he said.

Miller recommended farmers continue to do things that make money, such as buying soybean meal to feed their cows.

“Cutting back on protein will cause milk production to drop, and that’s not good,” he said.

Many dairy farmers used to sell extra heifers for additional income, but with low cow and heifer prices, that’s not an option at this time. Miller suggested farmers look for things they can do on their farms that will not reduce income.

“There are a lot of dairy farmers who are breeding the bottom half of their herds to beef bulls,” he said. “It’s a lot better to use sexed semen to get a beef bull calf you can sell at a few days old and get $100 for instead of $5 for a Holstein bull calf. Breed the top half of the herd to dairy bulls using dairy sexed semen to get heifers.

“You can also reduce your expenses and debt by feeding fewer dairy heifers.”

About the Author(s)

You May Also Like