If you’re a dairy farmer in the Northeast, you probably looked at your July milk check with jaw-dropping disbelief. Class III prices are hot right now, but negative producer price differentials (PPD) meant that you couldn’t cash in on that hot market.

Several factors, some of them in place long before the COVID-19 pandemic arrived, are helping drive these unusual fluctuations in farm gate milk prices. This includes the timing of pricing reports, a new calculation on the Class I mover and depooling of milk in the federal milk marketing order.

The good news is that the worst is likely over. The bad news? COVID-19 is still here, and it could roil markets again.

So, what’s a producer to do? A good risk management strategy is a start. And there is plenty of room for participation.

Look at the Dairy Margin Coverage program, which provides protection to producers when the difference between the all-milk price and the average feed price falls below a certain dollar amount selected by the producer.

According to data from the USDA’s Dairy Margin Coverage website, only 34.99% of Pennsylvania farms with a production history signed up for coverage this year, a big drop from last year when 87.18% of farms were signed up. In New York state, just 28.5% of dairies were signed up, down from the more than 80% of dairies signed up last year. And in Vermont, only 18.91% of dairies are signed up, way down from 84.76% last year.

Zach Myers, risk education program manager for the Pennsylvania Center for Dairy Excellence, says that it’s tough right now to get started in risk management. Dairy Margin Coverage is closed and won’t reopen until Oct. 12. Dairy Revenue Protection, which insures against unexpected declines in the quarterly revenue from milk sales relative to a guaranteed coverage level, is open, but you can only insure the last quarter of 2020.

This year, only 676 DRP policies were sold in Pennsylvania. Of those, 14 policies were indemnified, paying $192,506. Thus far, 14 policies have been sold for 2021.

Livestock Gross Margin for Dairy (LGM-Dairy) is open for signup 12 times a year, but the signup is very short — opens the last business Friday of each month and then closes the next day — so you have to do your homework before signing up for a policy. The plan provides protection when feed costs rise or milk prices drop and can be tailored to any size farm. LGM-Dairy uses futures prices for corn, soybean meal and milk to determine the expected gross margin and the actual gross margin. It’s like buying both a call option to limit higher feed costs and a put option to set a floor on milk prices.

You can also work with a private broker to do options-based risk management on Chicago Mercantile Exchange prices, but this tends to be more expensive than traditional government-subsidized risk management.

Myers says that there are many reasons farmers decide to skip participating in risk management. Maybe they had a bad experience with a product, or maybe they take a gamble thinking that the next year will be good enough to not have to spend the money on a risk management plan.

Some producers lack understanding of risk management, he says, while others don’t see the potential return as worth the investment.

But banking on a return in risk management, he says, is flawed thinking from the start. It should be about playing the long game of achieving some sort of stability in prices and cost.

“Risk management doesn’t guarantee a return. It’s just like insurance,” Myers says.

Wild price ride

While the Class III price shot up to $21.04 in June, a record increase of $8.90 from May, the producer price differential — the difference between the value of the same pounds of components at Class III prices and the value assigned to components in the other channels milk was sold through — hit its own record in the Northeast, negative $5.17. By comparison, May’s PPD was $1.33.

The overall uniform price for June was $15.66 per cwt, the highest since April but certainly not as high as Class III.

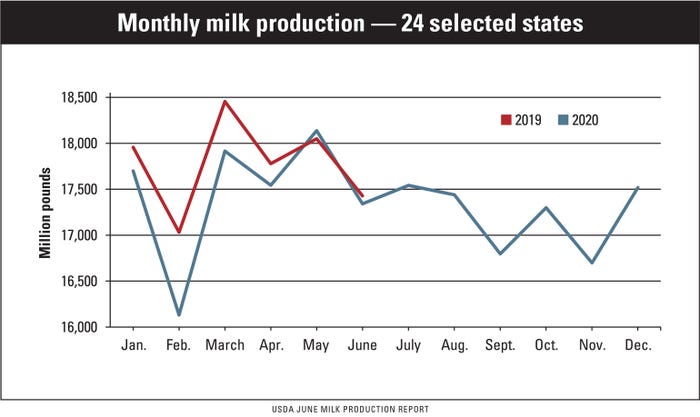

What’s driving Class III prices? Restaurants reopening, strong demand for dairy products at grocery stores and the government’s purchase of dairy products for the Farmers to Families Food Box Program. Also, dairy production has stayed relatively flat over the past year due to base excess programs designed to cut production.

Andy Novakovic, emeritus professor of ag economics at Cornell University, says the negative PPD tells only part of the story. A negative PPD usually happens because of a very large and rapid increase in Class III milk prices and is actually an indicator that dairy prices are going up.

The problem was that the Class I price, announced a full month before the Class III price for June was announced, was based on much lower prices and the spread between those class prices became huge.

Another big factor was that the calculation of the Class I price — also known as the Class I mover — changed in the 2018 Farm Bill from just the higher of Class III and Class IV prices to an average of both prices, plus 74 cents. This means that when the Class III and IV prices see big spreads, as what we’re seeing now, it lowers the Class I price than if the calculation was the “higher of.”

But the biggest factor, Novakovic says, was that processors took a lot of milk out of the federal pool — depooling — as a result of the higher Class III prices. When Class III prices are higher than the other classes, staying in the pool doesn’t benefit these processors because they have to pay the higher Class III price for their milk. Federal milk marketing orders only require Class I fluid plants to pool all their milk; all other plants can opt in or opt out. The result is that depooling lowers the overall value of the pool and the uniform price paid to farmers. Class III processors only must pay their producers the uniform price, or even a little more, and can keep the rest instead of pooling it.

June’s Pool Price Announcement showed 1.85 billion pounds of total producer milk in the pool, a big drop from May when the total pounds were 2.3 billion pounds.

Looking ahead

August milk checks, which will out soon and will be based on the July price announcement, will likely see another negative PPD, giving more incentive for processors to depool, which would once again lower the overall price for many farmers.

Even though the Class I advanced price for July has rebounded to $19.81 in the Northeast, the Class III price has also shot up, to $24.54 per cwt.

In their most recent Dairy Markets and Policy information letter, Novakovic and Mark Stephenson, director of dairy markets analysis at the University of Wisconsin, estimated that Class III and IV prices will likely converge by the end of the year “and to return to a more normal relationship.” They also estimate Class I prices will stay above Class III prices through the end of the year.

Another thing to watch, Stephenson says, is whether schools reopen and how that will affect supply and demand. Schools account for about 8% of milk sales, he says. At the same time, retail sales of dairy products are way up since people either out of work or working from home are doing a lot more baking and buying up butter and other dairy products as a result.

“But if people are going back to work, this could affect the retail demand. That may soften up,” he says. “It’s going to be back and forth. And, can the supply chain handle these things we’ve never seen before? I think we’re more acutely aware of it and we may handle it better, but I don’t think it’s going to be smooth sailing.”

About the Author(s)

You May Also Like