So, how is 2021 shaping up for dairy? Matt Gould sums it up with one word: “Mediocre.”

“It’s not very bullish; it’s not very bearish,” said Gould, chief market analyst for Rice Dairy and author of the Dairy Market Analyst weekly report.

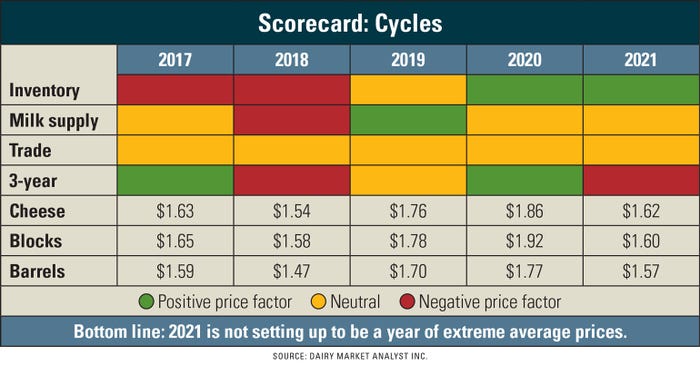

In coming up with a forecast for next year, Gould looked at four factors: a steady milk supply, reduced powder inventory, sluggish trade and the three-year dairy price cycle.

When it comes to global milk supply, based on the top eight dairy-exporting countries and regions of the world, including the U.S., Canada, the E.U. and others, milk production through June was growing by around 1 billion pounds per month.

Speaking during a virtual dairy conference put on by the Pennsylvania Center for Dairy Excellence, Gould said that based on past milk supply cycles, supply growth of 2 billion pounds per month is a red flag and can lead to excessive oversupply. In 2012, production growth approached 4 billion pounds in some months, while in 2014-15, most months saw production grow by 2.5 billion to 3 billion pounds a month. In both years, farm-gate milk prices dropped.

“You want some level of growth to keep balance up with demand,” he said. And with a growing middle class around the world, overall demand is rising. For 2021, he predicts production growth will be enough to keep up with demand.

“We don’t have this wall of milk coming at us. On the flip side, no big contraction taking place to set up really good prices either. 2019 was setting up that way,” but then COVID-19 hit, he added.

When it comes to milk powder inventory, it’s hovering around 375 million pounds a month, the lowest since 2015 when cheese prices were close to $2.50 a pound.

“When you have big inventories, it will overhang markets and prices will be lower. The price spikes are only when you draw down inventories, so no big inventories right now,” he said.

While President Donald Trump touts ag trade deals, especially with China, Gould said we’re in a time of depressed trade for dairy. Based on numbers from the top eight dairy exporting countries, dairy trade is rebounding a little bit and is up modestly over last year, but most of the year it’s been down.

Then there is the three-year price cycle, where one year is good, one year is mediocre and one year is bad. “It’s an unbelievable reliable indicator," he said.

Based on the current cycle where 2018 was a bad year, 2019 was mediocre and 2020 was supposed to be a good year, 2021 should be a bad year. But Gould sees it more like 2017, which was more of a neutral year.

“I wish it was more exciting, but that’s what we got,” he said.

Mixed commodities outlook

In terms of nonfat dry milk, exports are on the rise, with Gould expecting these exports to rise to 5.2 billion pounds by the first half of next year, the highest since 2016.

“As we get closer to the second half of 2021, we are going to build inventories. But first half of 2021 will be much closer to be in balance,” he said.

There is more butter available than is being exported, but Gould thinks the market will return to balance by the end of 2021.

Butter is in surplus right now in the U.S. Before COVID-19, 55% of butter was consumed in restaurants and food service. With restaurants and schools closing earlier this spring, demand collapsed, but retail butter sales rose sharply as people stayed home to bake and cook.

As the summer winded down, retail butter sales slowed considerably. But restaurants have been slow to reopen and most aren’t at full capacity.

“I’m not particularly bullish on this reopening of sit-down restaurants,” he said. “With butter, we’re looking pretty subdued.”

Cheese supply is balanced right now, he said, but he’s forecasting surplus cheese next year, partly due to the opening of new manufacturing plants being built.

“Cheese has been a winner in this COVID epidemic because pizza companies have done real well,” he said, with cheese sales up 20% over last year.

Even so, there will likely be too much cheese to be exported during the first half of 2021, with supply and demand coming more into balance by the end of 2021.

“Our exporters are out there aggressively trying to book sales at this point,” he said. “It's not particularly price-rosy right now for cheese.”

Dry whey markets were subdued this year as some plants closed. Along with that, the Chinese hog herd was decimated by African swine fever, a big market for whey exports.

As the year comes to an end, the Chinese hog herd has rebounded to levels before African swine fever and the whey market has come back.

But U.S. whey protein demand has collapsed due to gyms and fitness centers closing. With additional supply coming on line, “I see a bit of a yin and yang in whey,” Gould said, with prices steady overall in 2021.

Of course, the government’s purchase of cheese products is also affecting markets. “This is the wild card when it comes to dairy demand,” he said.

Currently, USDA is purchasing 3% of U.S. production in the form of cheese, butter, fluid milk and other dairy products.

Unless there’s government intervention, the Farmers to Families Food Box program will start winding down, especially in November.

Lower Class III, steady Class IV

Based on prices for cheese, butter, dry whey and nonfat dry milk, Gould estimated Class III prices dropping to $14.12 cwt in January, going as low as $12.99 cwt in spring and then rebounding to $16 cwt by summer. He’s forecasting an average Class III of $14.92 cwt, below the $16.89-cwt average for this year.

Class IV looks a little better with $14.58 cwt in January, holding steady through spring and early summer, and possibly reaching $16 cwt by late summer. He’s forecasting a $15.37-cwt average for Class IV, higher than the 2020 average of $13.76 cwt.

About the Author(s)

You May Also Like