Global ending stocks and usage rates are both on track to notch new highs in the 2020/21 marketing year. In fact, the global stocks-to-use ratio of 33.01% for wheat in 2020/21 is the second largest margin for wheat stocks since 1960. So why do recent price rallies suggest global wheat stocks are tighter than it seems?

The answer is complicated at best. To be sure, some of the recent price gains are attributed to corresponding expansions in the corn and soybean markets. Some exportable supplies have shrunk after crop shortfalls last year. Pandemic food hoarding continues for both humans and now livestock, sending usage rates to all-time highs.

But timing is most critical reason why wheat prices are on the rise amid bountiful supplies.

The Russian conundrum

Russia is experimenting with different options to limit wheat exports for the remainder of its 2020/21 marketing year, which ends June 30, 2021. Rising domestic food prices will inevitably lead to governmental actions to keep Russian citizens fed at a reasonable cost until the 2021 wheat crop is harvested.

But how much will Russian wheat exportable supplies shrink through the proposed measures? A formal proposal was approved in late January enact a higher tax on wheat exports beginning February 15 through June 30. The new tax was set at $1.66/bushel, a 50% increase from original estimates, and set to last four months.

Earlier this week, Russia announced it would begin to implement a formula-based export tax on grain on April 1 to stabilize rising domestic food prices in the pandemic era instead of the previously approved export tax. Details surrounding the logistics and implementation of the formula have not yet been released.

However, sources told Reuters last weekend that the formula could total 70% of the difference between the current wheat price and $5.44/bushel, effective June 1. Russia will likely abandon its fixed-size tariffs scheduled to begin on February 15 in favor of this new method.

Regardless of the method used to limit exports, Russian farmers are not expected to book many sales to international buyers until July, leaving many international buyers with few alternatives for sourcing wheat.

The speculation surrounding the execution of Russia’s reduced wheat exports has already had the effect of driving up world prices as global buyers seek out a new and affordable source for wheat. Russia is the world’s largest wheat exporter.

Harvest wraps up in the Southern Hemisphere

Yield shortfalls also plagued Argentina’s wheat crop this year. Local estimates peg the 2020/21 crop at 624.6 million bushels, 14% lower than the 2019 haul after a dry growing season due to La Niña weather patterns scorched Argentina’s wheat crops. Argentina’s 2020/21 wheat exports could fall by 6% from early 2021 estimates due to the shortfall. Argentina is the world’s seventh largest exporter of wheat.

But southern hemisphere crops will likely not last long on the market while the Russian export tax is in place. U.S wheat exporters could also see a bump in international purchases provided the dollar does not substantially rise.

Next year’s crop

Some weather concerns continue to plague winter wheat crops across Europe. Crops showed resistance to frost damage in December, but unseasonably warm temperatures in January across the European Union’s southeast region could put crops at risk for winterkill if a freezing spell is cast on the area.

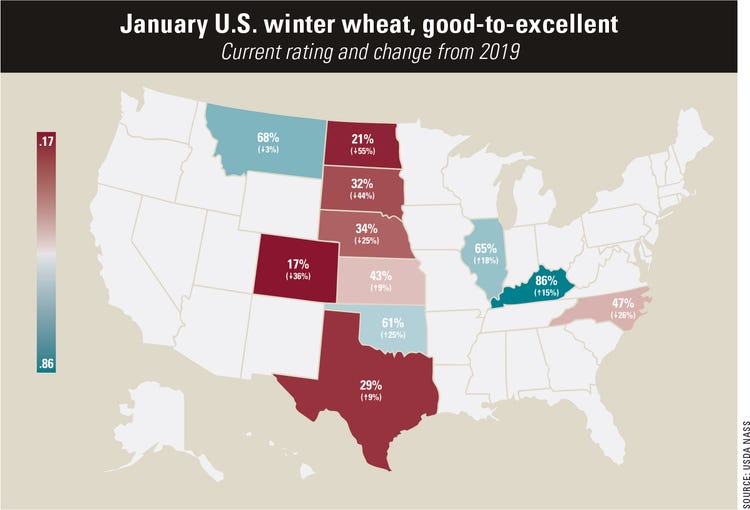

U.S. winter wheat conditions continue to struggle as La Niña-induced drought batters the U.S. Plains. By early February 2021, over 93% of acreage in the High Plains was in some category of abnormally dry to exceptional drought condition.

Winter wheat conditions are already struggling in the Plains. And amid high corn prices and abysmal pasture conditions, cattle feeders in the Plains – where 40% of U.S. cattle is raised – may seek to liquidate herds to save costs.

The weather forecasts will continue to have substantial impacts to wheat prices this year, both in terms of livestock consumption and production potential. As early 2021 rallies were supported by dry conditions in South America and Europe, similar weather shifts in the U.S. will also impact global wheat prices this spring.

About the Author(s)

You May Also Like