New results from the August 2021 Farm Futures survey find that U.S. row crop farmers are eager to cash in on profitable commodity prices and will likely continue to expand acreage into the next marketing year.

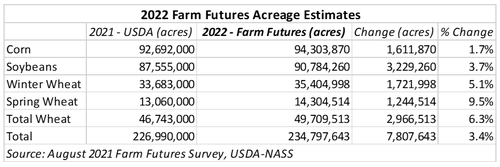

The survey, which gathered 737 producer responses via email questionnaire from growers across the country between July 13-August 1, found that farmers estimate they will plant 94.3 million acres of corn in 2022.

Though December 2022 corn futures prices are well off highs set this past spring, the current price at press time (about $5.17/bu.) offers an optimistic outlook on 2022 profitability. But, there are no guarantees markets will reward that optimism in 2022.

Using USDA trendline yields of 182.5 bushels per acre (bpa) for the 2022 crop, that would place 2022 production at 15.69 billion bushels, besting 2016’s record haul of 15.15 billion bushels. Using current 2021/22 corn usage rates of 14.65 billion bushels, the larger crop would nearly double ending stocks, which are slated to total 2.31 billion bushels.

That results in a stocks-to-use ratio of 15.8%, double the current 8.5% estimate for 2021/22. If realized, it would be the largest stocks-to-use ratio U.S. corn ending stocks have experienced since 2005. That would be a complete reversal of the two recent years of tight supplies following crop shortfalls (2020/21 – 7.4%, 2021/22 – 8.5%).

The boost to supplies could weigh corn prices lower during the 2022/23 marketing year. Of course, demand factors can change between now and next spring, which could cause an acreage shift beyond the intentions shared in the 2022 Farm Futures survey.

Soybean acreage to rise 4% in 2022

The Farm Futures survey predicts farmers will plant 90.8 million acres of soybeans in 2022. If realized, that would be a 3.2-million-acre increase from 2021 sowings and could top 2017’s record sowings of 90.2 million acres as the largest on record.

Will the extra acres finally provide relief after two consecutive years of tight soybean stocks? Maybe.

Using USDA trendline yields of 51.2 bpa and replicating 2021/22 demand estimates of 4.38 billion bushels for the 2022/23 campaign, U.S. soy growers could produce up to 4.59 billion bushels of soybeans in 2022 – a new record high, if realized.

The extra bushels would certainly go a long way to lessen supply pressures on global soybean flows. It would increase the stocks-to-use ratio for U.S. soybean ending stocks to 8.8% in 2022/23, up from the current forecast of 3.5% for 2021/22, which stands as the third tightest ending volume on record.

But carryout would only increase to 32 days in 2022/23, up from 13 days in 2021/22. That is significantly more comfortable than current marketing year estimates, but is still tight. New crop prices are likely to remain profitable, but the expectation of greater supplies could depreciate new crop prices in the coming year.

Wheat acreage to expand 6% in 2022

The August 2021 Farm Futures producer survey found farmers plan to plant 35.4 million acres of winter wheat for harvest and 14.3 million acres of spring wheat and durum acres in 2022. The total combined planted wheat acreage forecasted by Farm Futures stands at 49.7 million acres. Two years after U.S. wheat growers planted the smallest wheat acreage in history (44.3 million acres in 2020), growers plan to increase total planted wheat acres by an astounding 5.4 million acres.

If trendline yields of 49.5 bushels per acre are harvested, the U.S. could see the first wheat crop totaling over 2 billion bushels since 2016’s haul of 2.31 billion bushels. Farm Futures forecasts nearly 2.02 billion bushels of wheat will be harvested in the 2022 campaign, over 320 million bushels higher than current estimates for the 2021 crop. Even with higher production forecasted, stocks are likely to remain at tight levels amid strong global wheat demand.

Farm Futures estimates 2022/23 wheat usage to total 2.13 billion bushels due in large part to higher export targets. The usage rate, which will be the highest since 2016/17, will likely consume all new production that comes online in the new year, shrinking 2022/23 ending stocks to 632 million bushels with a stock-to-use ratio of 29.6%.

USDA currently estimates 2021/22 ending stocks-to-use at 30.4%. Supplies will likely remain plentiful over the next two years, but if 2022 projections are realized, it will be the tightest crop since the 2013/14 marketing year.

About the Author(s)

You May Also Like