The June World Agricultural Supply and Demand Estimates (WASDE) report from USDA has historically been a bit of a sleeper. To be sure, this month’s report will not have new supply information, as USDA’s National Agricultural Statistics Service (NASS) is currently survey growers for the June 30 Acreage and Grain Stocks reports.

Those reports are likely to offer the supply insights – and price responses – the market has been craving. But until then, any new adjustments to domestic grain stocks will likely be in the form of demand changes. Here is a quick preview of what to expect from tomorrow’s reports.

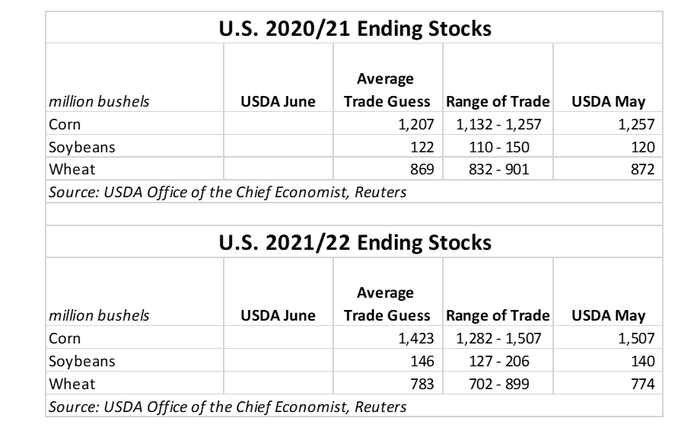

As mentioned before, no new supply information for corn and soybeans will be presented in tomorrow’s reports, so the focus will turn to demand for each commodity.

Corn – Weekly export rates continued to set new highs over the past month on steady Chinese and overall global demand, though those paces could ease back as futures prices creep back towards $7/bushel and the Brazilian safrinha crop is harvested. An upward revision past USDA’s current 2020/21 export estimate of 2.78 billion bushels would not terribly surprise markets.

Ethanol could also be another demand factor that further draws down 2020/21 corn stocks. USDA left the metric unchanged in last month’s report, but output levels have risen back to pre-pandemic volumes. The industry is taking a cautious approach to expansion as consumer fuel demand recovers, albeit somewhat slower than refiner demand for ethanol.

Soybeans – Stocks are tight as processors scramble to source feedstocks from dwindling on-farm stocks following an aggressive export and crush season earlier in the 2020/21 marketing year. Cash offerings at crush plants in the Eastern Corn Belt range between $0.45-$1.10/bushel over futures prices, reflecting scarce supplies and strong usage rates.

USDA will be hard pressed to change demand figures for old crop soybean in tomorrow’s report due to scarce supplies. Crush rates are expected to rise in 2021/22 on rising biodiesel demand, but crush plants will face stiff competition from the export market this fall.

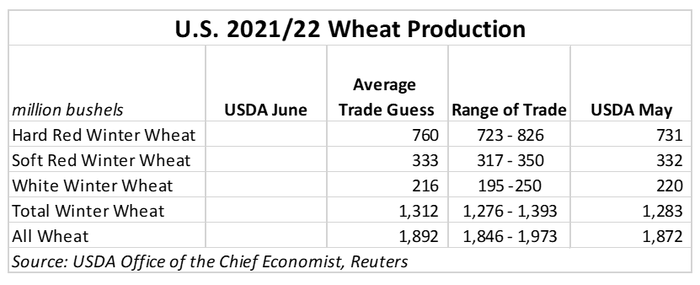

Wheat – Winter wheat harvest is underway in the Northern Hemisphere. In the U.S., early harvesting paces in the Southern Plains were delayed due to cool and wet weather this spring. But that bodes well for U.S. winter wheat yields, which could offset crop damage to spring wheat plants facing drought distress in the Northern Plains.

As the 2020/21 wheat marketing year draws to a close, final adjustments could be made to old crop ending stocks, though any demand revision is likely to be nominal. Market focus will instead turn to rising domestic feed demand for wheat expected to tighten stocks in 2021/22.

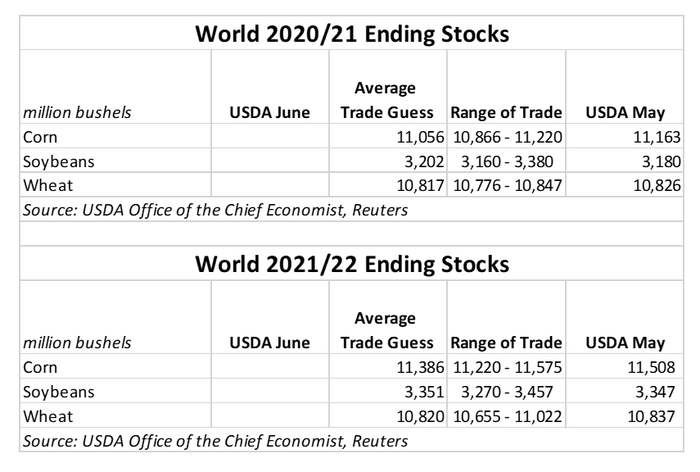

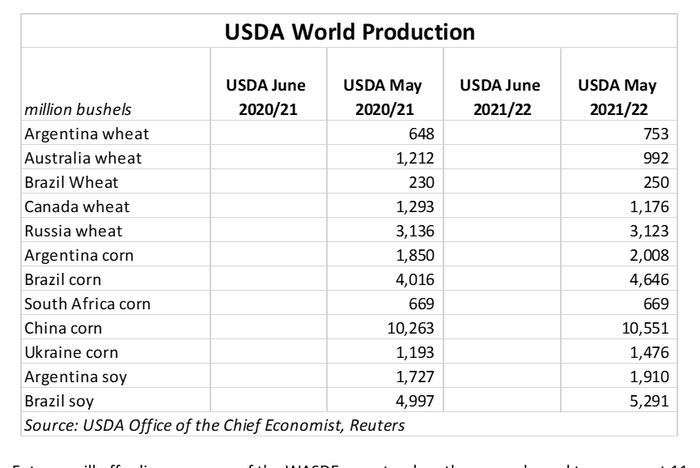

Global wheat production for 2021/22 is forecast at 29 billion bushels – a record high. But global demand closely matches that yield estimate as wheat is increasingly substituted for more expensive corn in livestock rations around the world. Chinese livestock consumption for wheat will be the factor to watch for global wheat stocks in tomorrow’s report, as it will likely provide the most immediate indication of how tight stocks will shrink.

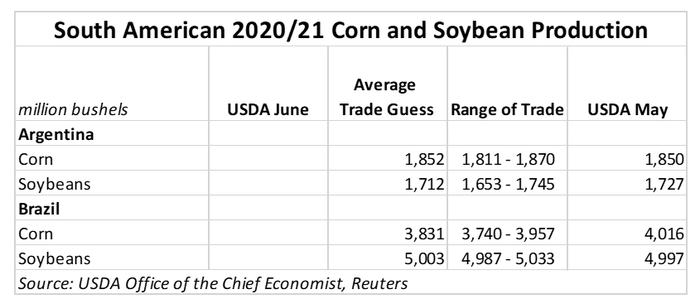

A smaller Brazilian crop due to drought damage to the safrinha (second) corn crop will play a significant role in shrinking global corn supplies for the 2020/21 marketing year. Few other adjustments are expected to global stocks from South American crops in tomorrow’s report.

Increased global corn production, namely in China and Brazil, will help increase 2021/22 global corn stocks over the year prior. But rising global livestock feed and ethanol demand are likely to offset production gains and send new crop stocks for global corn lower in this month’s report.

Tight global soybean supplies have virtually locked in demand prospects for the next year. But as planting season in Brazil approaches later this fall, expect more volatility. If Brazil can indeed harvest 5 billion bushels of soybeans, there will be a lot of soyoil processors, livestock and poultry feeders, and biodiesel producers waiting in the wings to snap up those new bushels.

Farm Futures will offer live coverage of the WASDE reports when they are released tomorrow at 11am CDT. Follow us on Twitter, @FarmFutures, or keep an eye on our website

About the Author(s)

You May Also Like