We have definitely passed the critical risk season for corn and a disaster has been averted. But the crop is not made and looking at these scenarios will show you how fast this market can change.

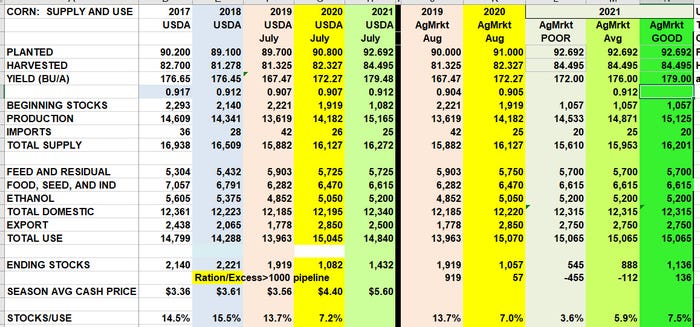

USDA numbers are on the left side and AgMarket.Net figures are on the right. You can see old crop data in the yellow column and how our numbers are in agreement (for the most part) with USDA 2020 ending stocks.

When we are discussing 2021 (the light green column), we need to realize that USDA’s yield is 179.5 bushel per acre. That is three bushels above the previous record in 2017. Although trend line regression formula suggests this is likely, the placement of increased acres this year in the poor yielding northern plains pull down on the weighted average, making it difficult to get above 178. So we created three scenarios for you to consider.

But before we look at how yield can impact the bottom line, we need to realize that USDA's demand assumptions are too low, given today's price and current pace of demand. Current sales to China exceed year ago and suggest they will be a significant importer next year. USDA has China imports pegged at 26 million metric tons. We suspect that that will be the minimum they purchase, and more likely closer to 29 mmt with the additional tons coming from the United States.

But even at 26 million tons (unchanged from this current year) USDA has exports declining from 2.850 billion bushels on this year’s exports to only 2.500 billion bushels for new crop. This makes absolutely no sense. The only justification for this would be that USDA did the same thing last year, starting out at 2.150 bil bu. exports and after 7 revisions they got to 2.850 where the entire industry had been screaming all year.

So let's be conservative and put next year's exports at 2.750 billion bushels. That means total consumption will be 15.065 billion bushels.

USDA is also using a historically high ratio for harvested acres. This makes sense given the high price. However, many acres in North Dakota and surrounding areas may become un-harvestable depending on the weather in the next couple of weeks. Much of these acres may be used for silage or abandoned. But again, to be conservative we will leave harvested acres. With a 179-bushel yield, using our revised demand, carry over will only be 1.1 billion bushels. This is pipeline requirements.

What happens if…

If yields fall to the previous record of 176 bushels per acre, carryover drops below 1 billion bushels and would require 112 million bushels of rationing or some imports. Rationing does not happen at current price levels.

We all expect a good crop. To think average yields could fall below 176 bu. per acre, we believe it would require adverse weather beyond what we have experienced. However, at this time of year, we need to understand the implications just in case it happens --- because it can.

For instance, last year on Labor Day weekend North Dakota had a damaging frost and yields were reduced by 30 bushels per acre. The same thing has recently happened to Brazil. And what about a derecho? So, we can't count the crop until it’s done.

If something were to push yields below 176 (record) towards the 172 level, the consequences would be great. A 172 seems like a low yield in today’s conversations, but reality is, last year’s yield was 172.27. We are talking about very realistic scenarios. At 172 bushels, stocks would be 545 million bushels, given demand. Obviously, this would be impossible and would therefore require about 500 million bushels in rationing.

Based on the inelasticity of an inflation based and low dollar market, higher prices would be required than what we have currently traded.

Potential sideways pattern

Having said that, if weather is conducive for a 176 – 179 yield, then we would expect the market to remain in a sideways pattern between $5.00 and $6.00. Our advice is to be 50% sold (our average is around $5.00) of expected bushels with calls bought against it (so our net should be higher than $5.00).

If yields are sub 176 bpa, our plan is already in place. So, in other words – being price neutral is the best mindset right now but if you see consensus that the yield could be below 176, then yes you can still be bullish.

Source: Ag Market.net, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like