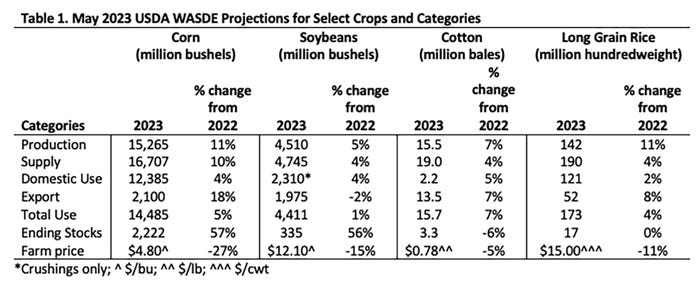

On May 12th, USDA released the latest World Agricultural Supply and Demand Estimates (WASDE) report. The May WASDE is significant as it provides USDA’s first official projections for the 2023 marketing year.

The report provides annual forecasts for the supply and use of various crops based on marketing years, which start August 1 for cotton and rice and September 1 for corn and soybeans.

It should also be noted that projections for production are based on the acreage reported in the March 31st USDA Prospective Plantings report and yield forecasts based on trend models or historical yields depending on the crop. Thus, the projections in Table 1 and discussed below will change as the growing season and marketing year advance.

Source: USDA

U.S. corn production is projected at 15,265 million bushels, based on 84.1 million harvested acres and a national average yield per harvested acre of 181.5 bushels. If realized, this would be a record yield and level of corn production.

Combined with carryover stocks from last year, the total U.S. corn supply is projected to be 10% higher than in 2022. This supply increase is offset by a 5% increase in total use.

Feed use is projected to increase by 375 million bushels, and ethanol to increase by 50 million bushels. Exports are projected to be up 18%, at 2,100 million bushels.

Corn

Corn ending stocks are projected at 2,222 million bushels, a 57% increase from 2022. The average farm price is projected at $4.80 per bushel.

Like corn, U.S. soybeans are projected to see higher supplies and lower prices in 2023. U.S. soybean production is projected to be 4,510 million bushels, a 5% increase from 2022. Most of the production increase is due to a higher expected yield of 52 bushels per harvested acre – also a record if realized.

On the demand side, domestic crushings are projected to increase by 90 million bushels from 2022, but exports are projected to decrease by 40 million bushels. With supplies outpacing demand, ending stocks are projected at 335 million bushels, a 56% increase.

Cotton

U.S. cotton is projected to plant less acreage in 2023 but will see higher production than in 2022. The 2022 cotton crop saw a record level of abandonment, with 13.76 million acres planted but only 7.31 million acres harvested, mainly due to dry conditions in Texas.

Currently, USDA projects 11.26 million acres planted with 8.71 million acres harvested. It will be important to keep an eye on acres abandoned as the year advances, with growing conditions in West Texas remaining dry.

In the May WASDE, U.S. cotton production is projected at 15.50 million bales, a 7% increase from 2022. On the demand side, exports are expected to increase by 0.9 million bales to 13.5 million bales. With higher exports, cotton ending stocks are projected to decrease by 0.20 million bales to 3.30 million bales.

The average farm price is projected to weaken to 78 cents per pound.

Rice

Lastly, the carryover of long-grain rice from 2022 is low at 16.8 million hundredweight but is more than offset by higher production.

Long-grain rice production is projected to increase by 11% to 142 million hundredweight.

Exports are expected to increase by 4.0 million hundredweight to 52 million, but any further expansion is expected to be challenged by competition from South America. Ending stocks are projected to remain flat at 16.8 million hundredweight, the same as in 2022.

Like other crops, the average farm price is projected lower to $15.00 hundredweight. Unlike other crops, though, the long-grain rice price is projected to remain above its 2021 price.

Overall, the USDA WASDE report projects a bearish supply and demand picture and lower prices compared to last year. There remains a large amount of uncertainty for the 2023 crop; however, USDA’s initial projections indicate lower prices for many southern row crops.

Actual planted acreage, weather, and crop growth are some of the main factors that will determine if lower prices becomes a reality.

Source: Southern Ag Today

About the Author(s)

You May Also Like