November 19, 2020

Now that the U.S. presidential election is out of the way, the grain market is focusing more on fundamentals for price discovery — supply and demand. As corn and soybean harvest wraps up, we’re getting a better idea of this year’s U.S. crop size, and of what’s happening with demand outlook for crops in the U.S. and on the world market.

Corn and soybean prices have risen considerably this fall, due to smaller-than-expected U.S. production as yields were hit by drought and windstorm damage, largely in Iowa. Other major corn- and soybean-producing states are also ending up with smaller-than-projected yields this year. Plus, export demand has increased significantly for U.S. corn and soybeans.

Cash prices of $4 for corn and $11 for soybeans at grain elevators in Iowa on Nov. 17 have boosted farmer morale. In the past three months, corn prices have risen 30% and soybeans 25%. The livestock sector has also improved, particularly hog prices. Cattle prices have had ups and downs and are now holding steady.

With the drought and derecho damage that occurred in a large area across the middle of Iowa this year, the corn and soybean market was anxiously awaiting USDA’s November crop production estimate to get a more accurate idea of yields and production.

How did Iowa crops do in 2020?

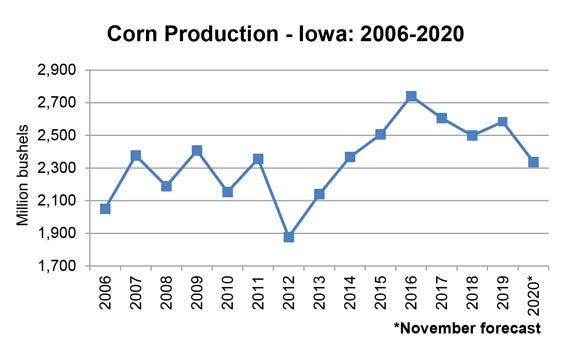

Iowa corn production for 2020 is forecast at 2.34 billion bushels, according to USDA’s November Crop Production Report released last week. Based on conditions as of Nov. 1, yields are expected to average 184 bushels per acre, down 2 bushels per acre from the Oct. 1 forecast and down 14 bushels per acre from last year. If realized, this would be the lowest corn yield for Iowa since 2014. Corn planted acreage is estimated at 13.7 million in Iowa in 2020. An estimated 12.7 million acres planted will be harvested for grain. The derecho took a toll.

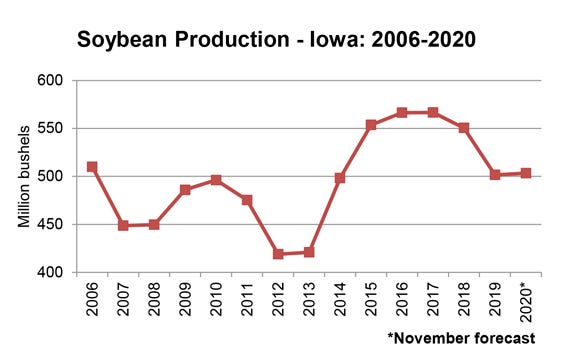

Iowa’s 2020 soybean production is forecast at 503 million bushels, according to USDA’s November estimate. The yield is pegged at 54 bushels per acre, down 2 bushels from the October estimate and 1 bushel per acre lower than 2019. Soybean planted acreage is estimated at 9.4 million, with 9.32 million harvested in 2020.

Forecasts in the November report are based on conditions as of Nov. 1 and don’t reflect weather effects since that time. The next official corn and soybean production estimates for 2020 will be published in USDA’s Crop Production Annual Summary report, to be released Jan. 12.

Corn production for grain in the U.S. this year is forecast at 14.5 billion bushels, down 1% from the October forecast but up 7% from 2019 production. Based on conditions as of Nov. 1, yields are expected to average 175.8 bushels per harvested acre, down 2.6 bushels from the previous forecast but up 8.3 bushels from last year. Area harvested is estimated at 82.5 million acres, unchanged from October but up 1% from last year.

Soybean production in the U.S. is forecast at 4.17 billion bushels, down 2% from the previous forecast but up 17% from 2019. Based on conditions as of Nov. 1, yields are expected to average 50.7 bushels per harvested acre, down 1.2 bushels from October but up 3.3 bushels from 2019. Area harvested for beans is forecast at 82.3 million acres, unchanged from the previous forecast but up 10% from 2019.

Corn, soybean price outlook

What’s the price outlook for the 2020-21 crop marketing year? Here’s the latest analysis from Chad Hart, Iowa State University Extension economist. The 2020-21 crop marketing year ends Aug. 31.

In USDA’s November World Agricultural Supply and Demand Estimates report, the big changes for corn are the 2.6-bushel-per-acre reduction to the national average yield and the 325 million-bushel increase in exports, Hart says. The combination lowers 2020-21 ending stocks to roughly 1.7 billion bushels (the lowest stock figure in several years). The shrinking stock levels led to higher expected corn prices, with USDA adding 40 cents to its season-average price projection, making it a round $4 per bushel.

For soybeans, the only major change comes in yield as well. With a 1.2-bushel-per-acre reduction, roughly 100 million bushels were taken out of production and stocks. The 2020-21 stocks-to-use ratio now stands at 4.2%, indicating a very tight market. USDA raised the season-average price estimate 60 cents, to $10.40 per bushel.

The reduction in corn yields is widespread and most likely linked to drought conditions across many parts of the U.S. Not only did the drought reduce yield, but there was also likely a secondary effect as the harvested bushels came in at below-average moisture levels. A similar yield story can be told for soybeans. Drought conditions reduced yields, and harvested bushels were drier than usual.

Soybean export sales strong

The 2020 marketing year has started off with a bang in export sales, with roughly 1.8 billion bushels already sold internationally. Ten weeks in and the U.S. has already passed last year’s total, Hart notes.

China is by far the driving factor here, he explains, adding, “Sales to unknown destinations are also up sharply, and those sales mainly end up in China as well. Movements in our other large markets have been more subdued and dwarfed by the Chinese actions. But it is encouraging to see growth in our smaller markets, as seen here with soybean sales outside of our top six export markets.”

The export start for corn is positive as well, but the gap isn’t nearly as great. “Still, nearly 1.4 billion bushels of export sales in the first 10 weeks of the marketing year is a good sign,” Hart says.

China is big buyer of U.S. corn

But here’s the major difference. “China is now our leading export market for corn,” Har says. “Sales to China account for just over 30% of all corn export sales. But it’s good to see growth beyond China, with growth in all of our major markets and the rest of the world totals.”

Feed demand for corn, soybean meal and distillers grain was being supported by record meat production. The 2020 projections were reduced earlier this year to account for COVID-19 impacts. “The 2021 projections by USDA display a significant rebound in meat production and a return to record production,” Hart says. “But the longer-term action in livestock and meat will depend on the ability to move meat from the farm and ranch to customers, both domestic and international.”

The bottom line: With recently better prices boosted by emergency government payments, USDA is forecasting $103 billion in net farm income for the U.S. in 2020. That compares with $84 billion in 2019.

You May Also Like