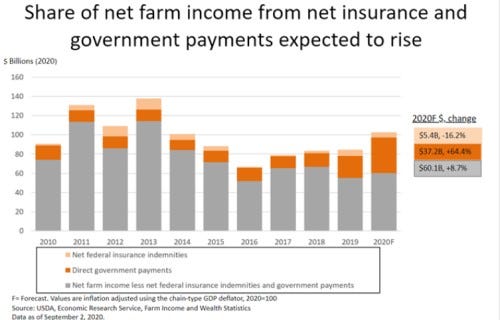

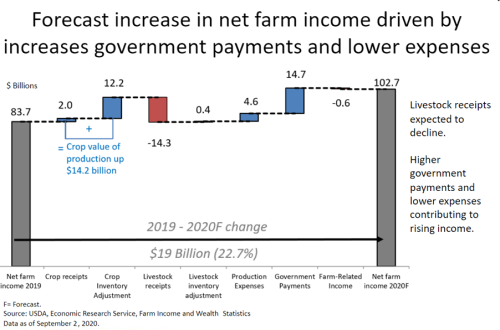

Overall, net farm income for 2020 is expected to rise $19 billion from 2019 to $102.7 billion in 2020, which is boosted by 64% higher government payments as well as lower production expenses. However, livestock receipts are expected to decline, while crop receipts and inventory adjustments contributed to the higher income levels, according to the latest forecast released by the U.S. Department of Agriculture’s Economic Research Service (ERS).

“Even if take away the increase in 2020 government payments, you would see an increase in net farm income,” ERS economist Carrie Litkowski said during a webinar on Wednesday. The value of agricultural production and animal production is forecasted to be stable in 2020. In addition, production expenses are projected to decline, which will boost income. “This would be enough for 2020, even if we were to take out the change in government payments,” she said.

Net cash farm income is projected to increase $4.9 billion (4.5%) to $115.2 billion. In inflation-adjusted 2020 dollars, net farm income is forecasted to increase $18.3 billion (21.7%), and net cash farm income is expected to increase $4 billion (3.6%).

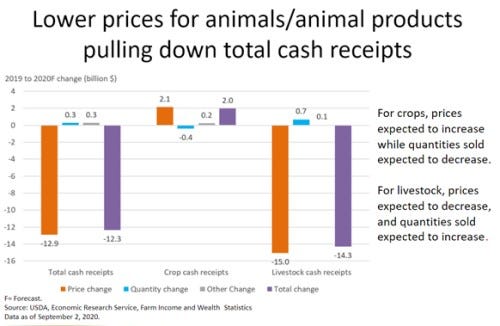

Overall, farm cash receipts are projected to decrease $12.3 billion (3.3%) to $358.3 billion in 2020. Total animal/animal product receipts are expected to decrease $14.3 billion (8.1%) following declines in receipts for broilers, cattle/calves, hogs and milk. Total crop receipts are expected to increase $2.0 billion (1.0%) from 2019 levels. Receipts for fruits and nuts are expected to increase, while receipts for corn, wheat, cotton and soybeans are expected to decline.

Litkowski said for crops, prices are expected to increase, while quantities sold are expected to decrease. Soybean cash receipts are expected to fall for the fourth consecutive year this year due to lower quantities, which outweigh higher prices.

For livestock, prices are expected to decrease, and quantities sold are expected to increase. Most types of livestock farm businesses are projected to have lower average net cash farm income. Hog producers can expect to see the largest decline -- a 36% drop in net cash income -- with large declines in receipts that will be larger than the government payments. The change in net cash farm income versus 2019 dropped 10.2% for dairy producers, 9.5% for poultry producers and 20.5% for cattle and calves producers, Litkowski said.

Cash receipts from cattle and calves are expected to fall $5.1 billion (7.7%) in nominal terms in 2020. Milk receipts are expected to decrease $900 million (2.2%) during the year and hog cash receipts down $3.5 billion (15.9%). Receipts for each of the preceding animal commodities are expected to fall during the year primarily because of lower price forecasts.

Broiler receipts are expected to fall $6.6 billion (23.4%) in 2020 because of significantly lower expectations for prices. Cash receipts for chicken eggs are expected to grow $1 billion (12.4%) in 2020, as higher prices should outweigh lower quantities sold. Higher prices for turkeys will drive receipt forecasts higher by $800 million (18.0%) in 2020, even considering expectations for lower quantities of turkeys sold.

Expenses

Total production expenses, including expenses associated with operator dwellings, are projected to decrease $4.6 billion (1.3%) in 2020 to $344.2 billion. Interest expenses are expected to decrease $5.6 billion (27.1%) and livestock/poultry purchases to decrease $2.1 billion (7.5%). However, fertilizer expenses are projected to increase $1.3 billion (5.7%) and cash labor expenses to increase $1.1 billion (3.1%) in 2020.

Feed purchases, the largest single expense category, are projected to increase 1.4% to $60.3 billion in 2020. The second-largest expense line item, cash labor, is also expected to increase 3.1% to $35.8 billion. Wage rate increases are expected to put upward pressure on hired and contract labor costs. Net rent and property taxes combined are forecasted to increase by 6% to $32.9 billion.

Expenses expected to decline will account for 31% of total expenses and are forecasted to collectively decline $10.6 billion. Interest expenses are projected to be at their lowest level since 2014, declining $5.6 billion from 2019 (27.1%) due to historically low interest rates. Livestock and poultry purchases are expected to decrease 7.5% to $26.5 billion, while pesticides are expected to decrease 2.1% to $15.2 billion.

Spending on oils and fuel is expected to decrease 13.9% to $11.4 billion, driven partly by the U.S. Energy Information Agency's August forecast of lower diesel prices -- down 52 cents/gal. -- in 2020.

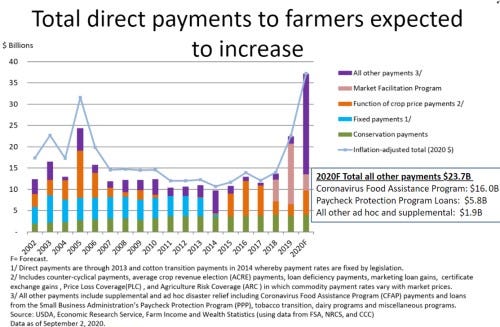

Government payments

USDA reported a 64% increase in government payments, which includes an influx of direct relief to producers through ad hoc assistance. Many farmers received Market Facilitation Program (MFP) payments in 2019 and the last installment of $3.8 billion at the start of 2020. Then, the coronavirus pandemic hit, and Congress authorized $16 billion for the Coronavirus Food Assistance Program (CFAP) as well as an estimated $5.8 billion for Paycheck Protection Program loans to agricultural entities, Litkowski said.

Government payments that are a function of crop prices such as the Price Loss Coverage program in the 2018 farm bill plans to pay out an additional $2.7 billion in 2020 because of the lower prices that trigger higher payouts. “Overall in 2020, direct government payments are at their highest level ever even when adjusted for inflation,” Litkowski said.

She did note that the forecasts include a total of $16 billion to be paid out for CFAP but acknowledged that payments to date are only $9-10 billion. The signup for CFAP closes Sept. 11, but she added that Agriculture Secretary Sonny Perdue has indicated that a second round of CFAP could be announced yet this month. She said the $16 billion represents the best guess without knowing the rules of CFAP 2, which she said are “really fluid.”

“We don’t have the rules to allow us to make a more explicit forecast, and this may get revised in December when we have details on CFAP 2,” Litkowski said. “We know USDA has money available to be spent. … We know Congress authorized money and money was readily available and is likely going to be spent.”

The Dairy Margin Coverage Program -- which replaced the Dairy Margin Protection Program in the 2018 farm bill -- is projected to make net payments of $200 million to dairy operators in 2020.

About the Author(s)

You May Also Like