Tomorrow’s monthly World Agricultural Supply and Demand Estimates (WASDE) report will be the second major market report released by USDA in as many weeks. Admittedly, there will not likely be as many changes in this report as in previous ones, especially to supplies.

Plus, USDA will release new crop supply and demand estimates for the 2021/22 marketing year in next month’s report. USDA attachés are already releasing estimates on new crop production, import, and export expectations, so markets will warmly welcome the new crop forecasts next month.

USDA’s World Agricultural Outlook Board (WAOB) will also add new soymeal usage designations for China in the May 2021 WASDE report, with the ultimate goal of determining Chinese usage and storage rates for the feedstuff in mind. Rising global feed demand as well as growing demand for renewable diesel fuels (largely produced by soyoil) is leading the charge for increased soybean consumption around the world.

But that doesn’t mean you should sleep on this month’s report. Here is a list of items the markets will be watching when today’s report is released.

Farm Futures will provide live coverage and analysis the reports on our website, FarmFutures.com, and on our Twitter page, @FarmFutures. USDA releases the updated data at 11am CDT.

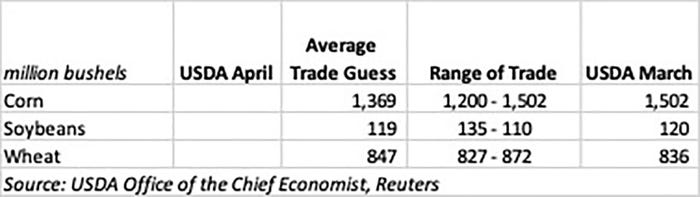

Last week’s Quarterly Grain Stocks report provided some hints about USDA’s adjustments that are likely in today’s WASDE report. USDA’s National Agricultural Statistics Service (NASS) pared 28 million bushels of corn from December 1, 2020 quarterly stocks last Wednesday, while adding 13 million bushels of soybeans and 29 million bushels of wheat to December 1 inventories.

The adjustments were made due to late-submitted reports from off-farm and commercial storage facilities. We will see the revision in the form of an adjustment to each commodity’s residual and feed usage category from WAOB.

Demand rationing will also be high on the list of factors to watch today, particularly for soybeans. Domestic loading paces have declined significantly in the past month as the Brazilian crop begins to enter international shipping channels. Weekly average soy export loading paces to China over the past eight weeks are over six times lower than the total weekly average shipping rate.

To be sure, the U.S. remains comfortably on track to reach its 2.25-billion-bushel soybean export target for the 2020/21 season. The most significant unknown at this point is the size of the Brazilian crop and how quickly – if at all – the South American country will run out of exportable supplies and force Chinese buyers back to U. S. shores for soybeans.

Domestic soybean crush rates slowed during the February 2021 cold snap, but marketing year to date crush rates remain 4% higher than the same time a year prior

The USDA seems more likely to adjust ending stocks for corn lower on increased export demand. Weekly corn export shipments totaled 80.8 million bushels in this morning’s weekly Export Sales report from USDA – the second highest weekly volume on record, not counting the weeks following government shutdowns. It’s worth noting that five of the largest weekly corn export loading volumes have been reported over the past six weeks.

Chinese demand played a large role in the large corn shipping paces – 28% of last week’s shipments (22.8M bu) were shipped to China. China’s total haul of U.S. corn this year currently registers at 356 million bushels. U.S. exports only shipped 83.1 million bushels of corn to China in the entire 2019/20 marketing year.

But China isn’t the only nation hungry for U.S. corn. Marketing year-to-date corn shipments to the next five largest U.S. buyers (Mexico, Japan, Columbia, South Korea, and Taiwan) are up nearly 25% from the same period in 2019/20. The largest increases are being driven by Southeast Asian countries, especially South Korea (290% increase), Japan (31%), and Taiwan (188%).

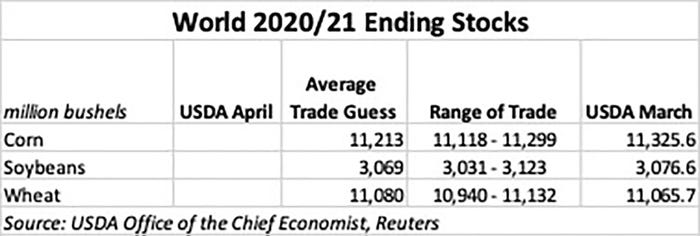

Global wheat stocks are likely to see few shifts in ending stocks revisions in tomorrow’s report. And there isn’t much of a new story there – global supplies are likely to remain high to close out 2020/21 and are expected to grow even higher as top exporters Russia, the European Union, and Ukraine see favorable growing conditions.

The real story will lie with corn and soybean global stocks. Any revisions to U.S. demand estimates and South American supply forecasts will tighten global supplies. But as soybean stocks remain tighter than those of corn, the oilseed complex could see more bullish trading activity as USDA’s forecasts are updated.

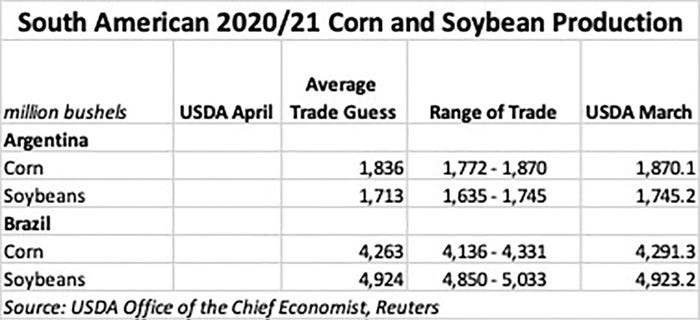

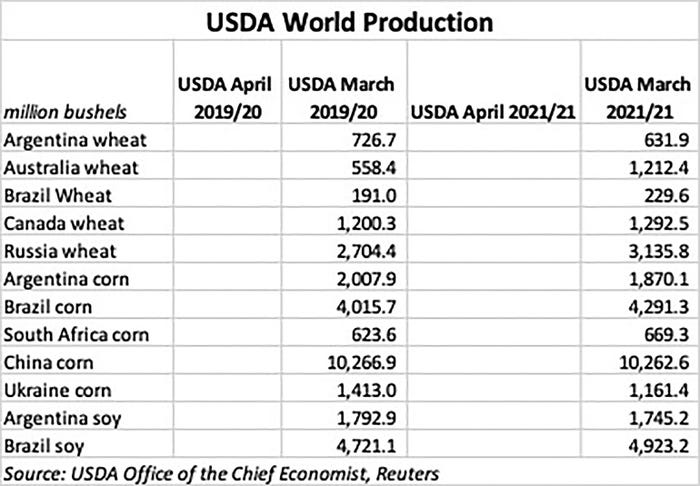

Corn and soybean futures prices will likely see the most price action from any revisions USDA applies to South American grain production estimates. Brazil’s government ag forecasting agency, Conab, released updated production estimates this morning for the current crops under production.

Conab expects Brazil’s total 2020/21 corn crop will rise nearly 1% from March 2021 estimates to 4.290 billion bushels. However, estimates for the safrinha, or second rotation, corn crop fell 0.2% from last month as the majority of the crop has been planted outside of the optimal yield window to 3.252 billion bushels.

Brazil exports most of its safrinha corn crop, so any USDA reductions to Brazil’s 2020/21 corn production will likely result in an increase in U.S. corn exports. However, recent USDA attaché reports suggest that the WAOB could cut Brazil’s corn estimate down to 4.134 billion bushels.

Conab also forecasts the 2020/21 soybean crop to register 4.98 billion bushels, slightly higher from March estimates despite quality concerns amid excessive rainfall during the harvest season. USDA attaché projections indicate USDA will leave Brazil’s 2020/21 soybean production total at 4.924 billion bushels.

About the Author(s)

You May Also Like