Grain futures are mixed this morning. Though USDA cut its forecast of corn and soybean production in Thursday morning’s World Agricultural Supply and Demand Estimates (WASDE) report, it projected tighter corn carryout but rising soybean inventories. Corn posted modest gains while soybeans sold off as a result.

“USDA’s attempt to update the supply and demand situation today was muddied by uncertainty over what’s going on in China,” notes Farm Futures senior grain market analyst Bryce Knorr. “While that was not surprising for soybeans, the confusion extended to corn as well.”

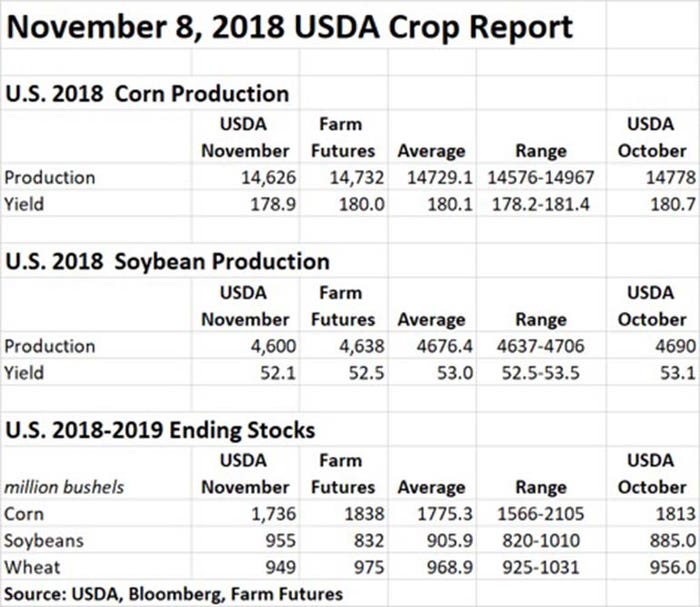

USDA lowered its assessment for U.S. corn production and noted smaller ending stocks, despite also noting lower feed and residual use and lower exports. Production is now estimated at 14.626 billion bushels, trending 152 million bushels lower than October estimates. Supply fell more than use, sending corn ending stocks down 77 million bushels.

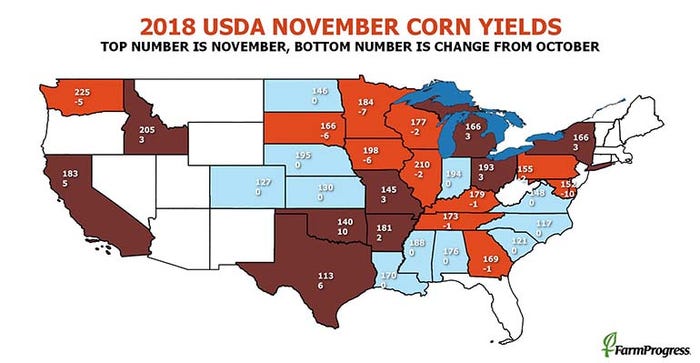

USDA’s latest per-acre yield estimates for the 2018 corn crop moved from 180.7 bushels per acre in October down to 178.9 bpa. Analysts anticipated a larger production of about 14.729 billion bushels on average yields of 180.1 bpa. Farm Futures, which regularly participates in these analyst surveys, contributed estimates of 14.732 billion bushels on average yields of 180.0 bpa.

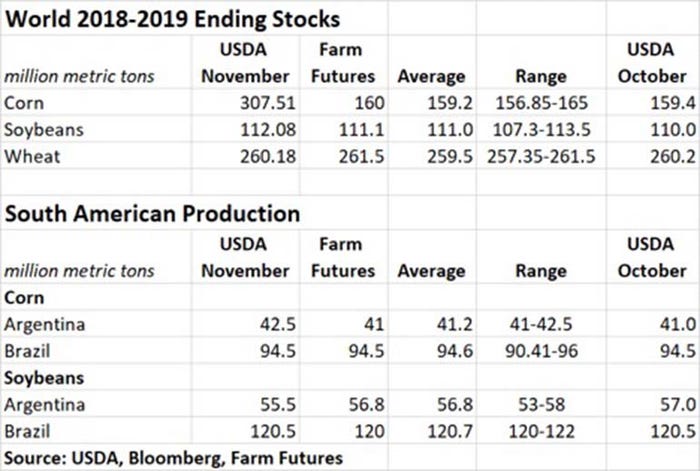

Global production, meantime, moved up another 29.9 million metric tons to reach 1.373 billion MT, with increased production estimates for China accounting for much of this increase. That was partially offset by lower European Union production from drought-stressed countries such as Hungary, Poland and Germany.

In South America, USDA expects Argentina’s 2018 corn production to reach 1.673 billion bushels (up from October estimates) and Brazil’s production to reach 3.720 billion bushels (unchanged from October).

All told, the agency revised its season-average price of corn by 10 cents, with a new midpoint of $3.60 per bushel.

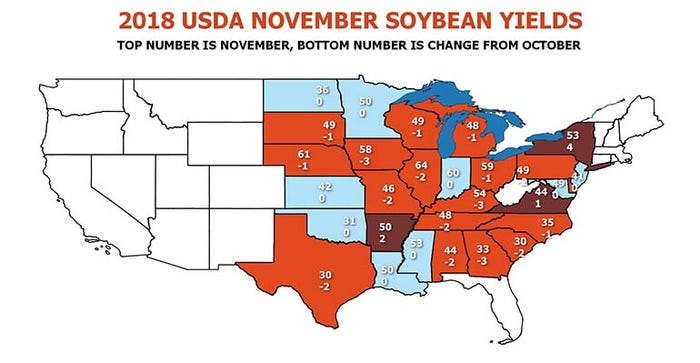

USDA also lowered its outlook for soybean production but increased its estimates for ending stocks, due in large part to lower export estimates. Production this year is now forecasted at 4.600 billion bushels, falling 90 million below October estimates, with per-acre yield estimates of 52.1 bpa falling a bushel from October estimates. Analysts were expecting production to move slightly higher, to 4.676 billion bushels on per-acre yields of 53.0 bpa.

Soybean export estimates fell 160 million bushels to 1.900 billion for the 2018/19 marketing year, primarily due to lower imports projected for China.

“USDA lowered its forecast of U.S. soybean exports more than expected,” Knorr notes. “The reduction came as the agency cut 145 million bushels off its projection of Chinese imports. But China says it wants to cut imports by around 375 million bushels. That’s not happening so far according to the latest customs data, which showed September-October imports up 7.5% from last year.”

Even so, soybean supplies remain huge, Knorr says. That could curtail rally potential this winter unless farmers decide to slash acres next spring.

“Corn would seem like the obvious replacement, especially after USDA’s larger than expected reduction in corn production, which came in with a yield close to what we found in our Feedback From The Field poll,” he says. “But the corn numbers were overshadowed by headline global supply numbers that surged due to revisions to Chinese production.”

However, the Chinese ministry says its higher production estimates was offset by higher consumption, which kept stocks stable, Knorr adds. By contrast, USDA added much of the bigger crops to carryout, welling world inventories to a number that will take more analysis to filter out, he says.

World soybean ending stocks for 2018/19 moved higher, from 110.0 MMT in October to 112.08 MMT in November. Analysts had expected a more modest increase. Global exports dropped by 2 MMT, with lower U.S. exports partially offset by increases in Brazil, Russia and Ukraine.

In South America, USDA expects Argentina’s 2018 soybean production to top 2.039 billion bushels (down from October estimates) and Brazil’s production to reach 4.428 billion bushels (unchanged from October).

The agency’s season-average soybean price remains unchanged at the midpoint, with a range of $7.60 to $9.60 per bushel.

For wheat, USDA kept current supplies unchanged for November but raised total use estimates by 7 million bushels due to an expected increase in planted acres for 2019/20. The agency lowered its projected ending stocks to 949 million bushels and narrowed its season-average price projections to between $4.90 and $5.30 per bushel.

Global ending stocks eased fractionally, from estimates of 260.2 MMT in October down to 260.18. Analysts had expected a modest increase.

“Wheat was a bystander to all these changes and also enjoyed good export numbers in today’s weekly update on sales,” Knorr says. “But the good tone to demand will have to continue after a very slow start to sales.”

About the Author(s)

You May Also Like