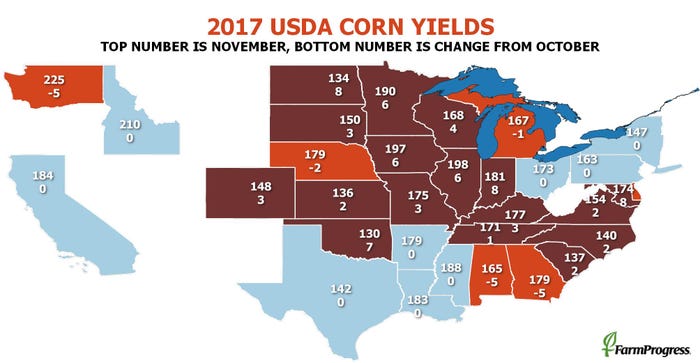

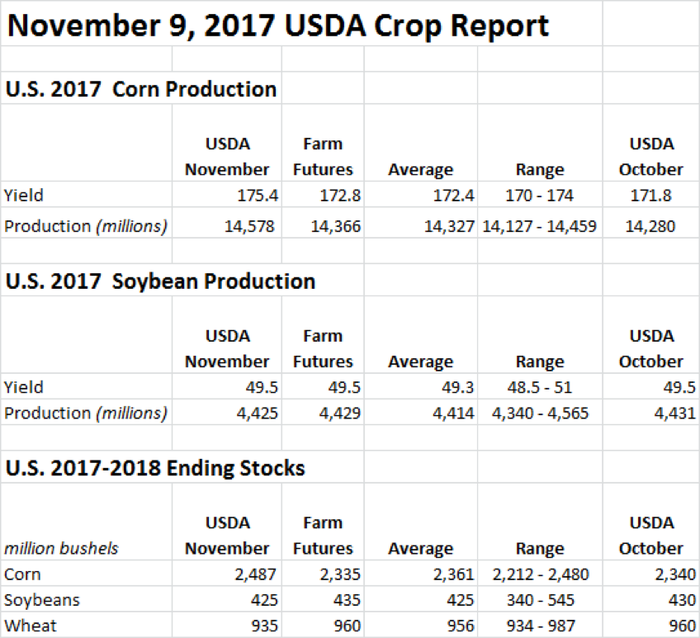

Ahead of Thursday’s USDA World Agricultural Supply and Demand Estimates (WASDE) report, a group of industry analysts predicted the agency would move U.S. corn yields to 172.4 bpa, up from its estimate of 171.8 bpa in October. USDA moved the yields much further, however, to a bullish estimate of 175.4 bpa. That would put average U.S. corn yields even higher than 2016’s record-breaking effort of 174.6 bpa.

USDA estimates for corn acres planted and harvested remain unchanged, at 90.4 million acres and 83.1 million acres, respectively. Total U.S. corn production is now estimated at 14.578 billion bushels, up from 14.280 billion bushels a month ago.

USDA has estimated not only larger production, but also increased feed and residual use, along with more exports, which were both raised by 75 million bushels. However, supply is rising faster than use, so USDA pegs corn ending stocks at 147 million bushels higher than October.

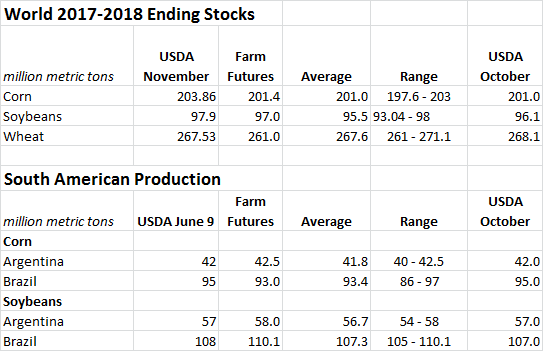

Global course grain production is an estimated at 125.9 million bushels higher, for a total of 52.0681 billion bushels. Larger U.S. and European production is partially offset by some reductions abroad, most notably in Ukraine, Russia and Vietnam.

USDA did not revise the average farm price range of $2.80 to $3.60 per bushel.

“The corn numbers are the biggest bearish surprise in the data,” according to Farm Futures senior grain market analyst Bryce Knorr. “Sharply higher production in the three I states helped increase the national yield more than expected. Even though USDA boosted its demand forecast, the increased product ion would add to carry at a time when stocks are already burdensome.”

December futures broke below the wedge Knorr has discussed earlier in the week. That might set the stage for a move to confirm cycle lows, he says.

“That ultimately could set the stage for a modest rally on tight farmer holding,” he says. “Basis remains firm thanks to the relatively drawn out harvest. And usage for ethanol looks stronger than USDA forecasts, which could also whittle away at supplies.”

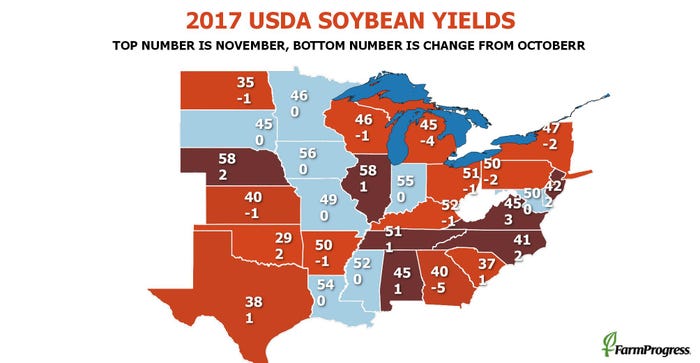

Trade analysts expected soybean yield estimates to come in slightly lower, but USDA left them unchanged, at 49.5 bpa. That keeps the crop slightly behind 2016’s record-breaking yields of 52.0 bpa.

U.S. soybean production, meantime, was lowered slightly, from 4.431 billion bushels to 4.425 billion bushels. Harvested area remained unchanged from October estimates, remaining at a record 89.5 million acres. Import supply fell slightly, too, with crushing volume, exports, seed and residual use totals all unchanged. That left U.S. ending stocks down slightly, from 430 million bushels to 425 million bushels.

USDA estimates the season average price for 2017/18 soybeans at $8.45 to $10.05 per bushel, 10 cents higher on the low end compared to a month ago.

“Today’s USDA report caught the trade leaning the wrong way for soybeans, which is why the market is pulling back today even though USDA lowered its production and carryout estimates slightly,” Knorr says. “Some bulls were betting on a more substantial cut, and that’s what triggering selling today. USDA also increased its forecast of Brazilian production, though it’s still too early to be making real judgements there.”

Today’s close will say a lot about the tone of the soybean market, Knorr adds.

“January futures are fighting to hold above the support line drawn off August-November lows, which comes in around $9.90, which is also right on the 25-day moving average,” he says. “Failure to hold support could trigger some liquidation by funds, which have tried to establish a small bullish bet on soybeans lately.”

Wheat prices are showing small gains following the WASDE report, due in part to U.S. stocks that are projected 25 million bushels lower from increased exports. Ending stocks are 935 million bushels, which is 246 million bushels lower than a year ago but still ahead of the five-year average.

Globally, wheat supplies are down fractionally, with global use fractionally higher. Ending stocks were lowered by 22 million bushels but remain at record levels. The projected average farm price for 2017/18 held steady at $4.40 to $4.80 per bushel.

“Today’s only bullish number came in wheat, where USDA raised its forecast of exports, cutting carryout 25 million bushels,” Knorr says. “That’s actually in line with what my models have been showing, though I didn’t expect the agency to make a change yet.”

The next round of WASDE and Crop Production reports will be released on December 12.

-----

Grain futures are turning lower this morning after USDA raised its forecast of corn yields to a record 175.4 bushels per acre, significantly above trade expectations.

About the Author(s)

You May Also Like