A rebound in fed- and feeder-cattle prices this fall unexpectedly helped push cow-calf returns for 2017 above those in 2016, says the Livestock Marketing Information Center.

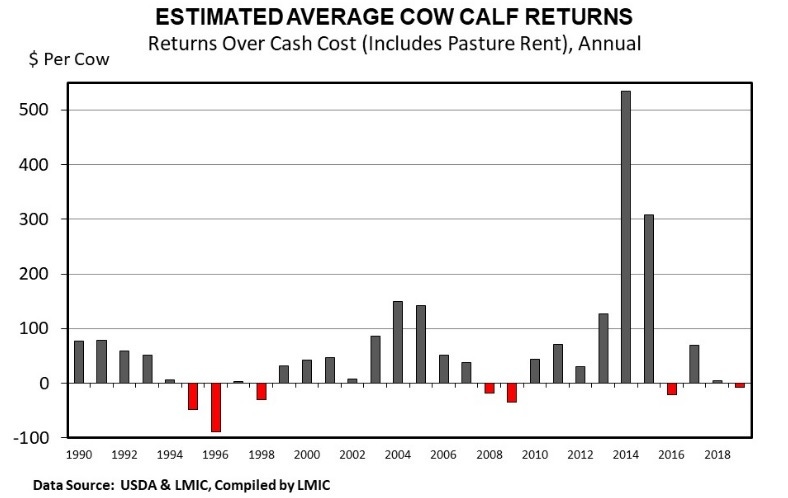

Since the mid-1970s, LMIC has maintained an annual index of cow costs and returns, and this year actually showed a small rebound into positive "profit" territory after 2016 dipped into "losses." Keep in mind this is an index. It is not survey-based and are developed for market analysis purposes. They do not represent an individual ranch/farm resource base. LMIC calculations only include cash costs of production and pasture rent. It is patterned for a "typical" commercial, full-time spring-calving and fall-weaning operation. Returns to owner management, labor, and other real costs are not included.

However, LMIC says the index is useful in a general context and may help signal such things as producer returns that influence national herd growth or contraction.

LMIC previously estimated cow-calf returns peaked in 2014, surging to about $535 per cow in its index. By 2016 the return had crumbled into the red, a $21 loss per cow. For 2017, the LMIC calculation suggests a $69 profit per cow.

What happened?

In the Southern Plains, using auction prices reported by USDA's Agricultural Marketing Service, in mid-November the LMIC projected steer calves weighing 500 to 600 pounds in 2017's fourth quarter would be in the upper $160s per hundredweight, a year-over-year increase of about 21% and $28-29 per hundredweight. Still, compared with the last quarter of 2015, these prices are down about 18%.

As 2017 progressed, beef prices were supported in several ways. Foreign demand was better than expected, and demand by packers for slaughter-ready animals was robust and helped pull animals through feedlots, keeping slaughter weights below 2016 levels. US retailers battled for customers, featuring beef and offering special prices. Consumer confidence in the economy seemed to boost spending on beef meals at home and in restaurants.

However, LMIC says 2017 cash production costs per cow were slightly higher than one year earlier. Part of that may have been because many areas of the US this year suffered from natural disasters, causing their production costs to spike up.

What's next?

LMIC said cow-calf returns may erode for the next two years. Cyclically, the US calf crop is forecast to continue increasing throughout 2019. US beef tonnage produced in 2018 is expected to be record large, and should rise again in 2019. Unless domestic and foreign demand for beef comes in much better than anticipated, calf prices are expected to slip for the next two years.

Although calf prices in the fourth quarters of both 2018 and 2019 could remain above 2016's depressed level, any faltering in demand relative to 2017 could quickly send cattle prices back down to 2016 levels, said the analytical group. Incidentally, this matches the predictions by CattleFax and several other analysts.

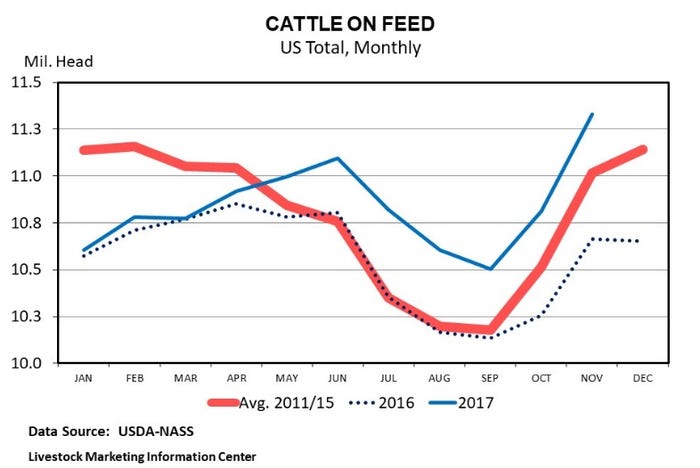

The November Cattle on Feed report showed an on-feed count of 11.3 million head, the largest inventory for November 1 since 2011 and confirmation that the national herd is still growing.

About the Author(s)

You May Also Like