At a Glance

- Logistics and weather events contributed to the volatile cotton prices in 2022.

- Global cotton consumption dropped to 110 bales in February of 2023, with the loss mainly from China, India, and Pakistan.

- Brazil and Australia remain strong competitors and the drought in west Texas will determine U.S. cotton production in 2023.

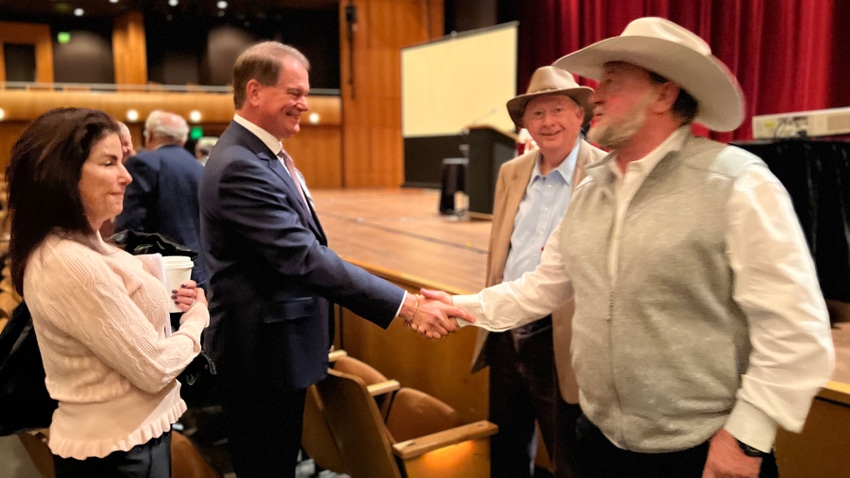

Many factors contributed to the steep price swings that U.S. cotton farmers experienced in 2022. This generated risky business with aftereffects continuing to impact the U.S. cotton industry. Recently, Joe Nicosia, executive vice-president of Louis Dreyfus Company, discussed upcoming battles that U.S. cotton producers face in 2023.

He looked back at significant worldwide events and projected where prices may go and the risks moving forward. Nicosia carried on with a word of caution.

“There are going to be winners in this game, and there are going to be losers. So, let’s make sure we find our best chances to be the winners.”

Stifled Shipping and Price Swings in 2022

Nicosia noted the significant impacts of logistics in 2022. When we came out of the COVID pandemic, the U.S. saw record imports, and the uptick complicated an already complex situation.

Timing is critical to move container ships, and delays left a multitude of vessels waiting on the U.S. coast for their turn to unload. As a result, many carriers chose quicker turnaround and better profit margins by returning with empty containers rather than waiting at the dock to backload U.S. exports.

This caused container shortages and chassis displacement, making it difficult to get anything moved. Thus, the price basis changed, and this domino effect wreaked havoc on our ability to export U.S. cotton. Buyers had to pay more for the execution premium, and producers faced discounts.

“There were detention charges, additional storage charges, and late pickup fees. These had to come out of the pricing system somewhere, somehow,” Nicosia said.

“This is important because we could have sold even more U.S. cotton toward the end of 2022 if we could have shipped it. Even the stuff we sold was late, which is not good for our reputation in being a reliable shipper.”

Logistics were not the only factor. Weather patterns, both globally and here in the U.S., took effect on price.

Here in the U.S., the drought in west Texas brought difficulties throughout the growing season and left many farmers with a zero crop. Fortunately, August rains came. This helped the cotton that survived in Texas and progressively improved yields across the Midsouth and Southeast, thus shifting production projections.

In Pakistan, major flooding devastated the cotton crop. The country made only 3.9 million bales out of the 6.2 million projected. This was a huge problem, as they are reliant on agriculture and the textile industry for foreign exchange.

Collectively, these issues resulted in huge price swings for cotton. Nicosia reported that over the past 15 months, we have experienced a 61-cent price range per pound. The new crop went from 86 cents in December of 2021 to $1.32 in May of 2022. Price volatility continued throughout the season, dropping to a low of 72 cents in October, before stabilizing at 88 cents this past December.

These fluctuations affirm the risks that cotton producers face when it comes to prices, and Nicosia continued with more factors that hang in the balance.

Economic Impacts and Global Consumption

Of course, inflation is a huge issue. The U.S. spent several years sitting just below the 2% target inflation rate, and when that shot up to 9%, it brought the hammer down.

Interest rates rose at some of the steepest levels in history, and Nicosia said they are not done. In turn, the value of the U.S. dollar has increased and consequently impacted exports and cotton producers.

Nicosia compared the value of the U.S. dollar to countries like Pakistan, Bangladesh, China, and Turkey. This is important because these countries are some of the largest buyers of U.S. cotton. When their currency weakens against our dollar, U.S. cotton becomes more expensive.

He also noted that Pakistan, China, and Turkey all grow cotton. Hence, this positions them to grow the crop themselves rather than buying the relatively more expensive U.S. cotton.

Another issue comes in global consumption. Nicosia said business was amazing during the first six to eight months of 2022. Then the revival of consumption dwindled, and by February of 2023, global consumption dropped to 110 bales. The loss was mainly from three of the biggest engines – China, India, and Pakistan.

“Within the last year, we have lost almost the size of the entire U.S. crop on an annual consumption basis. That is very substantial. The last 5 months have been about the quietest in my career that I have ever seen. We went through periods where we did not even get inquiries, because mills were shutting down as they cut down on their usage,” he said.

Factors influencing the loss of demand include high interest rates and low state bank reserves in key textile producing countries, making U.S. cotton unaffordable. Adding to that are countries rebuilding after natural disasters – from flooding in Pakistan and the devastating earthquake in Turkey.

Then there is Chinese consumption that was already struggling from the Xinjiang forced labor issue. China’s zero-covid policy intensified the struggle. The policy devastated not only their economy but also cotton, as it completely shut down demand and use.

Nicosia noted that in recent months, China has changed the zero-COVID policy and things are already looking up. The million-dollar question, he noted, is if China will be able to move back up to its former 40 million bale usage.

Consumption may be down, but Nicosia reminded, “Every time world consumption has gone down for two years, it rebounds strongly by an average of 6.6%. This indicates to me that consumption will move from 110 million bales back to 118 million, and I am optimistic that we are on the rebound.”

Looking ahead, Nicosia said that India and China have the biggest capability to increase consumption and believes we will see a resurgence in demand from these two.

Competitors to Consider

On the global front, Australia and Brazil are strong competitors, and Nicosia warned that Brazil is making major headway on the cotton front.

Brazilians own a good spot in the marketplace for acceptability, and they grow cotton well. The crop is rain fed, and just last year, they grew three million acres at 3.3 bales per to the acre.

Nicosia also calculated that a shift toward more cotton acres in Brazil positions them to exceed U.S. cotton production in the future. Of course, this would require infrastructure and segmented growth, but Brazil is not stopping.

“Brazil, in my opinion, will pass the U.S. in cotton production in the next three to five years to become the largest exporter in the world and take our place.”

(For more details, see the commentary in this issue: Will Brazil take the lead in cotton production?)

While U.S. planting intentions are down overall, Nicosia said that cotton has moved back to a more respectable price since planting intention surveys were conducted.

U.S. Outlook for 2023

Here in the U.S., cotton continues to compete with record setting returns on corn, soybean, and wheat. When we look at projected variable returns for 2023-24, Midsouth cotton is still struggling at $234 per acre and 28% return on variable costs.

The National Cotton Council says U.S. planting intentions are down by 17% overall, but Nicosia noted that cotton has moved back to a more respectable price since surveys were conducted.

“Prices in cotton have actually continued to appreciate relative to other row crops, and cotton continues to fight back for acreage. At the end of the day, the drought in west Texas will determine what happens here in the U.S.,” he said.

In west Texas, they are better off in 2023 than they were this time last year, but rain is still needed to get a crop. Good news comes as La Nina weather patterns are expected to neutralize by May. Hopes of relief are in sight as we move toward El Nino, but as Nicosia noted, it is touch and go either way.

About the Author(s)

You May Also Like