May 22, 2018

I’ve been pretty wrong about the new crop price outlook so far — and I’m glad. ICE (Intercontinental Exchange) cotton futures have been on an up-trend since March, and on a real tear since mid-May. In particular, new crop Dec’18 has blasted through 80 cents per pound, and is trading a little over 84 cents as of this writing.

What is going on? Will it last? The first thing to note is that Dec’18 is trading more on its own fundamentals. Open interest (as of May 18) has Dec’18 with almost as many contracts as the nearby Jul’18. As time progresses, more positions will roll into the Dec’18 contract, and its fundamentals will be even more influential.

Because it’s early, the expectations for new crop supply are fraught with uncertainty. We expect more cotton planted cotton acreage in the U.S. compared to last year. Northwestern Texas and the cotton producing regions of Oklahoma, Kansas, New Mexico, and Arizona remain under Extreme or Exceptional Drought classification.

WEATHER PREMIUM

Depending on timely moisture, the supply of U.S. cotton could swing 3 million bales either way. The uncertainty of that outcome will keep a weather premium in Dec’18 cotton futures until football season.

Internationally, there is also uncertainty about India’s current and future supply, and the major cotton-producing region in China has apparently experienced severe weather at planting.

The other major factor is that new crop demand is off and running. The pace of 2018/19 outstanding export sales (bales sold, but not shipped until after August 1) is already around 4 million statistical bales. Similar to a year ago, this is an above average pace of export business.

These export sales contracts obligate merchants to ship remaining old and early new crop bales for fall delivery. The influence of these export commitments should keep the Dec’18 contract supported, especially if there is any remaining production uncertainty.

PRICE PROTECTION NOW CHEAPER

Considering this, I am not as worried as I was a couple of months ago about Dec’18 falling below 70 cents. However, from where we are now, even 70 cents is a long, long way to fall.

Remember, the only thing you can know for sure is whether a forward contract or hedge on today’s futures price will be a profitable, or at least survivable, price floor.

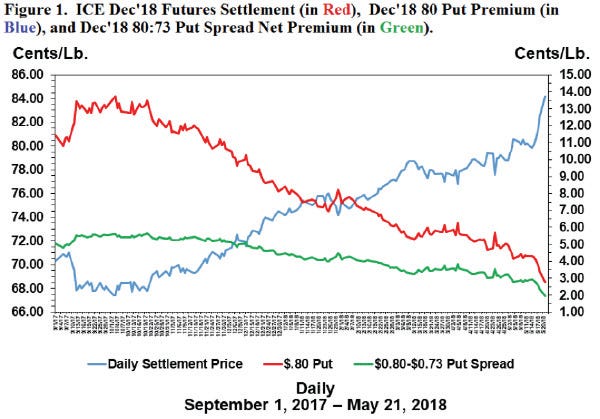

With the rally in Dec’18 cotton futures, the cost of insuring downside price protection has gotten cheaper. Amazingly, 80 cent put options on Dec’18 ICE cotton cost less than three cents a pound (Figure 1, in red). This means that you can insure a minimum cash price in the lower 70s, while maintaining upside potential for cash sales.

For additional thoughts on these and other cotton marketing topics, please visit my weekly on-line newsletter at http://agrilife.org/cottonmarketing/.

About the Author(s)

You May Also Like