December 3, 2015

There is debate and differences of opinion on how good a “safety net” Stacked Income Protection Plan will be. Only time will tell. Like it or not, it is what it is, and it’s cotton’s only program.

STAX is the new safety net for the cotton producer. Under the new 2014 farm bill, cotton is not a “covered commodity” and not eligible for ARC and PLC. In fact, with exception of the Marketing Loan, cotton is no longer a part of Title I; cotton is in Title XI under Crop Insurance.

As I explained it to growers, the 2014 farm bill pulled cotton and cotton base aside, gave it a pat on the head and told it be a “good little doggie.”

Cotton had to change due to the U.S. losing the WTO dispute with Brazil and STAX was considered a viable, WTO-compliant option.

The maximum guarantee has an area loss trigger of 90 percent of the county/area revenue and a coverage range down to 70 percent of the county/area revenue. Since revenue depends on both yield and price, whether STAX will pay in 2015 from one county/area to the next, obviously depends on yield. The Projected Price was 63 cents and the Harvest Price also ended up at 63 cents. So, there will be no “price effect” on revenue. Therefore, any STAX payment will only come from actual yield being at least 10 percent less than the expected county/area yield (assuming the 90 percent area loss trigger was selected).

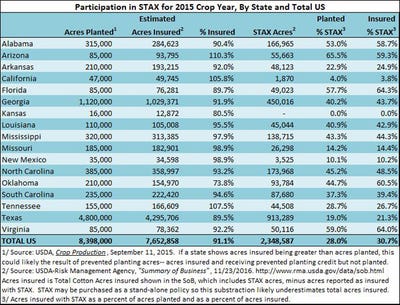

USDA-Risk Management Agency data show that 2.35 million acres were insured with STAX—28 percent of the upland cotton acres planted in 2015 and 31 percent of the total acres insured under all policies. For 9 of 17 states, it is estimated that STAX was taken out on 40 percent to 60 percent of acres planted. Participation was much lower in several states, however. In Texas, which comprised over half of all acres planted and insured, STAX participation was only 21 percent of all acres insured.

The dataset based on RMA’s Summary of Business, as of November 23, 2015, is not perfect. Note, for example, that in several states total acres insured is more than acres actually planted. How can this be? Likely, it is because acres insured included prevented planted acres. But there could be other reasons.

Also, the Summary of Business shows the Total Acres Insured for cotton, which includes yield policies, revenue policies, area policies, STAX and SCO. Because STAX can be purchased as a stand-alone policy or in combination with an underlying yield or revenue policy, this Total Acres Insured number results in significant “double-counting” because, for example, an underlying yield or revenue policy with STAX on the same acres would be counted twice when in fact both are on the same acres. The Total Acres Insured shown in the table have the STAX acres deducted.

The data does not provide a way to know the acres insured under STAX only—the assumption made in the table is that most STAX acres also have an underlying companion policy.

Total U.S. upland cotton acres insured (an estimated 7.65 million excluding STAX) plus 2.35 million acres insured with STAX, equals 10 million acres—1.6 million acres more than planted. It is difficult to draw any conclusions from this but it could suggest that most STAX policies were purchased in combination with an underlying “companion” policy.

Modifications in STAX are forthcoming for 2016 crop

STAX is optional. Cotton producers could choose not to purchase STAX (and an estimated 72 percent of 2015 upland acres planted and 69 percent of acres insured under other crop insurance policies did not have STAX) or could have purchased SCO (Supplemental Coverage Option) instead. Only 122 SCO policies were purchased for cotton in 2015.

STAX could be purchased with the Harvest Price Exclusion (HPE) option. The RMA Summary of Business reports that only 691 acres out of the total 2.35 million acres with STAX were with HPE.

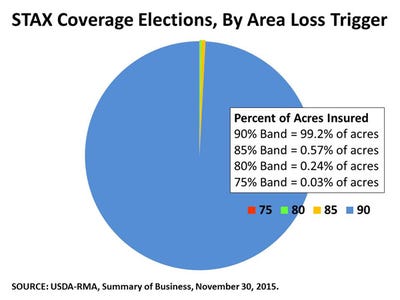

STAX could be purchased beginning at 90 percent coverage and covering a maximum range of 20 percent-- down to 70 percent of expected county/area revenue. The maximum coverage band is 90-70 percent. The minimum coverage band is 75-70 percent.

Over 99 percent of all acreage insured with STAX was at the maximum 90 percent level. RMA data does not indicate the coverage range; only the top of the coverage band. A policy with and area loss trigger at 90 percent could be a coverage range of 90-85 percent, 90-80 percent, 90-75 percent, or 90-70 percent of the county/area revenue depending on the producer’s choice and limitations due to the companion policy coverage level.

STAX and any underlying companion policy coverage levels cannot overlap. The companion policy may limit the STAX coverage range. I think it is safe to assume, however, that most policies took the maximum coverage range allowed by the companion policy coverage level limitation.

Several modifications in STAX are forthcoming for the 2016 crop year. In 2015, STAX had to be purchased for all cotton acres and a different coverage level (band) could be chosen for irrigated and non-irrigated production. For 2016, producers will be able to choose 0 percent STAX coverage on either irrigated or non-irrigated (the policy will technically be a 70-70 percent policy). So, farms that have both irrigated and non-irrigated production can now essentially choose not to cover one or the other.

Also new for 2016, there will be coverage for cottonseed. This will be a rider to the STAX policy. It is a yield only policy and will apply to the irrigated and non-irrigated acreage reported and the coverage bands chosen.

(Don Shurley is Professor Emeritus of Cotton Economics,Department of Agricultural and Applied Economics University of Georgia. He can be reached at [email protected].)

You May Also Like