May 26, 2022

The U.S. Department of Agriculture (USDA) announced May 16, 2022, that commodity and specialty crop producers impacted by natural disaster events in 2020 and 2021 will soon begin receiving Phase 1 of emergency relief payments totaling approximately $6 billion through the Farm Service Agency’s (FSA) new Emergency Relief Program (ERP — formerly known as WHIP+). Those payments are likely to begin in June.

The ERP represents the next round of disaster assistance authorized by last fall’s Extending Government Funding and Delivering Emergency Assistance Act, which authorized $10 billion to help crop and livestock producers impacted by adverse weather conditions that occurred during the 2020 and 2021 calendar years.

The announcement is good news for producers who have been waiting more than eight months for the program. “This week’s announcement of the Emergency Relief Program has been highly anticipated for several months,” explains Kody Bessent, Plains Cotton Growers Inc. (PCG) chief executive officer. “PCG, working alongside the National Cotton Council, Congress and other advocacy groups, has been encouraging the USDA to implement the program as quickly as possible to deliver this much-needed assistance to producers.

“We appreciate FSA working to streamline the application process and incorporating the changes Congress approved. The efforts are intended to improve the program as compared to disaster assistance provided to growers for losses incurred in 2018 and 2019 through WHIP-Plus.”

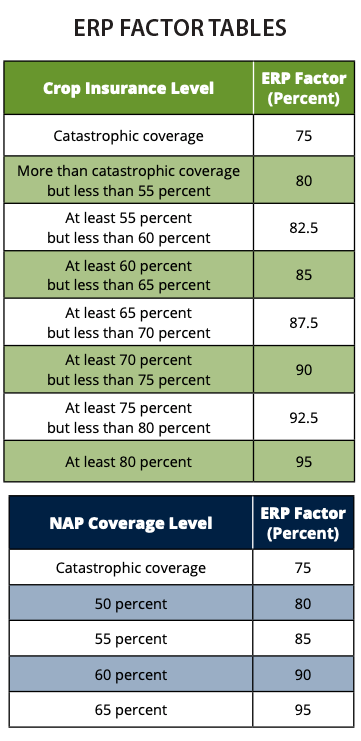

Details on how the USDA FSA plans to deliver ERP are still somewhat sparse, however, the publication of the Federal Register notice announcing the availability of funds for the program, published on May 18th, paints a picture of how FSA will proceed. We now have information regarding ERP coverage factors and how payments will be calculated, as well as how FSA will apply pay limits, determine payment eligibility and other components of the program.

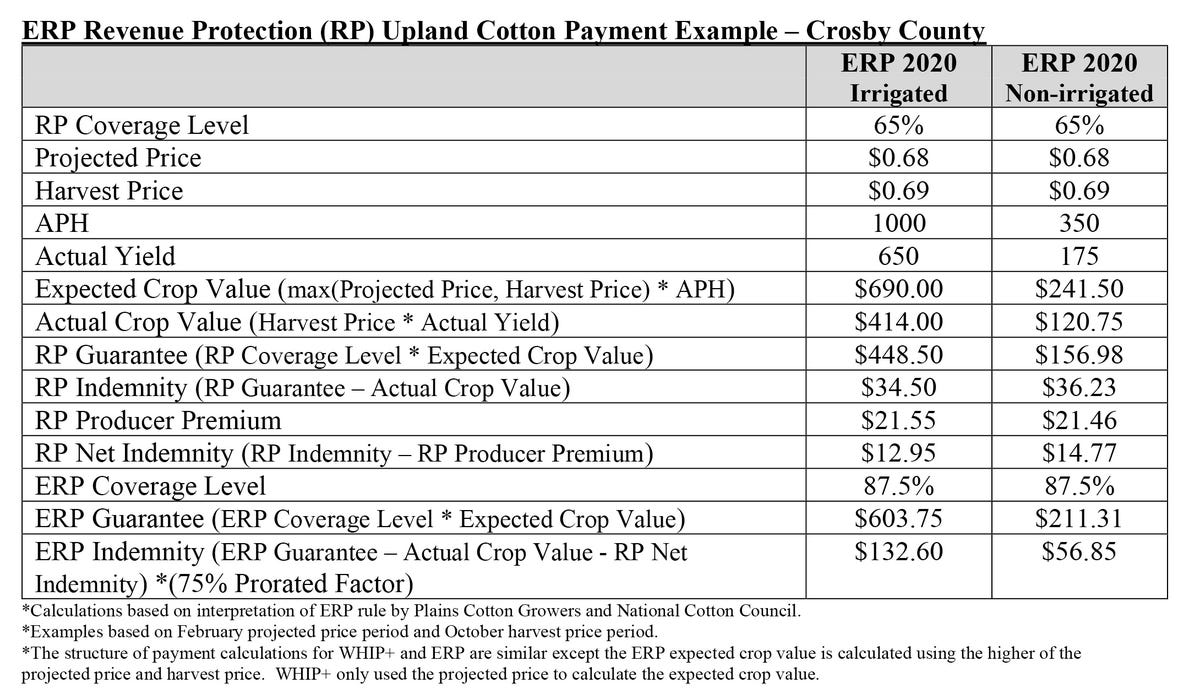

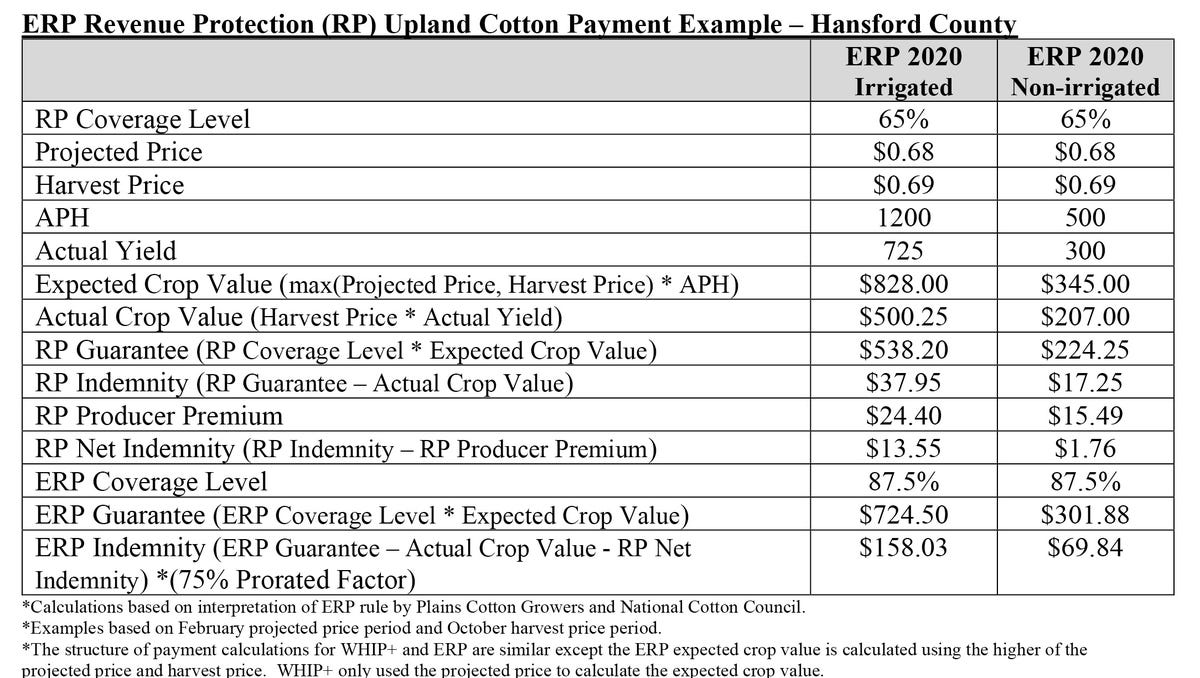

Simply put, the Phase 1 ERP benefit will be calculated using a similar formula as the previously implemented WHIP-Plus program and prorated by 75% to ensure that total ERP payments do not exceed available funding. Phase 1 ERP payment calculations will be based on the type and level of crop insurance obtained by the producer using the ERP factor in place of the insurance coverage level. This calculated amount will then be adjusted by subtracting the net crop insurance indemnity already received for losses minus service fees and producer-paid premiums.

Based on PCG and NCC’s interpretation of the ERP rule, below are a few regional examples of potential disaster assistance to the producer. Any discrepancy in payment once a producer receives the official USDA pre-filled application must be done by contacting their crop insurance agent if a producer believes any of the information on the form is incorrect and, as we understand the program today, the adjusted payment will be corrected in the implementation of Phase 2 ERP at a later date.

ERP Revenue Protection (RP) Upland Cotton Payment Example – Hansford County

How to Apply — Phase 1

To simplify the delivery of ERP Phase 1 benefits, FSA will send pre-filled application forms to producers whose crop insurance and NAP data is already on file because they received a crop insurance indemnity or NAP payment.

This form includes eligibility requirements outlines the application process and provides ERP payment information.

Producers will receive a separate application form for each program year. Receipt of a pre-filed application is not confirmation that a producer is eligible to receive an ERP Phase 1 payment. Producers will need to return completed and signed ERP Phase 1 applications to their local FSA county office.

Producers must have the following forms on file with FSA within a deadline that will be announced soon:

Form AD-2047, Customer Data Worksheet

Form CCC-902, Farm Operating Plan for an individual or legal entity

Form CCC-901, Member Information for Legal Entities (if applicable)

A highly erodible land conservation (sometimes referred to as HELC) and wetland conservation certification (Form AD-1026 Highly Erodible Land Conservation (HELC) and Wetland Conservation (WC) Certification) for the ERP producer and applicable affiliates.

Most producers — especially those who have previously participated in FSA programs — will likely have these required forms on file. However, those who are uncertain or want to confirm should contact their local FSA county office.

In addition to the forms listed above, certain producers will also need to submit the following forms to qualify for an increased payment limitation or payment rate:

Form FSA-510, Request for an Exception to the $125,000 Payment Limitation for Certain Programs.

Form CCC-860, Socially Disadvantaged, Limited Resource, Beginning and Veteran Farmer or Rancher Certification, for the applicable program year.

For more information, view the ERP fact sheet.

Source: is AgriLife TODAY, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

You May Also Like