After a precipitous drop in cotton’s market share in 2011 — thanks in no small part to dollar cotton prices in 2010 — consumer demand for cotton is returning.

Cotton Incorporated president and CEO, J. Berrye Worsham, addressing attendees at the National Cotton Council’s recent annual meeting in Fort Worth, Texas, provided an update that highlighted progress being made by research and promotion activities despite a greatly reduced budget.

“World demand for cotton is influenced by economic growth, and last year’s global economic upswing will be positive for cotton consumption worldwide,” says Worsham. “The sharp decline in cotton’s market share from increased use of synthetic fibers has flattened, and we needed that to occur so demand for cotton can begin.”

Cotton also lost demand because fabrics have been getting lighter. That trend also seems to be changing and subsequently having a positive impact for cotton.

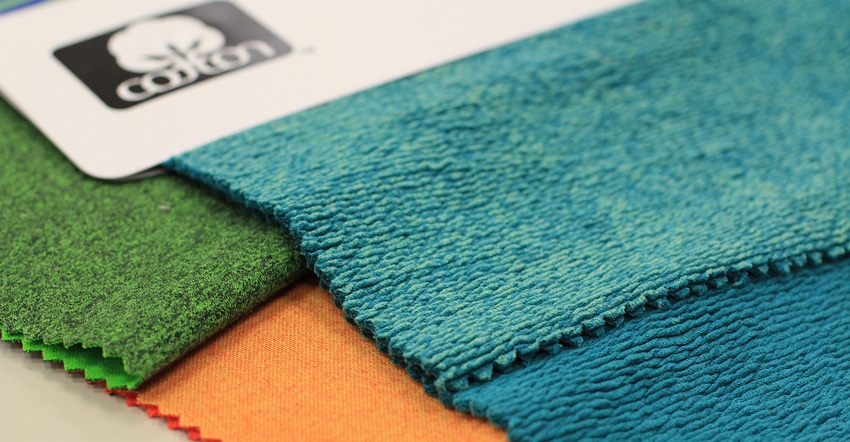

“Engineering performance features into cotton fabric is one way we are meeting the challenge synthetics present,” says Worsham. “Not only are we integrating innovative finishing chemistries into fabric development, we are looking at other fibers to improve fabric performance while still maintaining a cotton-rich product — that’s the reality we face currently.”

From wrinkle-resistance and moisture management, to water repellency and abrasion-resistance, Cotton Incorporated is addressing needs the market is requiring. “There is a segment of consumers that still demand natural products sans chemistries, and we are constructing cotton fabrics with natural thermal attributes,” adds Worsham.

Alternative chemistries and flagship technologies

Durable press, or wrinkle resistance, has been a key market product for cotton over the years. Because of increasing pressure to phase out formaldehyde, Cotton Incorporated last year filed for a provisional (non-formaldehyde) patent to improve the balance of durable press cotton properties using non-formaldehyde technology.

“Fluorine is another chemistry we are moving away from and looking for other more environmental-friendly chemistries that deliver quality apparel finishing results,” says Worsham.

Worsham’s research and marketing staff has nurtured key mill contacts across the world for decades. Today they have 180 technology suppliers in 23 countries. Cotton Incorporated’s textile chemists work with those suppliers to educate them on how to impart technologies that deliver finishes like TOUGH cotton, for abrasion resistance and STORM cotton for water repellency.

“We sometimes use spandex for stretch, nylon or polyester for strength, or rayon for drape,” adds Worsham. “Sometimes we even use wool, which allows us to keep a product ‘all natural’.”

Sixty percent of the demand for cotton today in the U.S. market comes in the form of a blended cotton apparel product. Five years ago, it was 40 percent. In lighter weight fabrics, other fibers are blended to keep cotton in the fabric consumer demand mix.

“We are targeting our flagship technologies toward the attention of mills, brands, and retailers, but the real challenge is getting those fabrics adopted,” says Worsham. “We have targeted our limited resources in the performance apparel — the fastest growing segment in the apparel market today.”

Education and sustainability

Cotton Incorporated utilizes the worldwide web for information-transfer and still partners with Cotton Council International on joint promotions around the world. One of their most successful workshops held twice each year, called ACTIVE, continues to attract key brand representatives in the active wear market.

“When we post these workshops online, they literally fill up in less than five minutes, which obviously confirms their interest in working with cotton,” says Worsham.

For the last five years, Cotton Incorporated’s marketing staff has participated in high-profile events like the Outdoor Retailer Show in Salt Lake City. “We have consistently been getting more and more inquiries from retailers who attend this show,” adds Worsham. “Now that we have fabrics to showcase, we are making headway.”

While the concept of sustainability is broad and at times quite vague, its importance and impact on today’s consumers and apparel manufacturers is real and must be considered in the business of creating demand for cotton.

Cotton Incorporated recently took a step forward in their efforts to ensure cotton is viewed as being sustainable from the field all the way to the mill and manufacturer. “Last year we hired Dr. Jesse Daystar, an expert in sustainability metrics and a leading authority in Life Cycle analysis, to boost our plans and efforts in this area moving forward,” says Worsham.

“Our growers know they are farming sustainably, but we have to position messaging throughout cotton’s supply chain to reinforce they are on continuous path of improvement, and Dr. Daystar is helping us do just that.”

One successful event directed through Cotton Incorporated’s ag division brings brands and retailers together on a production cotton farming operation. “We hold two of these farm tours each year and they allow attendees to walk away with an accurate interpretation of how U.S. cotton growers work to deliver a sustainable product while minimizing farming’s impact on their land.”

Farm tours

Arkansas producers Nathan Reed, Ramey Stiles, Trent Felton, and Larry McClendon have hosted tours on their farms for several years and recognize the educational value they deliver. “You can see opinions change throughout their time here on these tours. I’m sure it’s difficult to have an accurate opinion about farming if you’ve never been to a farm. It’s a good program,” says McClendon.

The day before Worsham spoke at the NCC meeting, Abercrombie & Fitch became the 512th brand member of Cotton Leads — an industry program founded on the principles of sustainability, traceability, and best practices. “Becoming a member means they are aware and believe U.S. cotton is sustainably produced and are not excluding it in their supply chain decisions — which is critical,” adds Worsham.

Worsham also commented on a topic that has received global attention over the last year — microplastics, little fibers released from polyester that work their way into water streams and ultimately into the ocean. This is a huge problem and there is no current solution. “The disconcerting thing is fish are actually attracted to these polyester microplastics and eat them,” says Worsham. “This is a big problem for polyester but an opportunity for cotton.”

Cotton Incorporated commissioned North Carolina State University to investigate how various fibers biodegrade in water. Results are preliminary at this point but show cotton is already two-thirds degraded after 180 or so days. “Rayon degrades a little slower than cotton, but polyester microplastics degrade less than 5 percent, and, therefore, they remain in the water much longer,” says Worsham. “We look forward to receiving the conclusive results of this study later this year.”

About the Author(s)

You May Also Like