For many cotton producers, 2020 will be a year that they would like to forget. First, the industry was influenced by the lingering effects of the United States' trade war with China that began in 2018. In addition, just when there appeared to be a loosening up on trade restrictions, as noted in the U.S.-China Phase One trade deal signed last January, the COVID-19 pandemic negatively affected world demand and disrupted supply chains. If the cotton industry can be characterized as a boxer in the ring, the prizefighter has been bruised with the punches. Fortunately, the competitor has also been resilient and is still standing to face the upcoming 2021 round. What follows is a brief discussion of the challenges and opportunities the industry will likely face before the 2021 closing bell sounds.

For many cotton producers, 2020 will be a year that they would like to forget. First, the industry was influenced by the lingering effects of the United States' trade war with China that began in 2018. In addition, just when there appeared to be a loosening up on trade restrictions, as noted in the U.S.-China Phase One trade deal signed last January, the COVID-19 pandemic negatively affected world demand and disrupted supply chains. If the cotton industry can be characterized as a boxer in the ring, the prizefighter has been bruised with the punches. Fortunately, the competitor has also been resilient and is still standing to face the upcoming 2021 round. What follows is a brief discussion of the challenges and opportunities the industry will likely face before the 2021 closing bell sounds.

Uncertainties with U.S. demand and potentially large carryover stocks will present some challenges to this year’s balance sheet. In the November report, U.S. cotton production was forecast at 17.1 million bales, a 2.8 million drop compared to 2019, as reduced area more than offsets a higher (and record) yield. Even if USDA lowers production further, ending stocks will still likely remain at historically burdensome levels. The U.S. is the world’s top distributor of cotton fiber. However, export projections remain at disappointing levels of 14.6 million bales, the lowest since 2015/16.

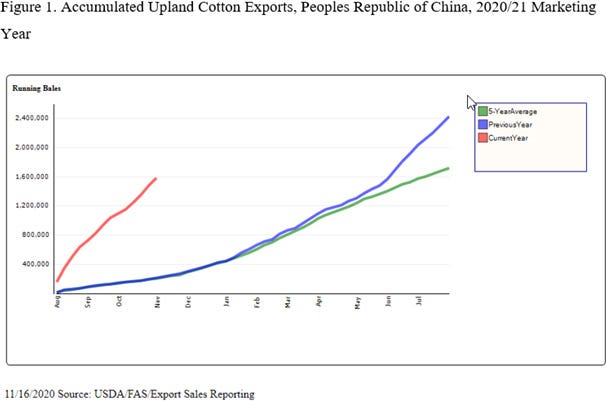

On the flip side of the coin, there may be some good news on the horizon and the opportunities that come with it. The latest USDA estimates indicate global cotton mill use in the 2020/21 is projected at 114.2 million bales, 12% above last year, with China leading the rebound. The global economy continues to recover from the impacts of COVID-19 and with promises of a vaccine available this year, additional raw cotton demand by textile-producing countries, including China, appears likely. China is forecast to spin 37.5 million bales of raw cotton, approximately 13.5% (4.5 million bales) above 2019/20. And some of that fiber will come from imports, forecast at 9.5 million bales as China adds foreign cotton to the national reserve for rotational purposes and for re-export in the form of textile and apparel products. We have seen an improvement in accumulated U.S. exports to China (Figure 1). Marketing-year-to-date exports have reached 1.59 million running bales, over one million bales ahead of last year’s shipping pace. The 2020/21 season-average farm price projection increased three cents to 64 cents per pound in the November report.

Looking ahead, much uncertainty remains in this outlook. While bearish ending stocks will not change overnight even if China resets its trade balance as the largest importer of U.S. cotton, there are signs of a textile and apparel sector recovery. Since U.S. producers need futures prices to be 75 cents or higher to be profitable, growers are encouraged to move quickly to take advantage of price opportunities as they occur, especially if cotton futures enter into the 75-cent realm once again.

2021 Outlook articles:

Source: is Oklahoma State University and Texas A&M University, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like