An “October surprise” ordinarily refers to late-breaking news, e.g., a political scandal, that influences the outcome of a fall election. Hopefully, we won’t have any of those kinds of surprises. In terms of cotton marketing, the issue is whether USDA will tighten its forecast of U.S. cotton production like it did in August, or expand it like in September.

There are reasons to expect either outcome. Reductions to the production forecast could result from the realization of reported boll rot problems in the eastern Cotton Belt, or damage from Hurricane Ian, or continued zeroing out of drought-damaged stands in the Southern Plains.

But more important than these speculative possibilities is an increase in actual data to refine the forecast. For example, the additional one and a quarter million bales of U.S. production that the USDA forecasted in September was due to a month-over-month increase in planted acreage, based on USDA FSA certified acres. New certified acres data from USDA FSA sometimes arises later in the fall or winter, so this remains a possible source of refinement.

In addition, USDA NASS continually surveys growers, as in September when they sampled more than 7,000 U.S. producers, including major cotton-producing states. This survey process includes what they call “objective yield surveys” for major crops. For cotton, this means boll counts from randomly selected field samples in September, October, November, and December.

Lastly, USDA NASS also reports monthly on cumulative bales ginned, which is another independent (albeit lagged) measure of U.S. cotton production.

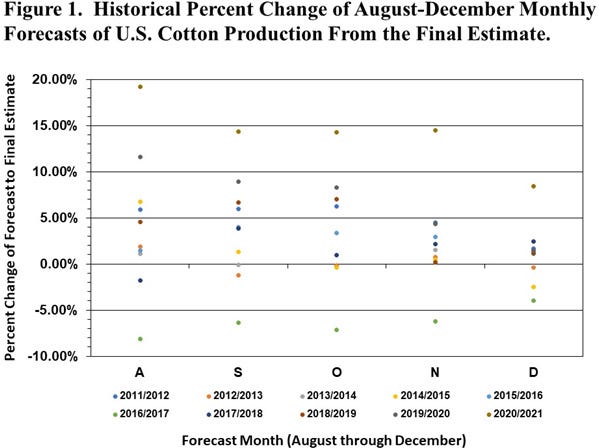

Going forward, we can expect fewer surprises and an increasingly clearer production picture. This expectation is supported by historical data in Figure 1. Figure 1 shows the percent deviations of USDA’s U.S. cotton production forecasts in August, September, November, and December, relative to the final production estimate at the end of the marketing year (i.e., the following July). As expected, the spread of the percent deviations shrinks across the fall season, presumably informed by the previously described data flow. It is also apparent from Figure 1 that USDA tends to overestimate the crop size, at least in the September through December time period.

The marketing implication of this refinement is a fading production risk premium in U.S. cotton prices, all other things being equal.

For additional thoughts on these and other cotton marketing topics, please visit my weekly on-line newsletter at http://agrilife.org/cottonmarketing/.

Read more about:

DroughtAbout the Author(s)

You May Also Like