August 21, 2014

I feel uneasy questioning USDA forecasts. This hesitancy is not a matter of patriotism; rather, it is because USDA is usually right, and I am usually wrong. But here goes.

USDA’s August supply/demand projections saw another large upward adjustment in U.S. cotton production, from 16.5 to 17.5 million bales of production. This follows a similar upward revision in July from 15.0 to 16.5 million bales. The July increase resulted from lower abandonment applied to more planted acres. The August increase was from raising the yield forecast from 816 to 820 pounds per acre, coupled with a further lowering of forecasted abandonment from 15 percent to 9 percent.

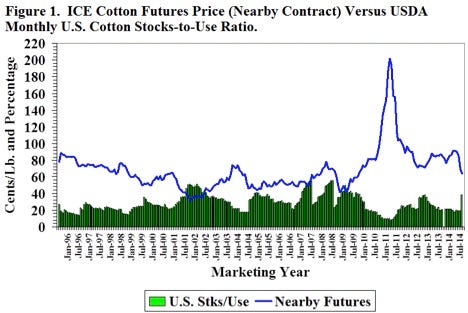

Even with an accompanying increase in forecasted exports, the bottom line of these August numbers was a 400,000-bale increase in forecasted ending stocks, from 5.2 million to 5.6 million. As Figure 1 shows, the historical implication of month on month (or year on year) increases in ending stocks is typically bearish for prices.

The August supply/demand report is a benchmark because it reflects actual field sampling of cotton plants. There is always uncertainty around these forecasts, and the 2014 crop may be subject to more than the usual amount of uncertainty. The reason is the reported lateness of some stands of West Texas cotton. Given the dry conditions in April and May, many dryland fields were not expected to get established in the first place. But the early summer rains got a lot of cotton to germinate and establish. However, the late planting dates and relatively cool growing conditions caused a lot of that cotton to be behind schedule.

For the latest on southwest agriculture, please check out Southwest Farm Press Daily and receive the latest news right to your inbox.

So what do you have when you count squares and bolls on a lot of West Texas cotton plants in August? You have the potential for production, and I think that is what USDA is reflecting with their forecast of 7.1 million bales in Texas. But a number of things have to line up to realize that potential.

Those things include 1) moisture in August, 2) dry, sunny weather in September and October, and 3) no early freezes. A quick look at NOAA’s cumulative rain map suggests that parts of West Texas received between 1 to 5 inches of rain between August 7 and 21. So there’s a start. Will all the other conditions unfold as needed? I have no earthly idea. But I would not be surprised if USDA came off their current production estimate by several hundred thousand bales. This might not happen until the October or November WASDE reports.

Futures reflection

I also think futures prices and market expectations already include the possibility of some downward revision in the current production estimate. If true, that may be what is supporting futures prices a few cents above the lows in late July. But if those aforementioned conditions line up and we do see over 7 million bales of Texas production, the market may well revisit those lows.

About the Author(s)

You May Also Like