This column still finds me traveling around West Texas, and still waving a red flag about the potential price weakening effects of an expected large 2019 crop.

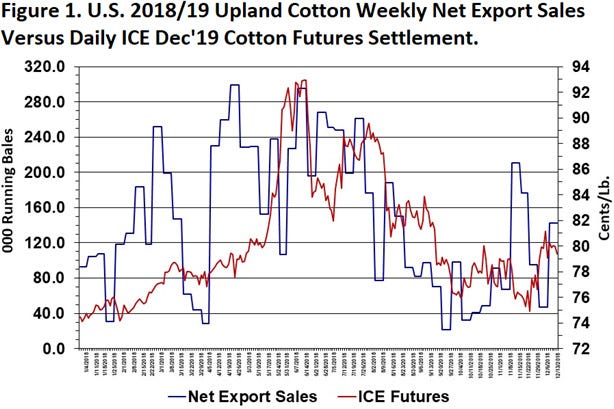

I have spent a lot of time in my outlook presentations talking about the contribution of the U.S.-China trade conflict to a reduction in export sales in the latter half of 2018. Figure 1 below shows how U.S. cotton exports were going like gangbusters in early 2018. Then the trend was reversed.

I attribute uncertainty about the China trade situation as a major influence in the downshift in U.S. exports. Other reasons probably include political and economic problems in Turkey (another important buyer of U.S. cotton), and perhaps also uncertainty about available supplies of quality U.S. cotton for the export market.

The current China situation is that, since July 6, China has had 25 percent tariffs on U.S. cotton imports. That means U.S. cotton is 25 percent more expensive, and thus less competitive than Brazilian or Australian cotton. Meanwhile, the U.S. is waiting until March 1 to either work out a solution or raise tariffs on $250 billion worth of Chinese imports, including Chinese apparel imports.

WILL EXPORTS RECOVER?

So, if there is a resolution to the U.S.-China trade conflict, will U.S. cotton exports recover? And if so, how much?

I would expect some improvement, but perhaps not the levels or upward trend that we saw in early 2018. First of all, the reduction in uncertainty should be a major relief to everybody: cotton buyers, cotton sellers, futures speculators, etc. Hopefully, this alone would foster more trade business.

Second, normal trade relations between the U.S. and China will allow shippers to restore and maintain their contacts with Chinese buyers. With China returning as a competing direct buyer with other cotton importers, those selling U.S. cotton will hopefully be in a better bargaining position. All of this should provide a boost to U.S. export sales, especially if China overall demand for cotton imports begins to increase, as expected.

So, what happens if there is no near term solution to the U.S.-China trade conflict? Continuing Chinese tariffs remain on U.S. cotton will continue to be a wet blanket on U.S. export sales. In the long run, Chinese buyers will improve and expand their contacts with competing suppliers.

If the U.S. raises tariffs on Chinese apparel imports, that may reduce the quantity demanded for apparel, which in turn could shrink China’s overall fiber demand. And lastly, prolonged tariffs may slow economic growth, which also is associated with reduced demand for cotton.

For additional thoughts on these and other cotton marketing topics, please visit my weekly on-line newsletter at http://agrilife.org/cottonmarketing/

About the Author(s)

You May Also Like