For the first time in 10 years, ICE cotton futures breached the dollar threshold. “Dollar cotton” always gets lots of attention, so let me give it some.

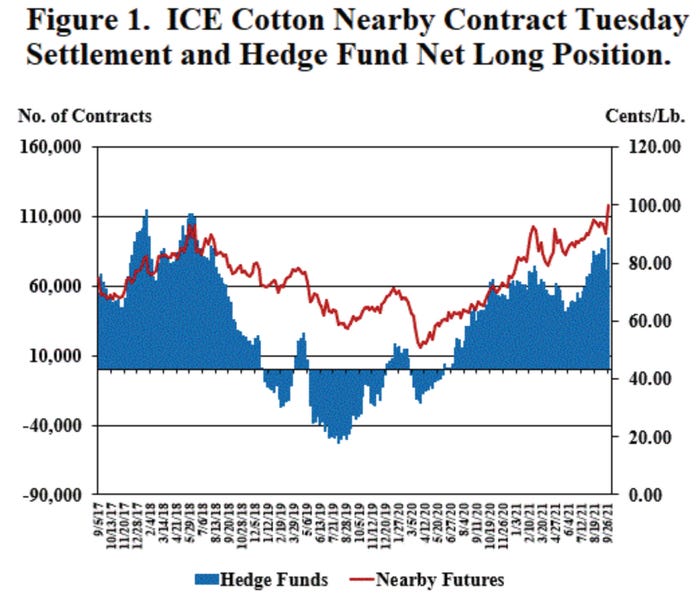

ICE cotton traded over a dollar as part of a notable 14-cent rally during the last week of September. The red line in Figure 1 doesn’t show it quite as dramatically since it is a graph of Tuesday settlements of the nearby ICE contract. On Tuesday, Sept. 21, the Dec’21 settled at 90.03 cents. On the following Tuesday (Sept. 28) it settled 10 cents higher at 100.03 cents per pound.

Figure 1 clearly shows that speculative buying was a major influence in this price rally. For the same Tuesday-to-Tuesday period, the net long position of the hedge funds increased an average of almost 4,700 contracts per day. So, the short, direct answer to “What gave us dollar cotton?” would be speculative buying.

See, WHEAT SCOOPS: Wheat stocks got tight

Now, what the hedge fund managers were thinking is another question. Some possibilities that come to mind are: 1) strong recent demand for U.S. cotton, especially by China, 2) eventual buying by merchants to settle on call contracts, and 3) questions about the size of the U.S., Chinese, and Indian crops.

The hedge fund managers may be reacting to other things like COVID infection rates, projected GDP growth, interest rates, bond yields, and stock market performance, not to mention political developments here and abroad. These influences have little to do with cotton fundamentals, but they can have a big effect on hedge fund behavior.

The main point I will make is that speculative buying can be unpredictable and short-lived. I would direct the reader’s attention to the blue peaks and valleys of Figure 1. Some of them are fairly skinny. That shows numerous instances of the hedge funds building up a large net long position in ICE cotton futures, only to sell off in a week or three. These upticks in hedge fund open interest are associated with temporary 5-to-10-cent rallies in ICE futures.

So, when I’m asked if this current rally will continue, I don’t know. Nobody knows. But to the extent that the rally is fueled by hedge fund buying, there is always the possibility of sudden reversals. Just look at the history.

Interestingly enough, the first question I was asked on the day cotton breached a dollar this time was “Do you think it will go to $2?” I think the person who asked that question was thinking of 2011. So let me point out that the current situation is not the same as 2011. Ten years ago, we had a global shortage of cotton supplies that was years in the making. When textile mills realized this, they went into a buying frenzy that pulled the cash market above two dollars. The futures market got pulled along for the ride, but it was not speculative buying that started it.

The second question I have been asked recently is how can growers take advantage of dollar cotton when they sold back when futures were below 90 cents? The opportunity to buy 85-cent calls as a “storage hedge” is past. The question now is whether spending money on a near-the-money call option is worth the bet that futures will rise from current high levels. In other words, are we on a steady march to $1.10 or higher? I don’t see the fundamental support for such a sustained rally, at least not yet. All I see is the speculative fuel that started it, which, as I’ve said, can be a fickle thing.

For additional thoughts on these and other cotton marketing topics, please visit my weekly on-line newsletter at http://agrilife.org/cottonmarketing/.

About the Author(s)

You May Also Like