The Beltwide Cotton Conferences were, as always, a good opportunity to hear public presentations and private opinions about the cotton market outlook.

Most of what I heard in San Antonio is consistent with the outlook for the last several months. In summary: (1) The world cotton supply/demand balance appears to be tightening; (2) the U.S. balance sheet remains officially heavy, with a projected doubling of ending stocks, year-over-year, for the 2017/18 marketing year; and yet (3) prices remain strong.

The reasons for price strength include strong export demand, as reflected by the seasonally high pace of U.S. exports. This certainly has the potential to improve the U.S. balance sheet in future monthly adjustments. If the USDA were to raise the target for 2017/18 U.S. exports, it would diminish the long run case for bearishness. Still, I doubt that the USDA will raise the U.S. export number enough to avoid adding at least a couple of million bales to ending stocks, year-over-year.

NEAR-TERM SUPPORT

Near-term price strength appears to be supported by two things: (1) ongoing speculative buying, and (2) the likelihood of excess mill fixations (i.e., net futures buying) of on-call contracts before the March, May, and July 2018 contracts mature.

At present, the unfixed on-call data from the Commodity Futures Trading Corporation suggest that roughly 10 cotton futures contracts will be bought for every one sold as mills finalize their on-call arrangements. That raises the possibility of perhaps brief bursts of upward volatility at some predictable times of the year, such as late February, late April, and late June. The possibility of price spikes may keep short speculators at bay.

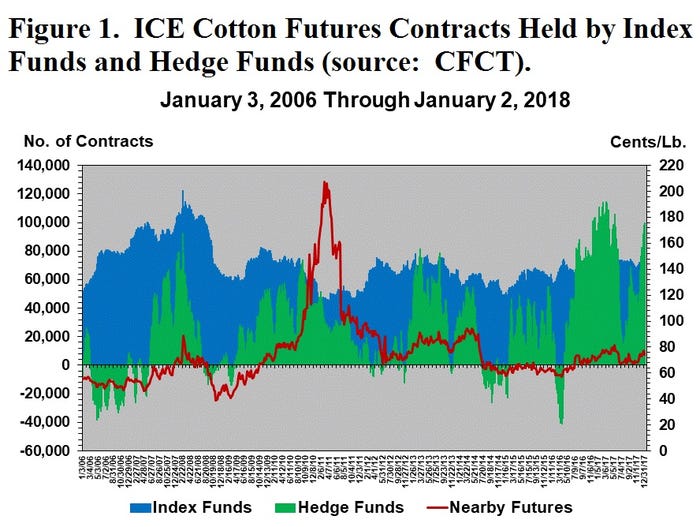

Speaking of speculators, this appears to be the crux of the matter. Figure 1 (green shaded area) shows the hedge fund speculative position to be highly variable, with lots of spikes up and down. The current net long position of the hedge funds began in April 2016. It is apparent from Figure 1 that the peaks and valleys of these speculators coincide with up and down price movements, respectively. The futures price rally that began in mid-November coincides with the most recent peaklet in the hedge fund net long position.

RANDOM PROCESS

The relative variation in the hedge fund position is also apparent from simple statistics (Table 1). Both the hedge funds (green shaded area) and the index funds (blue shaded area) have averaged a net long position of over 69,000 contracts since April 2016.

But, the more stable index fund position doesn’t fluctuate that much (as measured by a standard deviation of 3,315 contracts).

In contrast, the hedge funds have a standard deviation almost ten times as large. I expect this is due to the multiple opinions, data, analytical capabilities, and financial constraints of the hedge fund managers, compared to the more passive index fund approach.

Assuming the hedge fund behavior reflects a more or less random process, the statistics suggest that the hedge fund net long position could range between 40,000 and 99,000 contracts over two-thirds of the time. In other words, for no particular reason, they could downshift their net long futures position and the current price rally.

One comment I heard at Beltwide has stuck with me: “I don’t see what will spook the hedge funds out of their current net long buildup.” I don’t see what will spook them either. That’s the problem.

Table 1. Summary Statistics for Hedge Fund and Index Fund Net Long Position in ICE Cotton Futures (Contracts) between April 2016 and December 2017.

| Hedge Fund | Index Fund |

| 69,749 29,288 | 69,005 3,315 |

Maximum | 114,582 | 74,057 |

Minimum | 9,355 | 60,356 |

For additional thoughts on these and other cotton marketing topics, please visit my weekly on-line newsletter at http://agrilife.org/cottonmarketing/.

About the Author(s)

You May Also Like