USDA’s May WASDE (World Agricultural Supply and Demand Estimates) report is notable for being the first comprehensive and detailed report of world and foreign cotton supply and demand projections.

I would summarize the bottom line of this report as being price supportive. The bullish interpretation is based on a projected year-over-year decline in foreign (and world) ending stocks. It is harder for me to size up the U.S. cotton market implications, for a number of reasons.

The May WASDE projects a healthy, if not problematic, level of U.S. supply, based on a carry-in of 4.7 million bales and production of 19.5 million bales. I expect the carry-in will be trimmed a bit between now and August, but it will still likely be over 4 million bales. The level of U.S. new crop production is, of course, dependent on the weather. Still, if 2018/19 production exceeds 19 million bales, and ending stocks are around 5 million bales, I worry about downside price weakness.

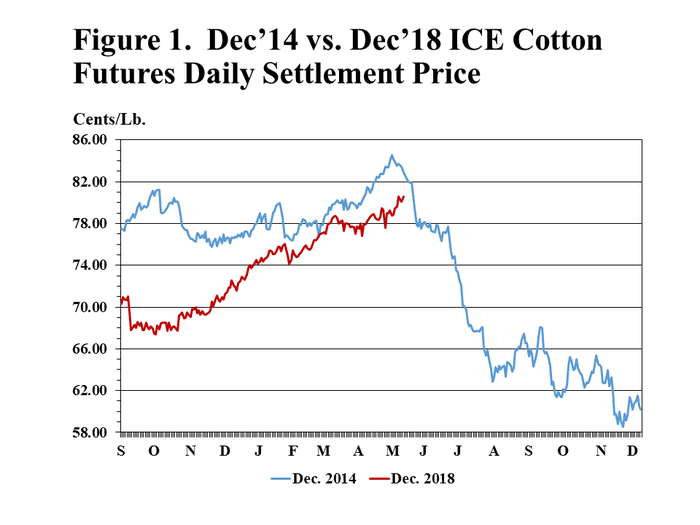

The May WASDE has occasionally been an apparent catalyst to large price adjustments, presumably from changing expectations about new crop fundamentals. An example of that was when the Dec’14 futures contract began a 12-cent slide in May, 2014 (Figure 1). That price decline followed USDA’s somewhat bearish projections for the 2014/15 marketing year of increasing U.S. and foreign ending stocks, year-over-year.

The 2014 price decline was also associated with a post-WASDE sell-off by hedge fund longs. The 2014 speculative long position had been growing prior to May, possibly because the drought situation in the southwestern U.S. was at least as bad as the drought situation we’re experiencing in 2018. So, the hedge fund influences and drought conditions are similar, and perhaps related.

Dec' 14 Futures vs Dec' 18 Ice Cotton Prices

There are some helpful differences between the cotton market in 2014 and now. The current demand for U.S. cotton appears good, and the May WASDE projects basically flat foreign production, higher world consumption, and higher levels of imports by major importers (China specifically). All of these are positive developments.

There is enough uncertainty in the new crop market to support prices, although it might be a seesaw pattern. The market is vulnerable to speculative sell-off reasons that we cannot anticipate. I expect at least one good summer rally based on weather and changing production expectations. Remember, the only thing you can know for sure is whether a forward contract or hedge on today’s futures price will be a profitable, or at least survivable, price floor.

For additional thoughts on these and other cotton marketing topics, please visit by weekly on-line newsletter at http://agrilife.org/cottonmarketing/

About the Author(s)

You May Also Like