February 16, 2017

The USDA cotton supply and demand projections were moderately price-supporting, by all appearances. 2016/17 world cotton supply remained mostly unchanged after a half-million bale increase in projected Chinese production was mostly offset by a number of small downward production revisions in Central Asia, West Africa, and Pakistan.

Foreign consumption was increased month-over-month in Central Asia, Bangladesh, and Vietnam (and partially offset by very small reductions in Turkey and Thailand). There were very small adjustments to foreign carry-in, imports, exports, and the Loss fudge factor category.

The bottom line of these adjustments was a month-over-month decrease in world ending stocks for 2016/17 of three-quarter million bales.

On the U.S. side of things, the only change was a 200,000 bale month-over-month increase in projected U.S. exports, from 12.5 million bales to 12.7 million, an increase that likely was anticipated by most analysts and traders. With no other adjustments, this change went straight to the bottom line, with a 200,000 bale decrease in projected ending stocks, from 5 million bales to 4.8 million.

These fundamental adjustments were probably already baked into market expectations. What appear to be the real drivers of old crop prices are the twin influences of hedge fund buying and expectations of mill fixations (discussed in a prior column).These catalysts may take old crop futures to 80 cents or higher, although I do not expect a lasting effect on the new crop market.

HIGHER INSURANCE BASE

New crop cotton futures have been pulled higher during January and February, just in time to help establish a higher crop insurance base price. The rally in new crop prices is a signal to plant more cotton, and I have no doubt that we will see more, especially in Texas.

The relative price of cotton has been penciling out better than wheat or feed grain alternatives, and a higher cotton insurance base price also encourages acreage.

The National Cotton Council grower survey, an early season benchmark, forecasted 11 million acres of intended plantings. The survey is a measure of grower intentions during January, and thus may not reflect the influence of the price rally in February.

The market awaits other major benchmarks: USDA’s March 31 Prospective Plantings and June 30 Planted Acreage reports. I will not be at all surprised if those surveys reflect a half-million more acres.

But once the crop is in the ground, the roles will reverse. New crop cotton prices will become influenced by production and ending stock expectations. I don’t expect the boom in U.S. exports to necessarily outlive the 2016/17 season. So, I have to conservatively assume that demand will be in slow growth mode.

WEATHER INFLUENCE

That means prices will likely be under the influence of a weather market, with the hedge funds acting as a catalyst. Dec’17 may briefly burst higher, but I do not expect sustained new crop prices above 70 cents. And if we have 11.5 million acres and good growing conditions, Dec’17 could retreat into the lower 60s by harvest time. I also expect to see a widening of the currently strong basis.

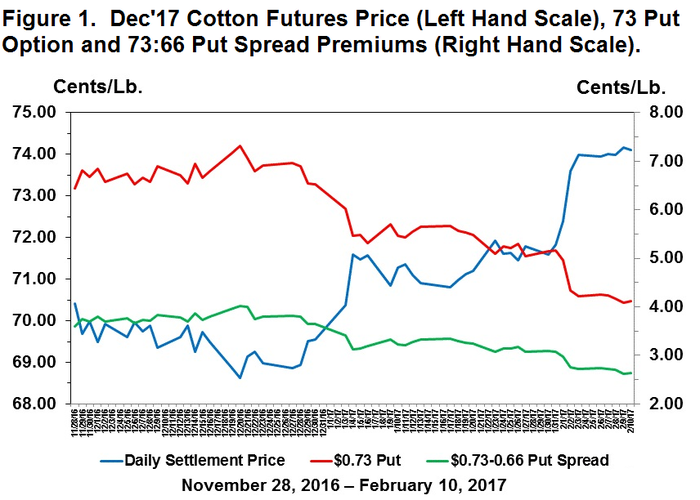

The active forward contracting that has been happening in Texas this month makes a lot of sense, given these possible outcomes. It also makes sense to be shopping for put options and put spreads, as shown in Figure 1.

This example indicates that, on Feb. 10, the cost of insuring against Dec’17 declining below 73 cents was a little over 4 cents a pound (the red line in Figure 1). This cost can be reduced to just over 2.5 cents a pound by only insuring against Dec’17 falling as low as 66 cents per pound (the green line in Figure 1).

For additional thoughts on these and other cotton marketing topics, please visit my weekly on-line newsletter at http://agrilife.org/cottonmarketing/

Dec. 17 cotton futures

About the Author(s)

You May Also Like