USDA released their benchmark Prospective Plantings report showing intentions for 13.5 million acres of U.S. all cotton. The pre-report guesses were for something less than that, but 13.5 million is not particularly surprising given relative prices of cotton, feedgrains, and wheat. In addition, the continued drought conditions in the Southern Plains region should reinforce the agronomic and financial incentive to plant more cotton.

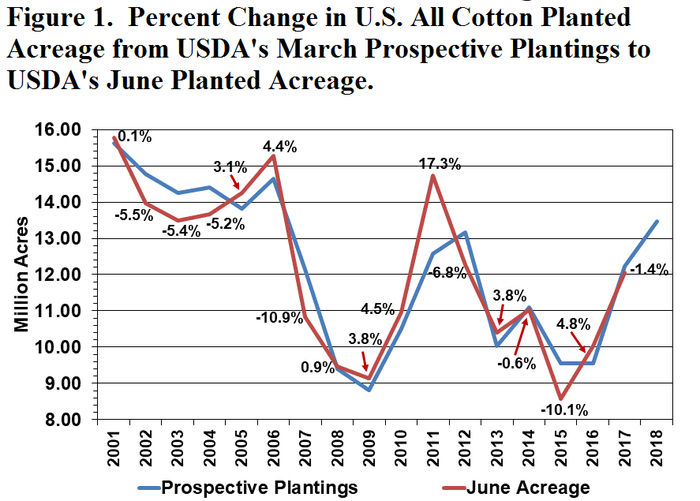

Assuming that relatively good cotton prices persist (and I hope they do) along with drought conditions (and I hope they don’t), there is a possibility of planted acreage to increase. Historically, the range of deviations between USDA’s March and June acreage reports averages about 4 percent (Figure 1). The reason for the deviations includes price changes, policy changes, dry weather, and wet weather. Some years the Prospective Plantings number turns out to be smaller in actuality. Some years there are increases from March to June. We saw this most dramatically during the dry Spring of 2011 when NASS measured 6 million acres of prospective planted cotton in Texas as of March 31. The actual planted acres measured on June 30 by USDA increased to 7 million acres, an increase of 17.3 percent (Figure 1). The conditions in 2018 are not as dramatic, but they are lined up the same way. I would not be surprised to see 13.7 or 13.9 million acres of all cotton before it is all said and done.

What does that mean for production, supply, ending stocks, and prices? The answer to that question is in Mother Nature’s hands. Planting a large acreage in dry conditions opens the door to a potentially large swing in production. Because of all the dryland production in Texas, it is not uncommon to have production potential vary by two or three million bales. The market will be watching for weekly planting and crop progress, weather conditions, and various reports from the field. The production reports in August and September by USDA will set the benchmark for the level of U.S. production. But it may yet take a few months to get an accurate picture of the U.S. supply. That period represents a window of uncertainty where prices may be supported by a weather premium.

Even if Dec’18 cotton futures are weakened by various sell-offs, the weather market uncertainty has the potential to facilitate a couple of rallies back above 75 or even 80 cents. Historically, these weather rallies do not tend to endure during the summer. When the weather premium fades during the fall, the possibility of stocks-to-use exceeding 30 percent could weigh heavily on prices.

Remember, nobody ultimately knows which way cotton prices will go. The only thing you can know for sure is whether a forward contract or a hedge on today's futures price will be a profitable, or at least survivable, price floor.

For additional thoughts on these and other cotton marketing topics, please visit my weekly on-line newsletter at http://agrilife.org/cottonmarketing/.

About the Author(s)

You May Also Like