USDA’s August WASDE report was surprising to say the least. Stunning… amazing… maybe terrifying, depending on your business.

Several things need to be put into context for this discussion. First, the August report has (or had) the reputation of being the first data-driven (field data, that is) forecast of U.S. production. This comes in the form of “objective yield surveys” where fields in major cotton-producing states are periodically sampled for squares and bolls. In the past, August was the inaugural month of Beltwide objective yield surveying, but most of that has shifted in recent years to September, with the exception of South Texas.

Second, the supply/demand forecast is influenced this year by production uncertainty from the drought. The question is really whether this drought will be worse than the 2011 drought of record. USDA’s answer to this latter question is YES. USDA adjusted forecasted abandonment from 32% in July to 43% in August. That is huge. And very bold considering how much time is left in the season.

In addition to raising abandonment, U.S. all cotton yield was lowered 24 pounds per acre. Altogether, this resulted in a three-million-bale cut in forecasted U.S. production. Again, that is unbelievable. But there it is. Perhaps by being bolder earlier, there will be smaller adjustments going forward.

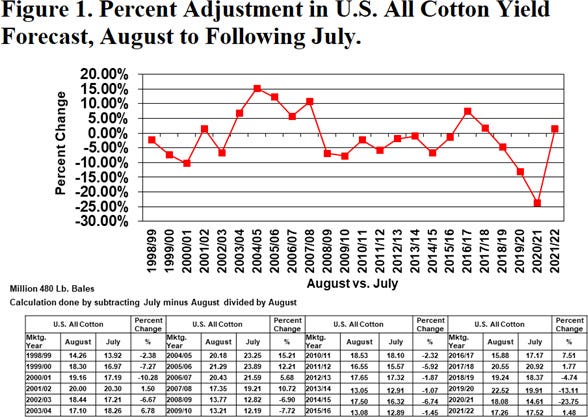

But there will be adjustments one way or the other. There always are. Sometimes it is the proverbial small crops getting smaller, or big crops getting bigger. History shows that more often than not, the August forecast is adjusted downward, by an average of 7% (Figure 1). But it depends on the year. A drought-stricken year like 2022 leads one to expect a series of incremental cuts.

But there is always room for surprises. What if USDA’s bold three-million-bale cut has rushed us sooner to the level of the final number? What if improved conditions increase the yield potential of surviving cotton? What if there are tropical troubles along the Gulf Coast or Atlantic seaboard?

The bottom line is always the ending stocks outcome. The current implication is for ending stocks a little below two million bales. That is literally the lowest ending stocks in a hundred years. From a price standpoint, that is a recipe for fundamental price support, and near-term volatility.

For additional thoughts on these and other cotton marketing topics, please visit my weekly on-line newsletter at http://agrilife.org/cottonmarketing/.

About the Author(s)

You May Also Like