June 20, 2016

Cotton marketing decisions are not an ‘absolute’ right or wrong, or good or bad. You can only weigh the advantages and disadvantages, and then make the best informed decision possible at the time. But one thing is certain: A repeat of 2015 doesn’t excite anyone.

The factors that impact price direction for the 2016 crop will include U.S. crop conditions, the sale of China reserve stocks, foreign production, and World mill use. Now you might say, well, duh, that’s a no-brainer. True, but coming off a disappointing 2015 and looking in the eyes of another relatively low price year, marketing, market risk management and good yields may be what saves some farm businesses. So, let’s make sure we understand what to look out for.

USDA’s first production and supply-demand estimates for the 2016 cotton crop came out in early May; and since then, in June also. One thing I noticed in these two cotton reports, USDA expects the U.S. Average Price for the 2016 cotton crop to be somewhere between 47 and 67 cents per pound. Obviously, this will change as more is known with more certainty as we move ahead into the 2016 cotton crop year.

As of mid-June, cotton prices (December futures) were at 64 to 65 cents. Prices cleared a hurdle at 64 cents and attempted 66 cents but retreated back for now. No one knows where prices are headed and that’s obvious considering USDA’s 20-cent range in the expected average price. But it’s clear that there are possible supply/demand scenarios that could take us on a path to lower prices than where we are now. Likewise, better prices are also possible although there would appear to be more downside than further upside at this point. But remember, expected prices and the outlook are moving targets and will change as the season progresses.

We will eventually find out

We are coming off a disappointing and difficult 2015 for many growers. Dec15 futures ranged mostly 60 to 67 cents and post-harvest futures ranged mostly 58 to 65 cents. So, there were just very few pricing opportunities that got anyone excited. The mid-point of USDA’s range in the 2016 crop expected average price would be 57 cents and, if realized, would be essentially the same as the actual average price for the 2015 crop.

The best things we had going for us in 2015 pricing were a very good basis, good premiums for above-base grade cotton, and LDP/MLG most of the season because the World price (the FE Price) was also low and the resulting AWP below the Loan Rate. An important consideration in 2016 pricing will be can we depend on those things again?

We know USDA’s June estimates will change as we move forward but let’s use those numbers for now. This time next year, U.S. ending stocks are expected to be 700,000 bales higher than now. Stocks outside of China are expected to increase slightly while China’s stocks will decline 12 percent. But, if you take the U.S. increase in stocks out of the picture, the outside-of-China stocks picture continues to shrink. This is significant and why prices will likely be sensitive to U.S. crop condition and prospects.

China’s cotton production is expected to decline for 2016 to the lowest level since 2000 and a 38 percent reduction since just 2012. China’s use of cotton in its spinning industry has declined almost one-third since 2009, cotton imports have decreased but yarn imports have increased, and China will increase use of imported and its own cotton in stocks. As a result, U.S. exports to China are expected to remain very low. But that’s old news by now; just as significant will be U.S. exports to markets like Vietnam, Bangladesh, Turkey and Indonesia. China is importing much less yarn so far this year compared to 2015. This could show up as increased mill use (spinning) for China and/or reduced imports and mill use for Vietnam, India, and Pakistan.

By most accounts, China’s sale of government reserve stocks has gone well. Recently, sales have been most if not entirely domestic rather than imported cotton. There have always been questions about the quality of China’s stocks. Does the fact that sales have done well indicate that quality is good? Not necessarily. I suppose if price is low enough, any cotton can find a home. Even at the end of the 2016 crop year, China is projected to have 55 million bales of stocks—that’s still 25 to 30 million bales above “normal.” It’s uncertain how far China can dig into its stocks and quality not be an issue. We will eventually find out.

These 3 price predictions are as good as any

For the 2015 crop year, prices were constantly under pressure due to weakening demand. World Use is currently projected at 110.6 million bales for the 2016 crop year—1.4 percent above last season. While this isn’t much, it’s important that we start to see some stability and growth on the demand side. Keep an eye on this number, if projected Use begins to erode that spells trouble.

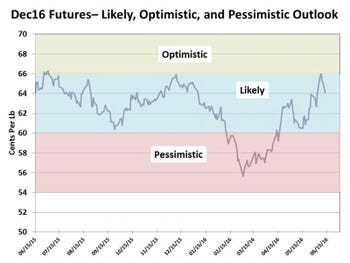

Currently (mid-June), Dec16 is at roughly 64 cents but having tested 66 cents a couple of times. Given all the factors in play at the present time, I consider the “Likely” range of Dec16 prices to be 60 to 66 cents per pound. Under more “Optimistic” supply/demand scenarios, 67 to 70 cents. Under “Pessimistic” scenarios, less than 60 cents would be possible.

In marketing, the goal is sometimes to just avoid the pessimistic range of prices if you can. In cotton, when prices are low, the Marketing Loan provides protection and also has to be considered. When futures prices are below about 64 cents, an LDP/MLG will typically be in effect. This means the opportunity cost of just doing nothing is going to be 64 cents +/- the basis.

Flexibility is important in today’s global environment. Prices can change quickly and abruptly. Contracting (for a fixed price) is a useful and popular risk-management tool but in an “LDP environment” could also be risky. If you contract and prices go down, you can also still collect any LDP and that’s good. If prices go up, however, you will have not only taken a lower price but there will likely also be no LDP. This is why Options or a minimum price contract can sometimes be a better choice.

It’s also increasingly important that producers be rewarded for quality if the market is paying for it. Contracts may not always pay premiums for quality but if it does and the basis is also good, this is worth considering. It is unknown how long the strong spot/cash basis and quality premiums of the past year will continue.

For the 2016 crop, the current outlook seems to suggest that protection on some portion of the crop at 66 cents or better could be a reasonable strategy. When to do that and how to do it is the question and growers will have to weigh the advantages and disadvantages of the alternatives. No decision is perfect but you want to try to avoid getting caught in the Pessimistic area with the majority of your crop if prices head in that direction.

(Don Shurley is Professor Emeritus of Cotton Economics, Department of Agricultural and Applied Economics University of Georgia. He can be reached at [email protected].)

You May Also Like