July 20, 2022

U.S. cotton growers pressed by drought are expected to abandon almost a third of planted acres against a backdrop of collapsing prices that are causing a bit of head scratching, Scott Stiles, extension economist for the University of Arkansas System Division of Agriculture, said on Wednesday.

On Tuesday, the U.S. Department of Agriculture released its monthly supply/demand projections, with significant adjustments to the cotton balance sheet.

“This month USDA reduced its estimate of U.S. harvested cotton acreage by 590,000 to a total of 8.55 million,” Stiles said. “This implies that almost 32 percent of the 12.48 million planted acres will be abandoned this year.”

The majority of U.S. cotton acres are in Texas, most of which is non-irrigated. At 7.12 million acres, Texas accounts for 57 percent of the U.S. total.

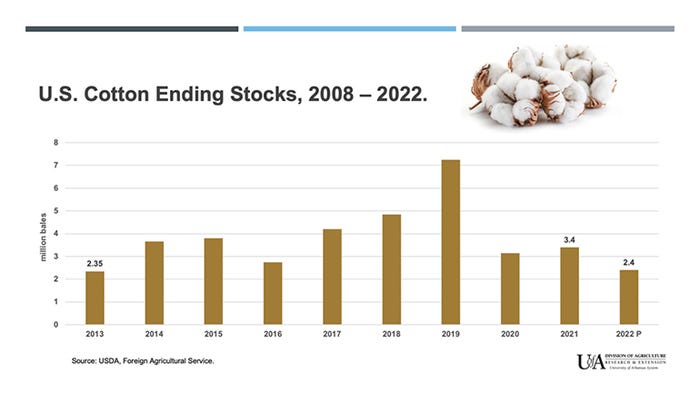

With the large cut to harvested acres, USDA reduced the U.S. 2022 crop by 1 million bales to 15.5 million. Half of the production cut was offset by a 500,000-bale reduction in exports.“The bottom-line result was 2022 ending stocks falling from 2.90 million to 2.40 million bales—the lowest since 2013,” Stiles said.The tighter U.S. balance sheet didn’t seem to concern the futures market.

Cotton closes down

Stiles said the “December contract closed at 90.84 cents on Tuesday and well off the mid-May high of $1.3379.”On Wednesday, the cotton market was lower again, “trading down to 86.20 at one point. That’s lowest we’ve seen the December contract since December 2, 2021,” he said.

“This massive 47-cent pullback in cotton prices is hard to rationalize with the U.S. crop getting smaller,” Stiles said. “A further reduction in crop size can't be ruled out in the coming months.

“With heavy investments being made in irrigation and insect management right now, this price collapse couldn’t come at a worse time,” he said. “Assuming an average yield for the state of 1,250 pounds per acre, we’ve lost over $585 per acre in market value over the past two months. Given the weather uncertainty surrounding this year’s crop, a price collapse of this magnitude was not expected.”

Other headwinds

Stiles said, “the cotton market is very much in tune with the health and direction of the general economy, and that may be the overriding market driver: growing concern about global recession and slowing consumer demand.”

“Higher interest rates tend to drive the value of the U.S. dollar higher, which is trading at 20-year highs now. This is a headwind for an export-dependent crop like cotton,” Stiles said.

Also Tuesday, USDA lowered its outlook for global mill use by 1.6 million bales. Mill use estimates for the 2022 crop were reduced in India, China, Bangladesh and Vietnam.

“All of which are key export markets for U.S. cotton,” Stiles said. “At 119.9 million bales, global mill use is now expected to be flat year on year.”

Source: University of Arkansas System Division of Agriculture, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any

You May Also Like