October 4, 2016

This has been a challenging year for cotton growers. The market for the 2016 crop started off a lot like 2015. Because of futures prices in the low 60s, the crop insurance price was established at a sub-par level.

Futures prices remained at sub-profitable levels for six months. There were few opportunities to meaningfully hedge a price that would cover a large share of production expenses.

Put options strategies generally have the advantage of providing a flexible floor against falling cash prices, while allowing for upside potential while the crop remains unsold until harvest. Another way of doing this would be to sell a futures contract and buy an at-the-money call option.

For the latest on southwest agriculture, please check out Southwest Farm Press Daily and receive the latest news right to your inbox.

Both of these strategies assume that growers would have cotton bales to sell in the harvesttime cash market (that is what gives you the upside potential). Many growers (especially dryland growers) face too much production risk to assume they will make a crop. In that case, the two hedging strategies described above could be applied to cover a level of production at, or just below, the grower’s APH yield/Revenue Policy coverage level.

MARKET INFLUENCES

In hindsight, a 65 cent put option on Dec ‘16 futures purchased for 4 cents in December 2015 was briefly worth between 8 and 10 cents a pound in March 2016. But those put premiums subsequently cheapened with the recovery, and then rally of prices, as well as the passage of time.

Then came a dry July and an apparent weather market rally, fueled with speculative buying. These sorts of rallies are often brief, and this one was no exception. Dec ‘16 futures rose twelve cents and then soon retreated about ten cents. Since then the market has fluctuated between 68 cents and 70 cents.

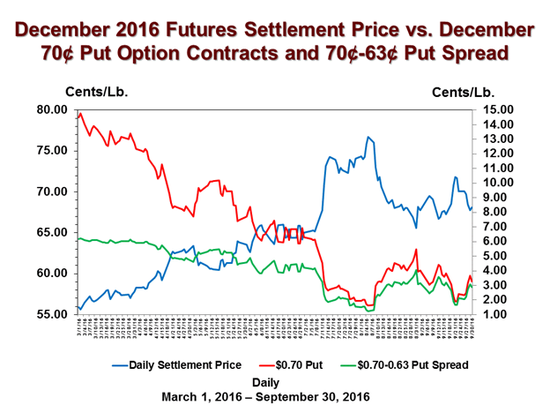

With Dec ‘16 futures at somewhat higher levels, a more relevant put spread strategy might have been something like buying a 70 cent put and selling a 63 cent put (see the accompanying chart). That spread has cost between 1 cent and 3 cents per pound since mid-July, and would have protected against a potential seven cent decline below 70 cents. (Note: This near to expiration, this is NOT the time to implement this spread. I am posting it for the benefit of hindsight.)

Weather markets and speculation-fueled rallies can develop in any year. In years like 2016, they provided the only opportunity for hedging prices above 70 cents. It might be the same in 2017, so growers should consider how to acquire the skills to move quickly and take advantage of such fleeting opportunities.

For additional thoughts on these and other cotton marketing topics, please visit my weekly on-line newsletter at http://agrilife.org/cottonmarketing/

About the Author(s)

You May Also Like