September 19, 2013

As the corn harvest is wrapping up in the South, 2013 is turning out to be the “perfect storm” for the vast majority of producers in the southern third of the United States. Yields were tremendous. Premiums were high on basis because of the lack of old crop corn and September futures remained very high right into harvest. Many producers early on had opportunities to sell new crop corn for well over $8 and even if that was missed, prices were still very profitable at harvest time.

Basis – marketing’s often overlooked opportunity

So much for history. It’s now time to look forward to 2014 if you haven’t started doing so already. The next 12 months will not likely be at all similar to the last 12. Expectations will have to change as prices will be feeling the impact of usage cuts.

Long-term cycles work

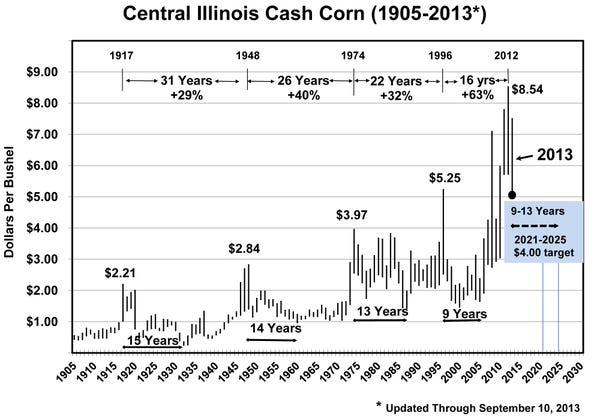

The accompanying chart shows the long-term cycle of corn prices going back to 1905. From peak to peak, the good news, the cycles are getting shorter. Thirty-one years, then 26 years, then 22 years and 16 years from the peak in 1996 to last year’s in 2012.

Peaks to trough are also getting shorter. Fifteen years, then 14, then 13, then nine. If the next one occurs in nine years, that would put the bottom in 2021. Could it come in seven? Maybe. Could it come in 13? Maybe. All that we know now and have confidence in is the long-term top has been established and now it takes years to build the bottom and to rekindle the demand base.

Ag news delivered daily to your inbox: Subscribe to Delta Farm Press Daily.

What are the fundamentals that are causing this? Producers are now going to have to pay a price for the high prices of the last three years. Exports are down 50 percent from a year ago. Not only have improved genetics helped U.S. farmers produce more corn, but the genetics are available around the world, which has allowed other farmers to produce corn where it was never grown before. $7.50 corn provided a huge incentive for new competitors.

Even more destructive than losing our export market, however, is that occurring at the same time, the ethanol industry has matured and mandates have peaked — and could even be cut back. Little or no growth of corn usage is coming from this sector. High prices have also resulted in long-term damage to the livestock industry as beef herds have contracted and limited expansion is taking place in poultry and pork.

Why the market’s ho-hum reaction to this year's late corn crop?…

The bottom line is that carryover supplies of corn will at least double this year, going from 700 million to over 1.6 billion. That’s going to result in a significantly lower average cash price of corn.

What to do?

Subscribers to The Brock Report forward sold 30 percent of the crop several months ago at approximately $6 per bushel. On remaining corn, there will likely be some rallies this spring that “hopefully” could carry December ’14 corn futures into the $5.20 to $5.30 range (currently trading at $5.04). Should that occur, start dividing your production up in thirds and get the first third sold in that range. If that’s the worst sale you make all year, you’ll have a good year.

This is a market that has the potential of not averaging much above $4. While it has not paid to be an aggressive forward seller in the last three years, this year forward selling could well pay big dividends.

For a free copy of our most recent report on strategies, give us a call at (800) 558-3431.

You May Also Like