Corn bulls were happy to see the market closed at its highest level since November 1st and above all short-term resistance. Technical traders are talking about the shorter-term charts showing higher lows and higher highs and the potential for continued strength. As I've mentioned on several occasions the MAR20 technical hurdles seem to be the $4.11^6 high posted back in mid-October and the heavy psychological resistance that has consistently been in place the past several years up in the $4.40 to $4.50 range. The bottom line, however, is the fact we still remain in this range between $3.65 and $4.10 per bushel. Also, keep in mind, we are still trading well below the 200-Day Moving Average which is up closer to $4.05 per bushel.

As a producer, I'm staying patient and waiting for higher prices before making additional cash sales. Those producers who are experiencing abnormally strong basis levels should be paying very close attention and entertaining the thought of reducing risk and rewarding the strength. I just worry that once the bigger commercials gain enough ownership of corn the basis could back off at the same time flat price runs into stiffer resistance.

The overall demand story for corn still remains a bit suspect. Bulls are banking on China stepping in and being a substantial buyer. Bears continue to point to weakness in ethanol, Chinas recent complications surrounding the coronavirus, and South America's more cooperative weather. The EIA's weekly ethanol data released yesterday showed a big bump in ethanol stocks to +24 million barrels up +1 million barrels from last week up over +2% from last year and again nearing the all-time record stockpile of 24.5 million estimated back in July. Keep in mind, ethanol stockpiles got down to around 20 million gallons back in November and has now snapped back aggressively higher adding almost +4 million gallons to our surplus. The trade will be chewing on weekly export sales data this morning with bulls hoping to see confirmation of increased Chinese interest in U.S. exports. Bears point to the fact China goes on a week-long national Lunar New Year holiday next week and is now battling complications of the coronavirus, which could eventually make commodity bulls a bit apprehensive in adding length. I've also been listening to some trade rumors that Chinese feed buyers aren't real happy with U.S. quality this year and have been talking to suppliers from Ukraine but there's some apprehension there as well with headline talk circulating around bird flu. There's just a ton of abnormal moving parts in play at the moment and we have to take this into consideration.

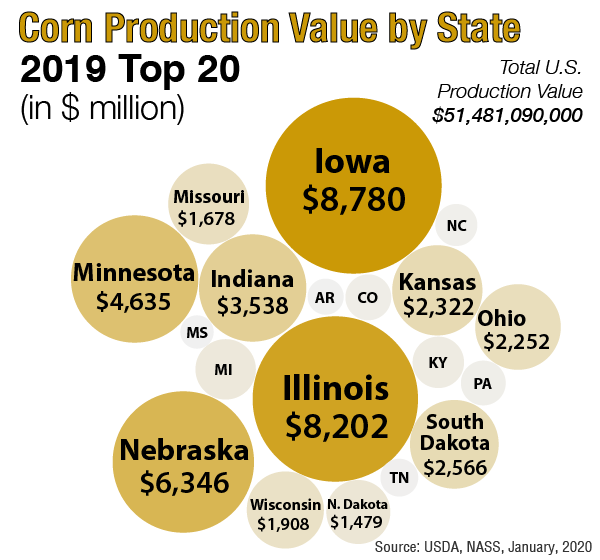

Weather in South America seems mostly cooperative but there's still a massive amount of unplanted second-crop corn scheduled to go in the ground in Brazil. Bulls are thinking it will be too wet in areas to the northeast and could ultimately reduce some second-crop corn acres. The Argentina crop is now mostly all planted but there are still some areas we are closely monitoring that could become too dry and create a yield drag. I should note, most sources are thinking Argentine producers planted about 6.3 million hectares of corn or about 15.6 million acres. Producers in Ukraine will actually plant a few million acres less. In comparison, the state of Iowa was projected to plant 13.6 million acres last year. Illinois plants around 11 million corn acres; Nebraska plants around 10 million corn acres; Minnesota plants around 8 million corn acres. Both Kansas and Indian will generally plant between 5 and 6 million corn acres each. South Dakota, North Dakota, Wisconsin, Missouri, and Ohio will generally plant between 3 and 5 million corn acres each. I always find it interesting when you start comparing foreign nations to our top producing U.S. states.

For a free trial to my newsletter, click here

The opinions of Kevin Van Trump are not necessarily those of Corn and Soybean Digest or Farm Progress.

The source is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like