Recent flooding has created various negative impacts to the central U.S. in recent days – loss of property, loss of livestock and even loss of life, to name a few. The latest batch of export inspection data from USDA indicates logistics may be hampering the movement of grain as well.

Export inspections disappointed all around last week with plenty of competition and transportation problems limiting shipments, according to Farm Futures senior grain market analyst Bryce Knorr.

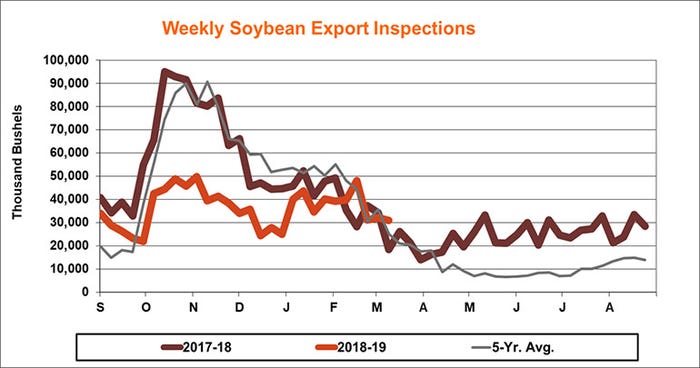

“Soybeans must run above the top end of last year’s inspections during the second half of the marketing year to meet USDA’s forecast for the 2018 crop, so these week-by-week reports will remain fodder for bulls and bears,” he says. “Wheat and corn fell well short of the rates projected by USDA, and time is running out for wheat.”

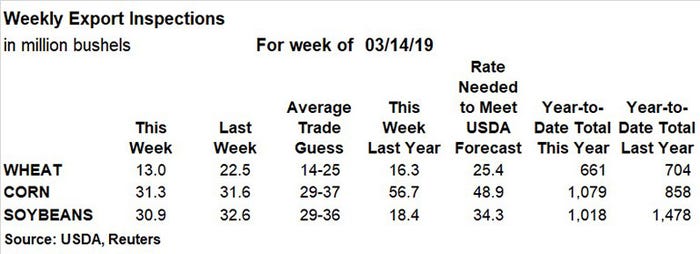

Soybean export inspections reached 30.9 million bushels for the week ending March 14, which was slightly behind the prior week’s total of 32.6 million bushels and on the low end of trade estimates that ranged between 29 million and 36 million bushels. The weekly rate needed to match USDA forecasts moved higher, to 34.3 million bushels, while year-to-date totals of 1.018 billion bushels for 2018/19 continue to drag 31% lower than the pace of 2017/18 inspections.

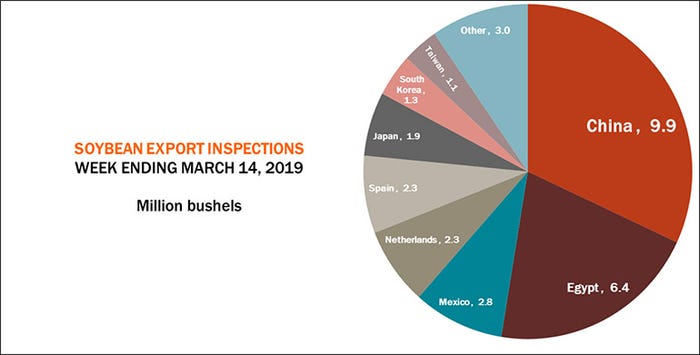

China was the No. 1 destination for U.S. soybean export inspections last week, with 9.9 million bushels. Other top destinations included Egypt (6.4 million), Mexico (2.8 million) the Netherlands (2.3 million) and Spain (2.3 million).

“China took just a third of the total as new buying appears to be cautious without a long-term trade agreement,” Knorr says. “With the U.S., China accounts for just 15% of year-to-date inspections. Customers from the EU block picked up some of the slack with 23% of the total.”

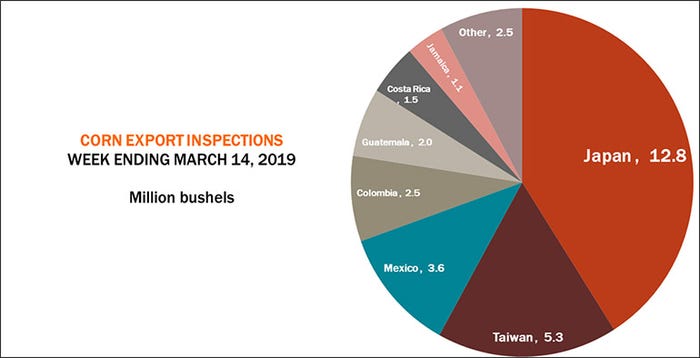

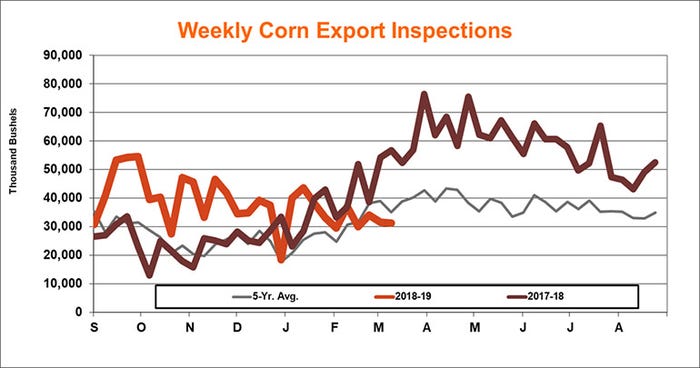

Corn export inspections inched below the prior week’s tally of 31.6 million bushels, notching 31.3 million bushels last week. That total was on the low end of trade estimates, which ranged between 29 million and 37 million bushels, with the weekly rate needed to match USDA forecasts moving up to 48.9 million bushels. Marketing year-to-date totals of 1.079 billion bushels are still up almost 26% from last year’s pace.

Japan was the No. 1 destination for U.S. corn export inspections last week, with 12.8 million bushels. Other top destinations included Taiwan (5.3 million), Mexico (3.6 million), Colombia (2.5 million) and Guatemala (2.0 million).

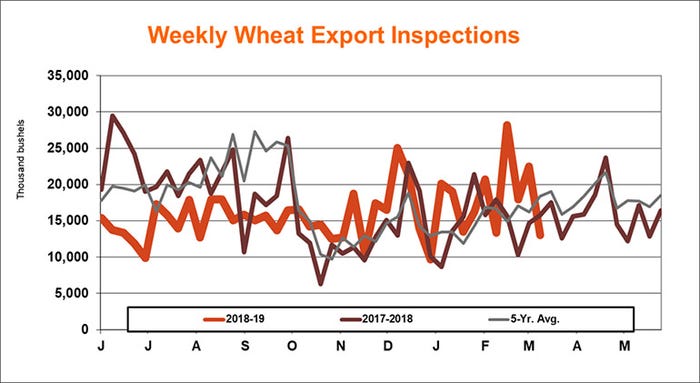

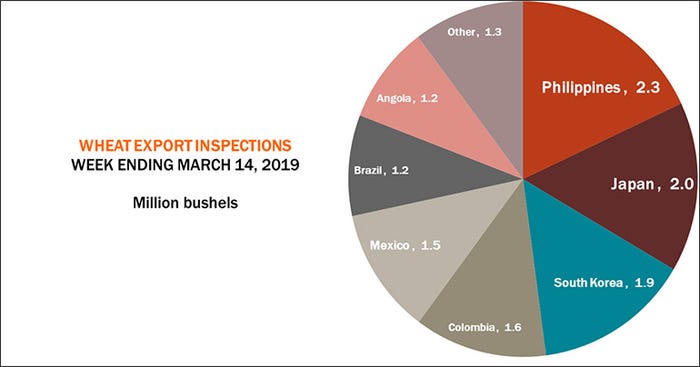

Wheat export inspections slumped to 13.0 million bushels last week, down significantly from the prior week’s total of 22.5 million and falling below trade estimates that ranged between 14 million and 25 million bushels. The weekly rate needed to meet USDA forecasts moved up to 25.4 million bushels, with marketing year-to-date totals at just 661 million bushels.

“USDA still forecasts a 7% increase in total wheat sales, but the year-to-date total is behind the 2017 crop by 6%,” Knorr says.

The Philippines was the leading destination for U.S. wheat export inspections last week, with 2.3 million bushels. Other top destinations included Japan (2.0 million), South Korea (1.9 million), Colombia (1.6 million) and Mexico (1.5 million).

About the Author(s)

You May Also Like