Soybean prices saw a surprise boost in today’s Crop Production and World Agricultural Supply and Demand Estimates (WASDE) reports from USDA after an unexpected yield cut for the 2021 crop dropped the total crop to 4.425 billion bushels – now the second largest crop on record narrowly following 2018’s haul of 4.428 billion bushels.

Immediately prior to the report’s release, corn and soybean futures were each down around 0.5%, winter wheat contracts were close to steady and MGEX spring wheat futures were up more than 1%. But in the minutes immediately following the report, prices greened up considerably. Soybeans jumped 2.5% higher, with corn up around 0.75% and most wheat contracts trading 1-1.5% higher.

Soybeans

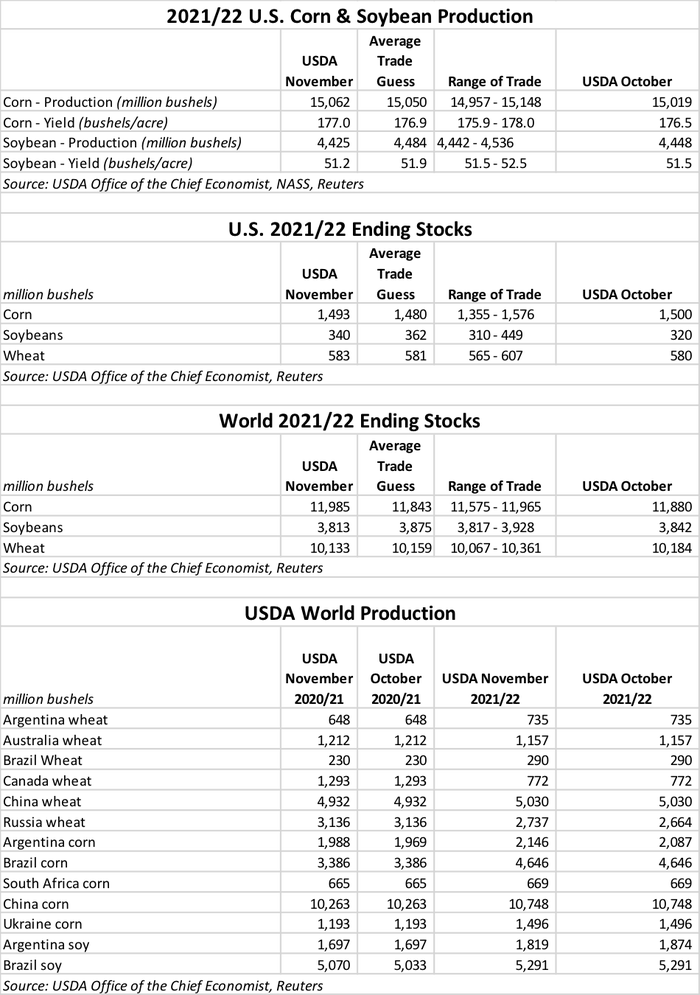

The “soybean surprise” caused the biggest price movements late this morning. USDA projects soybean yields at 51.2 bushels per acre, versus the agency’s October estimate of 51.5 bpa and an average trade guess of 51.9 bpa (which would have matched 2016’s record-breaking output). That had USDA lowering production estimates by 23 million bushels – in contrast with analyst expectations of seeing that number move 36 million bushels higher. “Lower yields in Indiana, Iowa, Ohio and Kansas account for most of the change in production,” USDA notes.

“Despite lower soybean imports from top global soy buyer China in the coming months, the reduced soybean production forecast in Argentina and the Eastern Corn Belt of the U.S. helped prop up the post-report rally,” notes Farm Futures grain market analyst Jacqueline Holland. “Tight soymeal stocks also played a role in the morning’s rally after soymeal futures soared 2.5% to 3.5% higher in the aftermath of the report’s release. January 2022 soybean futures traded on the Chicago Board of Trade rose 2.25% past the $12/bushel benchmark on the tightened supply outlook for the time being.”

Domestic ending stocks for soybeans moved 20 million bushels higher, to 340 million bushels. Analysts were generally expecting to see a bigger jump, with an average trade guess of 362 million bushels. World ending stocks also saw a modest drop, moving from 3.824 billion bushels in October down to 3.813 billion bushels.

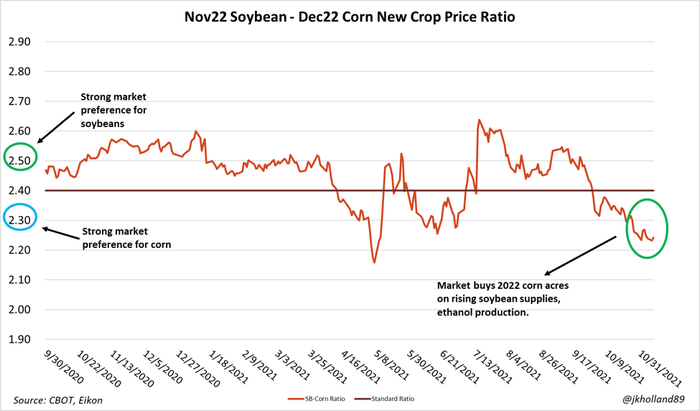

“Ending soybean supplies will remain more comfortable than 2020/21 levels, at a stocks-to-use ratio of 7.8%,” according to Holland. “But even with the morning’s rally, 2022 soybean acres still have not been able to buy any future acreage back from 2022 corn prices. The new crop 2022 soybean-corn ratio continues to trade the 2.3 mark, at which the market exhibits a strong preference for corn acreage based on futures prices. Even with rising input costs and tightening global soybean supplies, corn remains a more lucrative option for growers on the fence about 2022 crop rotations.”

USDA lowered its season-average farm price by 25 cents, to $12.10 per bushel, while the agency held steady its prices for soymeal and soyoil prices.

Corn

Corn yield and production estimates moved higher as expected, meantime. USDA now marks yields at an average 177.0 bushels per acre, up half a bushel from October estimates and very close to the average trade guess of 176.9 bpa. Production estimates moved modestly higher, to 15.062 billion bushels. That’s up from USDA’s October projection of 15.019 billion bushels and slightly higher than the average trade guess of 15.050 billion bushels.

“Even with a 0.5 bushel per acre increase to 2021 U.S. corn yields, which added 43 million bushels to 2021 production forecasts, a 50-million-bushel increase to 2021/22 ethanol production will likely snap up much of the newfound production,” Holland says.

High fuel prices amid a global energy crunch have increased demand for the more cheaply produced fuel additive over the past month and the ethanol industry has not delayed in responding to market incentives, Holland adds.

“Weekly output has increased over 21% over the past five weeks, justifying the upward revision for corn consumption rates for ethanol,” she says.

Other domestic demand categories were left unchanged, Holland points out. Upward revisions were made to Argentine corn production for both the 2020 and 2021 years, which contributed to rising global corn supplies. With U.S. ethanol back on the rise – and with no signs of slowing down while global energy supplies remain tight – farmers are likely to continue enjoying lucrative harvest basis offerings at their local ethanol plants.

Domestic ending stocks for the 2021/22 marketing year were trimmed by 7 million bushels, to 1.493 billion bushels. Analysts were expecting to see a 20-million-bushel drop. World ending stocks moved 105 million bushels higher, to 11.985 billion bushels. USDA noted higher production potential in Argentina, the European Union and several African nations.

USDA’s estimates for season-average farm prices held steady from last month, at $5.45 per bushel.

Wheat

For wheat, USDA noted “lower supplies, higher domestic use, reduced exports and slightly higher ending stocks” in today’s report. U.S. ending stocks tilted 3 million bushels higher compared to last month, reaching 583 million bushels and coming in just above the average trade guess of 581 million bushels.

“Slow first quarter wheat milling rates led USDA to cut domestic food usage for wheat,” Holland says. “Slow export paces also helped add 3 million bushels to U.S. wheat stocks for the 2021/22 season after a 10-million-bushel cut to anticipated 2021/22 imports.”

But there is more to that dynamic than meets the eye, Holland asserts.

“Marketing year-to-date soft red winter wheat exports are 30% higher than the five-year average,” she says. “Even though white wheat exports are not going to match last year’s shipping paces, growers with soft red winter wheat and white wheat supplies available may be able to capture more marketing opportunities in the months to come.”

Globally, 2021/22 wheat stocks trended 51 million bushels lower versus October, moving to 10.133 billion bushels. That was a bigger drop than analysts anticipated, offering an average trade guess of 10.159 billion bushels.

“USDA cut 2021/22 European Union production by 37 million bushels to 5.09 billion bushels,” Holland says. “The EU is the world’s largest wheat producer and second-largest exporter. USDA’s cuts came on the heels of a rapid early shipping season for EU wheat but also triggered another noteworthy adjustment.”

The agency also added 73 million bushels to 2021/22 Russian wheat projections based off recent tenders supplied to top importer Egypt, Holland says. The rapid export paces out of the Black Sea region suggest that more wheat may have been harvested in Russia than was previously believed following turbulent growing and harvest conditions earlier this year, she says.

USDA raised its season-average farm price estimates by 20 cents, reaching $6.90 per bushel. The agency made that upward revision due to “NASS prices to date and expectations on cash and futures prices for the remainder of the marketing year.”

Read the November WASDE report in its entirety.

About the Author(s)

You May Also Like