For more than four years – from 2014 until the start of the trade war last summer – I used a little quip to explain lower prices in the Corn Belt. “Demand is good, but supply is gooder.” Bad language aside, I was trying to make a serious point. Prices were not low because demand was faltering – export and domestic demand for corn and soybeans had remained quite strong. Prices were low because of more acres and a succession of years with above above-average yields. Strong production simply outran good demand.

The environment has changed. It started, of course, with the trade war. But demand is soft across the board. For evidence, let’s check the September WASDE report.

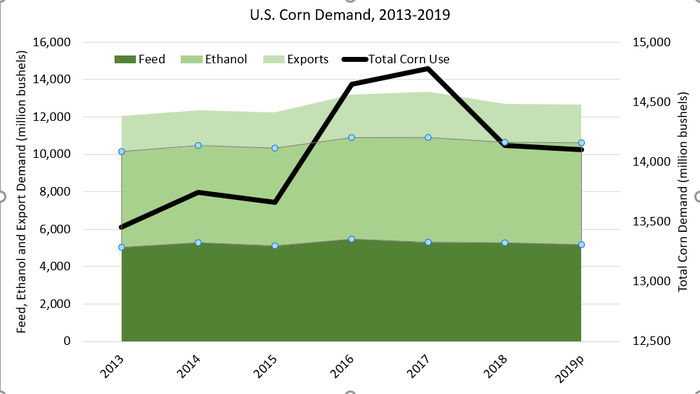

Corn demand can be split into three main components; feed, ethanol and exports. And all three components are showing signs of weakness (see accompanying chart).

Feed demand is projected to decline 100 million bushels in the 2019/20 crop year. I understand that this represents just 2% of total feed demand, but commodities are different, and it doesn’t take a large change to cause problems.

Export demand is projected to decline 10 million bushels this year. I know it’s a small number, but it is nearly 400 mb less than the level of exports enjoyed in 2017/18.

After decreasing by 230 mb in 2018/19, ethanol demand for corn is projected to increase by 75 mb in the current crop year. Are you, like me, just a bit skeptical of increasing demand for corn in ethanol production? We read the same headlines and press releases – we should not be surprised if corn demand for ethanol production declines again.

The story in soybeans is well-known, and a modest increase of 30 mb in crush demand will not make up for exports running 300-400 mb behind levels enjoyed in the 2016 and 2017 crop years.

Higher prices result from one of two occurrences: a short crop (lower supplies) or strong demand, or a combination of the two. Short crops are interesting and the price response follows a specific pattern. Prices spike quickly as the market adapts to a new reality of a smaller crop and supplies (see corn prices in June). Volatility is high but the price impact is generally short in duration.

Strong demand gives rise to a different type of price reaction. Consistent growing demand will result in prices that rise slower and last longer. Demand driven markets are generally less dramatic – less “spike” – than a supply driven market, but they tend to be more powerful and enduring.

I remain unconvinced that final yields and production will be as good as predicted in the latest WASDE report. I tell people that I am in a Missouri state of mind and Missouri, of course, is the “Show Me” state. But our focus on crop size and yields may be missing the larger point. Demand is the problem, and sustained price rallies will be scarce until we solve that problem.

The opinions of Ed Usset are not necessarily those of Corn and Soybean Digest or Farm Progress.

The source is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like