Farmers have been enjoying high grain prices for the better part of the last year. USDA predicts those prices will continue to remain at profitable levels through the 2021/22 marketing year. But with new crop prices slipping below eight-year highs recorded earlier in May 2021, has the party ended for the new crop rally?

For producers looking forward to locking in 2021 profits, the price depreciation in the new crop corn and soybean futures contracts is not a deal breaker. Far from it, to be exact.

Using conservative back of the napkin break-even estimates for 2021 corn ($4.00-$4.40/bushel) and soybean ($10.00-$10.40/bushel) production, current price levels remain more than profitable for farmers looking to book forward sales for the 2021 crop.

At press time, new crop corn and soybean futures prices traded well within the range of seven- and eight-year highs, respectively, even though new crop prices were over a dollar lower than peak May 2021 prices.

The elephant in the room

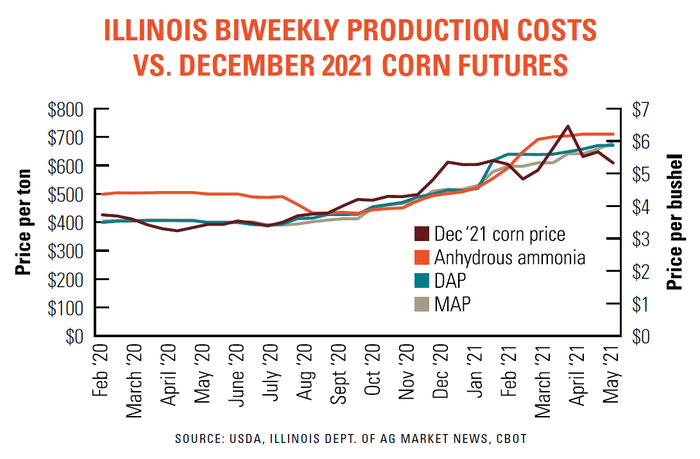

But input prices have shown little sign of falling in the post-pandemic era. In Illinois, bi-weekly production costs for anhydrous ammonia are 42% higher than a year ago, standing at $710/ton as of press time. Phosphate costs continue to rise as the U.S. scrambles to source enough of the nutrient ahead of fall application season, with Illinois DAP and MAP prices up 68% and 70%, respectively, over the past year.

Supply chain snafus and shortages are on growers’ and retailers’ radar heading into harvest, but uncertainty around pricing continues to loom large across farm country. The rest of the world has been slower to recover from the pandemic than the U.S., which has played a key role in keeping production costs for agricultural inputs high.

Waiting for expenses to fall is a valid option for producers, but with current corn and soybean prices providing more than enough flexibility for higher operating costs plus comfortable owner returns, is it worth it?

Hedging bets

Of course, profit and pricing projections are dependent upon growers hitting yield forecasts, which has been increasingly challenging over the past three growing seasons. With drought gripping the Upper Midwest for the first half of 2021, growers are facing another year of doubts as to how much volume to price ahead of harvest.

To be sure, there is a lot of time still left in the 2021 growing season, though the prospect of top end yields seems to be off the table at this point. Booking smaller volumes now may still help to offset rising 2022 input costs down the road.

Don’t expect the market volatility surrounding tight corn and soybean supplies or rising fertilizer costs in 2021 to go away. Grain demand is likely to remain high, even though domestic usage and export rates are likely to be capped by limited supplies over the next year.

Pollination is just around the corner for both corn and soybean crops, providing a better indication of yield potential and – hopefully – pricing opportunities. Remember, input prices typically drop slower than those of corn and soybeans. Forward sales can provide a safe hedge against high fertilizer prices – and peace of mind amidst an increasingly volatile global economic climate.

About the Author(s)

You May Also Like